|

By Mike Holly

Although the causes of economic crises recurring throughout US history and often spreading worldwide can’t be proven using empirical means, oppressive government regulations favoring special interests in relevant industries have preceded every crisis. Typically, cronyism involves support of politicians in exchange for regulations denying others the freedom to compete with the moneyed interests (e.g., monopolies). Less competition leads to higher costs and lower quality. It reduces economic growth, jobs, wages, innovation, and productivity. Attempts to control economic growth through government spending and/or manipulating interest rates (e.g., stimulate growth with low rates) generally leads to more severe crises. None of these things are recent phenomena, but can be found again and again throughout American history. Mercantilism After the Revolutionary War, when the agrarian economy was beginning to industrialize, politicians pursued British-style mercantilism, including colonialism, against natives and regulations blocking competition in banking and manufacturing. Financial panics and depressions resulted under a national bank in 1792 and from 1819–21 and state-regulated banks from 1837–43 and 1857–59. The Civil War was a dispute between Republicans representing manufacturers in the North that blocked free trade with import tariffs against Europe, and Democrats representing agricultural plantations in the South that refused to replace slavery with mechanization using the North’s high-cost goods. Monopolization The “Gilded Age of Capitalism” shifted the economy from agriculture to industry led by “robber barons” who lobbied mostly Republicans. The government helped create railroad monopolies with low-interest loans, land grants, and special frontier privileges. The railroads formed a conglomerate that monopolized much of the rest of the economy by favoring large over small customers (e.g., Rockefeller’s Standard Oil over farmers), large suppliers (e.g., Carnegie Steel), and big banks (e.g., J.P. Morgan). Both railroads and banking (with both national and state banks) were implicated in the severe financial panics from 1873–78 and 1893–97, occurring during the Long Depression of 1873–96, and another panic in 1901. Banking regulation led to the panic in 1907. During the Progressive Era, the US used regulation to form many of today’s monopolies. From 1906 to 1910, Republicans led efforts to create state-regulated electricity and natural gas utility monopolies, and the Seven Sisters oil and physician oligopolies. In 1913, Democrats sanctioned the telephone monopoly and founded the Federal Reserve banking monopoly (i.e., which regulates the banks). After World War I, the Fed raised interest rates which led to the depression of 1920–21, which bankrupted many companies and led to manufacturing oligopolies, including in the automotive industry. Thanks to these new frontiers in a regulated economy, by the 1920s, only 200 corporations controlled over half of all US industry and the richest 1 percent of the population owned 40 percent of the nation's wealth. As in recent times, the Fed responded by providing easy credit at low interest rates, which led to increased consumer and business debt, uneconomic and risky investments, and inflated assets, including stock prices (further increasing wealth disparity). After the Fed tried to raise interest rates, the result was the Great Stock Market Crash of 1929. Nationalization During the 1930s, the crash led to the Great Depression, the worst financial crisis in US history, and then spread from the world’s largest economy globally, albeit with less severity abroad. Democrats, led by President Roosevelt (FDR) and supported by bankers, agriculture, oil, and labor, tried to redistribute wealth by limiting competition through government takeovers, including trucking, airline, and housing industries, and restricting the supply of food and oil. This led to continued global depression and World War II, which was financed with debt. Finally, the post-war boom or “Golden Age of Capitalism” saw a dismantling of wartime regulations and growing opportunities especially in manufacturing (like China today). During global rebuilding, the US became the world’s economic leader with about 4 percent annual growth, even with increasing interest rates, decreasing debt, and high taxes. Although wealth disparity was historically low, Democrats increased regulation of necessities, leading to today’s high costs. FDR had taken money from taxpayers to subsidize home loans at low interest rates including guarantees from the Federal Housing Administration (FHA) since 1934, and securitization by the Fannie Mae secondary mortgage monopoly since 1938 (and Democrats added Freddie Mac to form a duopoly in 1970). After the war, the subsidies led to unsustainable demand for more expensive and larger homes, urban sprawl, and a shortage of affordable housing. FDR had also taken money from taxpayers to subsidize favored farm crops, which discouraged alternative