|

By Robert P. Murphy

President Donald Trump sparked controversy — as is his wont — when he recently told CNBC that he was “not thrilled” with the Federal Reserve’s announced hikes in short-term interest rates, which he claimed would hinder the economic expansion for which his administration had worked so hard. “I’m letting them [the Fed] do what they feel is best,” he added, but this assurance was not enough to prevent journalists and policy experts from pronouncing Trump’s remarks as unprecedented interference with the central bank’s independence. It may be unusual for a president to openly voice such criticism, but it wouldn’t be the first time one has pressured the Federal Reserve for short-term political gain. In 1965, President Lyndon Johnson considered firing then-Fed Chairman William McChesney Martin, but upon learning this would probably be illegal, he opted instead to dress down the recalcitrant central bank chief at his Texas ranch. By Martin’s later account, a heated argument erupted that resulted in the president shoving him against a wall. According to financial journalist Sebastian Mallaby, as LBJ pushed Martin around the room, he yelled, “Boys are dying in Vietnam, and Bill Martin doesn't care.” Better known is President Richard Nixon’s tape-recorded collaboration with Fed Chairman Arthur Burns, Martin’s replacement, who maintained an easy-money policy to stimulate the economy before the 1972 election, which contributed to Tricky Dick’s landslide victory and fueled price inflation for the rest of the decade. In terms of the resulting capital destruction and economic dislocations, this episode is one of modern U.S. history’s greatest object lessons about the risks of executive power reaching beyond its constitutional authority. For another example showing that Trump’s behavior is nothing new, consider that President George H. W. Bush had a running public dispute with then-Fed Chair Alan Greenspan over monetary accommodation. Bush would later blame “The Maestro” for his 1992 reelection loss. Far from being unthinkable, the idea of government officials manipulating monetary policy for political gain is so intuitive that economists have a name for it: the political business cycle. The classic model was published in 1975 by Yale University economics professor William Nordhaus. For most countries that he analyzed, Nordhaus found no smoking gun proving political interference with the central-bank policymaking, but he concluded that it appeared the United States had a very politicized business cycle. Nordhaus looked at 10 “before and after” election periods covering five U.S. election cycles. For nine of those 10 periods, the unemployment rate matched his model’s prediction: Joblessness fell before the election and rose afterward. This pattern is exactly what one would expect if elected officials exercised discretion over the timing of the economy’s booms and busts. If the economic fluctuations were due to random chance, the probability that they would coincide with the observed pattern would be very small, only slightly above 1 percent. Although intuitive, the simple predictions of a “political business cycle” model didn’t perform as well in the two decades following Nordhaus’ seminal work. One refinement was to assume politicians only lean on the central bank to loosen up before an election if it seemed they would otherwise be likely to lose; an incumbent who was confident of reelection wouldn’t take the risk of goosing the economy for short-term gain but having to paying a political price for it during the next term. (For details, see Kenneth Schultz’s 1995 article in the British Journal of Political Science.) Fortunately, hyper-refined economic models aren’t always necessary for showing that political factors influence central bank policy. Indeed, ordinary narrative history can reveal even scandals of the opposite kind: central banks aggressively asserting their political independence at great cost to the economy. Nicholas Biddle was chief of the Second Bank of the United States — the Fed’s predecessor — who decided to fight moves by President Andrew Jackson to veto the renewal of the bank’s charter and withdraw Treasury deposits from the bank. A champion of hard money, Jackson said the central bank was a political tool that served the monied elites at the expense of ordinary people. .... Read the rest of this article at The Fiscal Times

For the vast majority of people, wages have been stagnant since the 1970's. What happened in 1971? Well, that was the year that the U.S. dropped what was left of the gold standard. The major beneficiaries of that fateful decision have been the politically-connected and crony 1%.

Wikileaks founder and chief editor Julian Assange has been in solitary confinement in the Ecuadorian embassy for more than six years. Though the original charges have been dropped against him, he remains in the Embassy for fear of being extradited to the US for prosecution. His "crime"? Publishing things the government does not want us to know. It is past time for Assange to be freed.

