|

By Ron Paul

In addition to funding for a border wall and other border security measures, immigration hardliners are sure to push to include mandatory E-Verify in any immigration legislation considered by Congress. E-Verify is a (currently) voluntary program where businesses check job applicants’ Social Security numbers and other Information — potentially including “biometric” identifiers like fingerprints — against information stored in a federal database to determine if the job applicants are legally in the United States. Imagine how much time would be diverted from serving consumers and growing the economy if every US business had to comply with E-Verify. Also, collecting the relevant information and operating the mandatory E-Verify system will prove costly to taxpayers. Millions of Americans could be denied jobs because E-Verify mistakenly identifies them as illegal immigrants. These Americans would be forced to go through a costly and time-consuming process to force the government to correct its mistake. It is doubtful employers could afford to keep jobs open while potential hires went through this process. A federal database with Social Security numbers and other identifying information is an identify thief’s dream. Given the federal government’s poor track record for protecting personal information, is there any doubt mandatory E-Verify would put millions of Americans at risk for identity theft? Some supporters of E-Verify deny the program poses any threat to civil liberties, as it will only be used to verify citizenship or legal residency. They even claim a system forcing individuals to have their identities certified by the government is not a national ID system. These individuals are ignoring the history of government programs sold as only affecting a particular group or being used for a limited purpose being expanded beyond initial targets. For example, Americans were promised that only the wealthiest Americans would ever pay income taxes. And some of the PATRIOT Act’s worst provisions that we were told would only be used against terrorists are routinely used to investigate drug crimes. E-Verify almost certainly will be used for purposes unrelated to immigration. One potential use of E-Verify is to limit the job prospects of anyone whose lifestyle displeases the government. This could include those accused of failing to pay their fair share in taxes, those who homeschool or do not vaccinate their children, or those who own firearms. Unscrupulous government officials could use E-Verify against those who practice antiwar, anti-tax, anti-surveillance, and anti-Federal Reserve activism. Those who consider this unlikely should remember the long history of the IRS targeting the political enemies of those in power and the use of anti-terrorism laws to harass antiwar activists. They should also consider the current moves to outlaw certain types of “politically incorrect” speech, such as disputing the alleged “consensus” regarding climate change. Claiming that mandatory E-Verify is necessary to stop illegal immigration does not make it constitutional. Furthermore, having to ask the federal government for permission before obtaining a job is a characteristic of authoritarian societies, not free ones. History shows that mandatory E-Verify’s use will expand beyond immigration enforcement and could be used as a tool of political repression. All those who value liberty should oppose mandatory E-Verify.

By Simon Black

Less than two weeks ago, the United States Department of Treasury very quietly released its own internal projections for the federal government’s budget deficits over the next several years. And the numbers are pretty gruesome. In order to plug the gaps from its soaring deficits, the Treasury Department expects to borrow nearly $1 trillion this fiscal year. Then nearly $1.1 trillion next fiscal year. And up to $1.3 trillion the year after that. This means that the national debt will exceed $25 trillion by September 30, 2020. Remember, this isn’t some wild conspiracy theory. These are official government projections published by the United States Department of Treasury. This story alone is monumental– not only does the US owe, by far, the greatest amount of debt ever accumulated by a single nation in human history, but $25 trillion is larger than the debts of every other nation in the world combined. But there are other themes at work here that are even more important. For example– how is it remotely possible that the federal government can burn through $1 trillion? Everything is supposedly totally awesome in the United States. The economy is strong, unemployment is low, tax revenue is at record levels. It’s not like they had to fight a major two front war, save the financial system from an epic crisis, or battle a severe economic depression. It’s just been business as usual. Nothing really out of the ordinary. And yet they’re still losing trillions of dollars. This is pretty scary when you think about it. What’s going to happen to the US federal deficit when there actually IS a financial crisis or major recession? And none of those possibilities are factored into their projections. The largest problem of all, though, is that the federal government is going to have a much more difficult time borrowing the money. For the past several years, the government has always been able to rely on the usual suspects to loan them money and buy up all the debt, namely– the Federal Reserve, the Chinese, and the Japanese. Those three alone have loaned trillions of dollars to the US government since the end of the financial crisis. The Federal Reserve in particular, through its “Quantitative Easing” programs, was on an all-out binge, buying up every long-dated Treasury Bond it could find, like some sort of junkie debt addict. And both Chinese and Japanese holdings of US government debt now exceed $1 trillion each, more than double what they were before the 2008 crisis. But now each of those three lenders is out of the game. The Federal Reserve has formally ended its Quantitative Easing program. In other words, the Fed has said it will no longer conjure money out of thin air to buy US government debt. The Chinese government said point blank last month that they were ‘rethinking’ their position on US government debt. And the Japanese have their own problems at home to deal with; they need to scrap together every penny they can find to dump into their own economy. Official data from the US Treasury Department illustrates this point– both China and Japan have slightly reduced their holdings of US government debt since last summer. Bottom line, all three of the US government’s biggest lenders are no longer buyers of US debt. There’s a pretty obvious conclusion here: interest rates have to rise. Read the rest at Sovereign Man