crops. After 1946, Democrats increased subsidies leading to inflated prices for farmland. Since 1973, the US has subsidized food overproduction leading to dumped exports that retard agricultural and economic development in the developing world and uneconomical bio-fuels protected by tariffs against Brazilian ethanol (until 2012). FDR had led support for the nationalization of oil industries (e.g., Mexico), and military spending to defend dictators in oil-rich countries (e.g., Saudi Arabia). In 1965, Democrats led nationalization of about half of health care purchasing through Medicare and Medicaid. These programs, and later Obamacare, subsidized increased demand while the supply of doctors and hospitals has been restricted. The resulting health care crisis led to skyrocketing costs nearly triple those of other developed countries. Psuedo-Deregulation The dreaded stagflation of the 1970s is considered tied for the second worst financial crisis in US history. The Fed responded to inflation by raising interest rates, leading to the Great Recession of the early 1980s, which led to the Savings and Loan Crisis, and spread as the Latin American Debt Crisis. Since then, the Fed has been lowering rates overall. Meanwhile, politicians claimed to be trying to increase cost efficiency through privatization of public industries, and foster competition through partial deregulation of private industries. Worldwide, politicians allowed the monopolists to write the rules, including preferential bargain sales to cronies, which led to even nastier deregulated monopolies. Deregulation was limited mainly to common carrier industries, including airlines in 1978, trucking in 1980, telecommunications in 1996, and electricity and natural gas utilities during the 1990s, and also banking in 1999. For example, states allowed utilities to design rigged trading schemes, gain preferential access to transport lines, and sell assets to affiliates for pennies on the dollar. Deregulation declined after manipulations led to the California Energy Crisis of 2000. Corporatism After the energy crises and bursting of the internet bubble in 2000, big business Republicans and big government Democrats practiced corporatism. The US House Budget Committee explains: “In too many areas of the economy — especially energy, housing, finance, and health care — free enterprise has given way to government control in partnership with a few large or politically well-connected companies.” In 2003, regulations led to increased ethanol production from corn, but after that led to the 2007–08 Food Crisis, growth was stopped by mandates that the fuel be made from expensive-to-process cellulose. Meanwhile, George W. Bush promoted home loans securitized through the Fannie and Freddie duopoly and the Fed’s big banks, while encouraging the Fed to lower interest rates, leading to a bubble in home ownership and prices. Soon after the Fed started raising rates, the bubble burst leading to the 2007–09 Subprime Mortgage Crisis, 2007–08 Financial Crisis (considered tied for the second worst financial crisis in US history), 2008–10 Automotive Crisis, and 2008–12 Global Recession. In 2010, Dodd Frank gave politicians more oversight over the Fed’s big banks, increasing influence peddling, and risks of crises. The Fed has been loaning trillions of dollars at low interest rates to the big banks. Lower rates can encourage financial engineering, like mergers, which allow bankers and corporate executives to bleed profits from large corporations, who receive preferential tax treatment, especially abroad. Since 1998, the financial sector has spent over $6 billion lobbying Congress. The Bank for International Settlements, or so-called “bank of central bankers,” warns another global debt crisis is coming, and the debt-trap is now even worse than before 2007. The US has led many nations to continue to lower interest rates and accumulating private and public debt. Now, a slowing economy could make the debt toxic and lead to a financial crisis that would be hastened as the Fed raises rates. The Bank warns: “It is unrealistic and dangerous to expect that monetary policy can cure all the global economy’s ills.” Obamacare could allow bureaucracies to control patient treatments and prices, while lobbied by the industry. Since 1998, medical interests have spent over $6 billion lobbying Congress. The Free Market Solution Today, there is no party that favors true privatization or free markets. Republicans favor monopolization, while claiming support for free markets and blaming the Democrat’s high taxes and regulations for crises. Democrats favor nationalization, while blaming non-existent free markets for crises. Meanwhile, many Americans appear to be embracing the regulatory nationalism of crony capitalist Donald Trump or the democratic socialism of Bernie Sanders. The solution, however, is simply to take as much power as possible out of the control of corruptible politicians and their special interest supporters. This article originally appeared at The Mises Institute.

Migrants are on the rampage in Greece as they seek to enter Macedonia and parts north, ultimately to Germany. The Europeans are paying the price for their open-door welfare state migration policy and support for US interventionist foreign policy that lead to mass migrations. Is this the end of the political union?

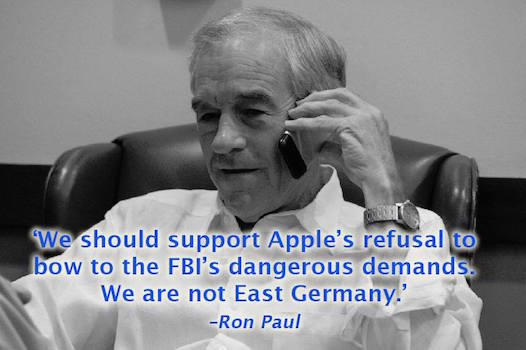

By Ron Paul

The FBI tells us that its demand for a back door into the iPhone is all about fighting terrorism, and that it is essential to break in just this one time to find out more about the San Bernardino attack last December. But the truth is they had long sought a way to break Apple’s iPhone encryption and, like 9/11 and the PATRIOT Act, a mass murder provided just the pretext needed. After all, they say, if we are going to be protected from terrorism we have to give up a little of our privacy and liberty. Never mind that government spying on us has not prevented one terrorist attack. Apple has so far stood up to a federal government's demand that it force its employees to write a computer program to break into its own product. No doubt Apple CEO Tim Cook understands the damage it would do to his company for the world to know that the US government has a key to supposedly secure iPhones. But the principles at stake are even higher. We have a fundamental right to privacy. We have a fundamental right to go about our daily life without the threat of government surveillance of our activities. We are not East Germany. Let’s not forget that this new, more secure iPhone was developed partly in response to Ed Snowden’s revelations that the federal government was illegally spying on us. The federal government was caught breaking the law but instead of ending its illegal spying is demanding that private companies make it easier for it to continue. Last week we also learned that Congress is planning to join the fight against Apple -- and us. Members are rushing to set up yet another governmental commission to study how our privacy can be violated for false promises of security. Of course they won’t put it that way, but we can be sure that will be the result. Some in Congress are seeking to pass legislation regulating how companies can or cannot encrypt their products. This will suppress the development of new technology and will have a chilling effect on our right to be protected from an intrusive government. Any legislation Congress writes limiting encryption will likely be unconstitutional, but unfortunately Congress seldom heeds the Constitution anyway. When FBI Director James Comey demanded a back door into the San Bernardino shooter’s iPhone, he promised that it was only for this one, extraordinary situation. “The San Bernardino litigation isn’t about trying to set a precedent or send any kind of message,” he said in a statement last week. Testifying before Congress just days later, however, he quickly changed course, telling the Members of the House Intelligence Committee that the court order and Apple’s appeals, “will be instructive for other courts.” Does anyone really believe this will not be considered a precedent-setting case? Does anyone really believe the government will not use this technology again and again, with lower and lower thresholds? According to press reports, Manhattan district attorney Cyrus Vance, Jr. has 175 iPhones with passcodes that the City of New York wants to access. We can be sure that is only the beginning. We should support Apple’s refusal to bow to the FBI’s dangerous demands, and we should join forces to defend of our precious liberties without compromise. If the people lead, the leaders will follow.

By Chris Rossini

The irony is so thick in this story, you may not be able to handle it. Let's go back to the financial crisis of 2008. Easily, one of the biggest heists in world history went by the name of TARP, and it bailed out the crony banks. For those who don't remember, the U.S. Treasury Secretary at the time was Henry "Hank" Paulson. In 2007, before the Fed's centrally-planned economy hit the fan, Paulson was whistling past the graveyard. He was saying things like: "This is far and away the strongest global economy I've seen in my business lifetime."

In March of 2008, Paulson kept whistling:

"We've got strong financial institutions . . . Our markets are the envy of the world. They're resilient, they're...innovative, they're flexible. I think we move very quickly to address situations in this country, and, as I said, our financial institutions are strong."

However, once the Fed's kaleidoscope economy went into a free fall, Paulson's story changed and the pilfering of the American taxpayer was set in motion. Paulson nationalized Fannie Mae & Freddie Mac, transferring $5 TRILLION of mortgage liabilities to the federal government.

There was also TARP, the big bailout of the banks. Americans were so strongly against it, but it mattered not. The banks would get their $700 BILLION bailout no matter what the taxpayers thought. Paulson would say on Sept. 19, 2008: "We're talking hundreds of billions of dollars - this needs to be big enough to make a real difference and get at the heart of the problem. This is the way we stabilize the system." "If AIG collapsed, it would have buckled our financial system and wrought economic havoc on the lives of millions of our citizens."

Interesting that Paulson would project such fear about a nation whose markets were supposedly "the envy of the world" and "resilient" and "flexible"...etc. Nevertheless, Americans were mugged for the benefit of the crony banks and that was that.

Now for the irony.... Today, CNBC has a headline that says: Hank Paulson: China needs to let ‘failing companies fail’. No further comment. Ok, maybe just one...End The Fed.

Politicians and their supporters are always trying to justify government redistribution. Excuses are everywhere, but theft is always wrong. Ron Paul tackles the issue. Also, who's responsible for 9/11? Don't look to Republican debates for that answer. This episode of Myth-Busters covers these topics and more. Check it out!