Just when it seemed the war in Syria might be winding down, it heats back up. First a Russian plane is shot down, then an Israeli plane is shot down after completing a bombing run on Syrian territory. Meanwhile the US continues occupying parts of northeast Syria with no legal basis in US or international law...

By Liberty Report Staff

Someday, when Republicans control the Presidency, the Senate and the House, we'll get that "limited government." Oh..wait! Ron Paul talks to Varney below:

It’s hard to tell which is worse, Republicans and Democrats doing the opposite of what they “campaign on,” or voters always falling for it. Democrats are usually anti-war when out of power, then drop bombs like Republicans when in power. Republicans are anti-spending and debt when out of power, and then they spend like Democrats when in power. Ron Paul discusses this all-too-familiar script.

For some reason the Sen. Grassley Memo released earlier this week is being largely ignored by the media. In fact the memo not only confirms what we learned in the Nunes FISA Memo, but it adds several fascinating layers to the story of who was meddling in the 2016 US Presidential election. Former CIA officer Phil Giraldi joins today's show to discuss the operatives behind the scenes...

By Tyler Durden

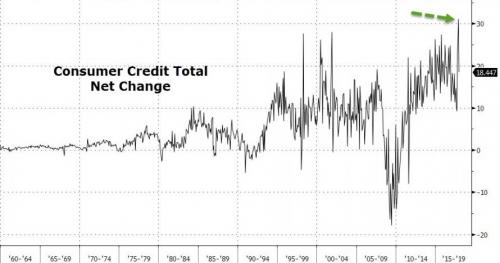

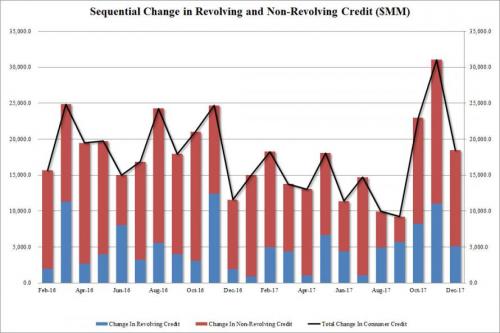

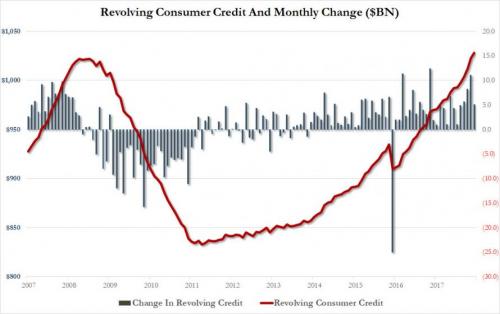

The US consumer closed out 2017 with a credit bang. While we reported last month that in November US credit card debt had just surpassed the previous all time high hit in July 2008 just before all hell broke loose when Lehman filed for bankruptcy two months later, there was a slight chance that in December this number had declined after the record surge in November credit-funded spending (which was just revised from $28BN to $31BN).