By Adam Dick

Federal Bureau of Investigation (FBI) Director James Comey seems to have quickly reversed course to admit the obvious — that the February 16 magistrate judge’s order for Apple to help the US government breach an iPhone’s security, including encryption, is as much about establishing precedent for more court orders as it is about the government trying to obtain information connected to one phone related to the December 2 mass murder in San Bernardino, California. On Sunday, Comey issued a statement that started with this declaration: “The San Bernardino litigation isn’t about trying to set a precedent or send any kind of message.” Then, on Thursday, Comey backtracked from this assurance by testifying before the US House Intelligence Committee that the order and appeals arising from the order “will be instructive for other courts.” Comey told the committee: Whatever the judge’s decision is in California — and I’m sure it will be appealed, no matter how it ends up — will be instructive for other courts. And there may well be other cases that involve the same kind of phone and the same operating system. What the experts have told me is the combination — and here’s where I’m going to get well out of my depth — of the 5c [iPhone] and this particular operating system is sufficiently unusual that it’s unlikely to be a trailblazer because of technology being the limiting principle. But, sure, a decision by a judge — the judge weighing a decision in Brooklyn right now — all those decisions will guide how other courts handle similar requests.

Notably, Comey is still unwilling to admit the true breadth of the privacy invasion the court order portends. The reasoning for requiring Apple to breach protections related to one iPhone would just as well support requiring the same privacy-stripping action to be taken by any company regarding any of such company’s phones, computers, or other devices, no mattering what operating systems the devices may use. Will Comey soon fess up to a larger plan?

This article was originally published at The Ron Paul Institute.

By Ron Paul

Americans are justifiably frustrated. While the Fed and government continue manipulate things in order to keep the stock market up, Americans must deal with the reality of a severely distorted economy. There needs to be, and will be, a serious liquidation of the unsustainable debt and malinvestments that the Fed has piled up. I sit down with CNBC to discuss our conundrum below:

Author and attorney Jim Ostrowski joins the program today to discuss his book, "Progressivism: A Primer on the Idea Destroying America."

By Chris Rossini

We've all seen the FDIC sign at the bank. Perhaps we've never read it all the way through, like the part about "faith," but we're aware that there's "insurance" from the government should our bank head into the land of Lehman. Why is that sign there? And what's going on behind the curtain? Well, since we do not have a monetary system of sound money and honesty, there has to be some kind of assurance for depositors in order to part with their hard earned money. That FDIC sign basically says: "Go ahead, your money is safe here. No need to pay attention to this bank. No need to keep an eye on what it's doing, or who it's lending to. Just make your deposit and walk away." That's virtually what every American does too. Put the money in, and walk away. Is your money there any time you want it? Well, most people think so. Is it really there? No, of course it's not there. We're forced to live in a "fractional-reserve" monetary system. In other words, banks only keep a fraction of the deposits that are entrusted to them, and lend out the rest at interest. Sure, you can withdraw some of your money whenever you want...the keyword being some. Don't even think about withdrawing large amounts though. By law, the bank must report you to the government for such suspicious behavior. Withdrawing large sums of your own money is a no-no in the land of the free. What about that FDIC sign though? How legit is it? Well, it should not come as a surprise to you, but it's all smoke and mirrors. Simon Black tells us: Last week the FDIC released its annual financial statements, giving the public a glimpse into the financial condition of the organization responsible for backing up the entire US banking system. [...]

By the way, part of being forced to live in a fractional-reserve system is that you have to deal with "financial crises". It's baked in. Central planners can't possibly manage something as complex as an entire economy. A financial crisis is basically economic law asserting itself and smacking back those arrogant PhD's. Unfortunately, the vast majority of people get economically hammered during a financial crisis, because they trust the PhD's.

With sound money, and honest banking, the idea of a financial crises that engulfs almost all of the population would be unheard of. We're not there yet. The PhD's must suffer their coup de grace first. That little sign at the bank? It's only there to make you feel comfortable about putting your earnings into a system run by central planners. That's it. Even FDIC admits that they can't bail everyone out. The great economist Murray Rothbard summed up the deceit known as "deposit insurance" perfectly: "Deposit insurance" is simply a fraudulent racket, and a cruel one at that, since it may plunder the life savings and the money stock of the entire public.

It wouldn't be the first time that people were swindled by their government, and unless we move to sound money and no central bank, it won't be the last.

Once again the US prison at Guantanamo Bay, Cuba is in the news. President Obama has made a last-ditch effort to fulfill one of his campaign promises to close the facility down, but Republicans in Congress are determined to keep it operational. Both sides are ignoring the real issues involved in the debate. It has to do with the Constitution and war.

|

Archives

July 2024

|

RSS Feed

RSS Feed