Well, that did not happen, and while December total consumer credit increased by less than the expected $20BN, it was still an impressive $18.45BN, of which $5.1billion was credit card debt and $13.3 billion non-revolving - or student and auto - loans.

More importantly, with the latest $5.1 billion increase in revolving, or credit card, debt the total is now $1.027.9 trillion, the highest number on record.

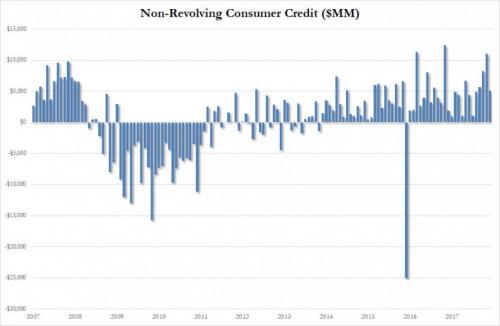

Meanwhile, non-revolving credit which with the exception of one definition change month, has never gone down, also hit a new all time high of $2.813 trillion, a monthly increase of $13.34 billion.

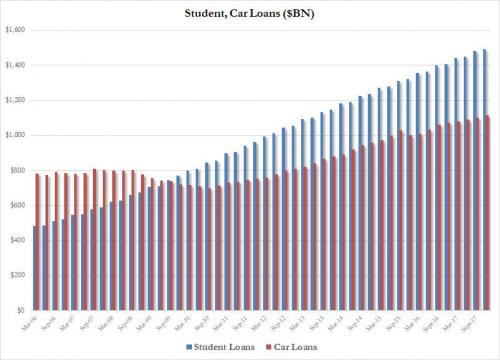

What about its components? Well, with everything else going for record highs, we doubt it will be a surprise to anyone that both student debt and auto loans hit a new all time high in the quarter ending December 2017, with $1.491 trillion for the former, and $1.11 trillion for the latter.

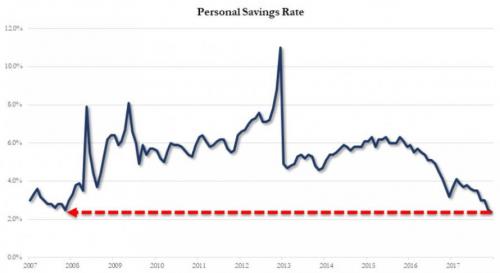

So for anyone still wondering why the US economy closed 2017 with an upward GDP burst, here is your answer. The problem is that with the personal savings rate just shy of all time lows...

... and with US consumers deep in the red on their household debt, just what will keep the US economic expansion going from this point on is far less clear, especially if the stock market has now peaked, as recent events suggest.

This article was originally published at ZeroHedge.

There is a new push for US and allied intervention in Syria. There is a vast propaganda network of NGOs pushing cooked up documentaries and providing "expert" witnesses all aimed to mobilize opinion in favor of a renewed war on the Syrian government. The White Helmets are a key part of this propaganda campaign. Syria expert Vanessa Beeley joins the Liberty Report to debunk their lies...

By Adam Dick

The Trump administration “is using much the same playbook to create a false choice that war is the only way to address the challenges presented by Iran” as the George W. Bush administration used to gain support for the Iraq War. College of William & Mary Professor Lawrence Wilkerson presents this argument, along with abundant supporting evidence, in a Monday New York Times editorial. Wilkerson should know. In the lead-up to the Iraq War, Wilkerson was chief of staff for United States Secretary of State Colin Powell, whose United Nations presentation regarding Iraq Wilkerson, at the beginning of the editorial, credits with boosting support among Americans for a war against Iraq. Wilkerson, who is a Ron Paul Institute for Peace and Prosperity Academic Board member, has frequently disparaged that effort to build up support for the Iraq War. Indeed, in the editorial he laments that “[t]hat effort led to a war of choice with Iraq — one that resulted in catastrophic losses for the region and the United States-led coalition, and that destabilized the entire Middle East.” The consequences of a war with Iran would also be dire. Addressing some of those consequences in his editorial, Wilkerson predicts that “this war with Iran — a country of almost 80 million people, whose vast strategic depth and difficult terrain makes it a far greater challenge than Iraq — would be 10 to 15 times worse than the Iraq war in terms of casualties and costs.” Read Wilkerson’s editorial here.

By Christopher Westley

This past Tuesday afternoon, I was speaking with a reporter who was interested in the positive effects of infrastructure spending that occurred in the form of fiscal “stimulus” in my part of the country, back during the dark days of the Great Recession, around 2009 and 2010. How did this help our region, he wanted to know? My answer: It didn’t help very much, and that if it did, then (a) it didn’t matter because the growth was not sustainable — it would have stopped when infrastructure spending stopped; (b) you would have to balance any seen positive economic activity with unseen, decreased economic activity on the part real people coerced to finance the stimulus; (c) it may have delayed the correction to the extent that it allowed business owners and workers to put off making tough choices based on market signals: and (d) you would have to believe economic growth is something that occurs due to infrastructure spending as opposed to the development of property rights institutions, saving, time preference, the specialization and division of labor, and so on. Still, I wondered: Why the concern about infrastructure spending? Then I went about my day, ignoring Trump’s State of the Union, like a normal person. It was only this morning that I read about his infrastructure spending proposal: Tonight I’m calling on Congress to produce a bill that generates at least $1.5 trillion for the new infrastructure investment that our country so desperately needs. Every federal dollar should be leveraged by partnering with state and local governments, and where appropriate, tapping into private sector investment, to permanently fix the infrastructure deficit. And we can do it.

Then it made sense. Infrastructure spending and its effects on the economy were pre-speech talking points, as were the Keynesian biases that this spending tempered the severity of the Great Recession, and would likely provide an economic boost in the future.

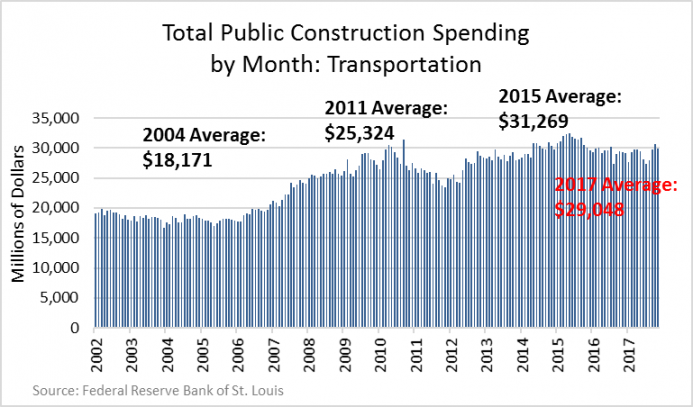

The assumption is current levels of public infrastructure spending are deficient, and that as a result, highways, bridges, airports, trains, and waterways are today dilapidated, dirty, and dangerous. But if this were true, the more accurate conclusion would be that public infrastructure spending is among the biggest scams of the century. Rest assured, it’s not true. The fact is that federal, state, and local spending on transportation infrastructure is well into the tens of billions each month. As the chart below shows, this spending increased to over $25 billion a month in 2011, during the heyday of QE2. This number has only increased over time, as the average spending over the last two years has been just under $30 billion a month.

Monthly public spending on infrastructure in the US exceeds the annual GDP of Paraguay. Annually, we spend more on infrastructure than the GDP of Hong Kong.

Let’s admit it: If infrastructure spending promoted economic growth, the US economy would resemble a modern day Incan Empire. But to argue as much would be to claim that industrial revolutions occurred in the past mostly because the mass of workers were relieved, by force, of a portion of their wealth to finance new turnpikes, canals, and railroads. This isn’t the case. The Industrial Revolution moved from England to the United States because capital became more secure in the latter relative to the former. Tom DiLorenzo points out in his book How Capitalism Saved America that most roads in the 19th century — when the Industrial Revolution moved from England to North America — were privately financed. It would take the advent of the 20th century Progressivism and the overweening nation-state that transportation functions became the domain of public-sector cartels. We should view this development as the exception, not the rule. As Walter Block wrote in The Privatization of Roads and Highways, "we must realize that just because the government has always built and managed the roadway network, this is not necessarily inevitable, the most efficient procedure, nor even justifiable." To be fair to Trump, he is at least promoting an issue that was a common talking point as a presidential candidate. At the time, my reaction was twofold. On the one hand, if the Feds must waste billions of dollars, better it be within our shores than overseas.1 (Why should the military-industrial complex always get the loot?) On the other hand, Candidate Trump’s focus on infrastructure expansion contradicted his criticisms of the ruling class, which he considered subservient to special interests. To assume that special interests don’t similarly influence infrastructure spending is naïve, in the least. People who are “like, really smart,” like Trump, get this better than anybody. But why the regime focus on infrastructure? A couple of possibilities come to mind. First, wasteful infrastructure spending is at least visible. When taxpayers read about billions of dollars being misplaced in Afghanistan, for instance, it is seen as a zero-sum game. With the exception of “bridges to nowhere,” many people believe domestic infrastructure spending provides at least some net benefit — even when they acknowledge its unseen costs. The federal government has long had a difficult time justifying its very existence in the post-Cold War world. Infrastructure might then serve the propaganda purpose today that the Space Race served in the 1960s. Second, the political class loves infrastructure spending because it can be so easily targeted, even down to the level of zip code. The ability to direct tens of millions of dollars in conscripted capital to politically important regions of the country is a godsend to a ruling class that depends on the support of key constituencies. While politicized spending dates back to the Washington administration, I have always admired the late Jim Couch’s important research on its effects in centralizing power during the New Deal. Given that infrastructure projects most always employ large numbers of local workers, this spending serves as a way for the State to maintain popular support by a large class of workers whose livelihoods now depend on federal spending. If a government that robs Peter to pay Paul can always depend on the support of Paul, then Trump’s proposal guarantees a good number of Pauls — a bought-and-paid-for voting bloc. While the Pauls can be identified, they should nonetheless be ignored. As Rothbard wrote in For a New Liberty (p. 387), “the chances of converting those who are waxing fat by means of State exploitation are negligible, to say the least. Our hope is to convert the mass of the people who are being victimized by State power, not those who are gaining by it.” Trump is at his populist best when he appeals to the victims. Unfortunately, he is at his populist worst when he adds to infrastructure spending already out-of-control by creating new divisions in society between the productive and parasitical classes. Why is this? Because in this new political era, a divided, unproductive government is one of the few things that most unites us, while a government united behind welfare or warfare boondoggles — including infrastructure spending — sow division. It’s no mistake that these divisions have increased as the institutional constraints on the redistributive state have been removed. Infrastructure is an effect of wealth creation, not its cause. Confusing this point is the road to hell, not prosperity, which is, as The Donald might say, “Sad!”

1 This is a very weak justification for such spending to the extent that it still justifies many billions of dollars’ worth of coercive wealth redistribution. Furthermore, as Rothbard often argued, such spending on welfare always seems to result in increased spending on warfare, given the symbiotic relationship between the two types of government expansion.

This article was originally published at The Mises Institute.

|

Archives

April 2024

|

RSS Feed

RSS Feed