“How To Win A Grassroots Media Rebellion“ - Caitlin Johnstone At Ron Paul Institute Conference8/30/2018

The mainstream media and its partners in government want to silence any non-regime voices. Australian renegade blogger joins the Ron Paul Institute's August 18th Washington conference to tell us how we can fight back!

While the UN has found what it believes may be war crimes in the three plus year Saudi-led attack on Yemen, the US government still maintains that its role in helping guide Saudi attacks actually saves lives rather than takes them. Isn't it time to stand up to the Saudis and their partners in crime?

President Trump's resident neocons, chiefly Mike Pompeo at State and National Security Advisor John Bolton, are determined to scuttle any moves toward peace with North Korea. With this week's cancellation of a Pompeo trip to Pyongyang, will they succeed in derailing Trump's big peace initiative?

By Ron Paul

President Trump recently imposed sanctions on Turkey to protest the Turkish government’s detention of an American pastor. Turkey has responded by increasing tariffs on US exports. The trade war is being blamed for the collapse of Turkey’s currency, the lira. While the sanctions may have played a role, Turkey’s currency crisis is rooted in the Turkish government’s fiscal and (especially) monetary policies. In the past seven years, Turkey’s central bank has tripled the money supply and pushed interest rates down to 4.5 percent. While Turkey’s government did not adopt Ben Bernanke’s proposal to drop money from helicopters, Turkish politicians have taken advantage of easy money policies to increase subsidies for key voting blocs and special interests. The results of the Turkish government’s inflation-fueled spending binge are not surprising to anyone familiar with Austrian economics or economic history. Turkey is now plagued with huge deficits, a collapsing currency, and a looming economic crisis, making it the next candidate for a European Union or Federal Reserve bailout. Turkey’s combination of low interest rates, money creation, and massive government spending to “stimulate” the economy parallels the policies the US government has pursued for the past ten years. Without drastic changes in fiscal and monetary policies, economic trouble in America is around the corner. The very large and growing federal debt will cause a major crisis as the government’s debt burden will be unsustainable. Instead of cutting spending or raising taxes, politicians can be expected to pressure the Federal Reserve to do their dirty work for them via inflation. We may even see the Fed “experiment” with negative interest rates, which would punish Americans for saving. The monetization of the federal debt will erode the dollar’s purchasing power and decimate middle-and-working-class Americans who are already seeing any gains in their incomes eaten away by inflation. If we are lucky, the next Fed-caused downturn will cause only a resurgence of 1970s-style stagflation. The more likely scenario is the type of widespread economic chaos not seen in America since the Great Depression. The growth of cultural Marxism, the widespread entitlement mentality, and the willingness of partisans of various sides to use force against their political opponents suggests that this economic crisis will result in civil unrest that will be used to justify new crackdowns on individual liberty. Those who understand the causes of, and cures for, our current predicament have two responsibilities. First, prepare a plan to protect your family when the crisis occurs. Second, do all you can to spread the truth in hopes the liberty movement reaches critical mass so it can force Congress to make the changes necessary to avert disaster. Since the crisis will result in a rejection of the dollar’s world reserve currency status, individuals should consider alternatives such as gold and other precious metals. Restoring a free-market monetary system should be a priority for the liberty movement. Other priorities include ending our interventionist foreign policy, cutting spending in all areas, rolling back the surveillance state, protecting all civil liberties, and auditing (and ending) the Federal Reserve. If we do our jobs, we can build a society of peace, prosperity, and liberty atop the ashes of the welfare-warfare state.

As the Syrian military prepares to re-take Idlib province and end years of al-Qaeda control over the area, Trump's National Security Advisor John Bolton warns that the Syrian government may try another gas attack. The neocons are not ready to admit defeat in Syria quite yet. Will the late John McCain's jihadist allies in Syria stage an attack and wait for the US military to act as their air force?

'Battlefield America The War on the American People': John Whitehead at RPI Media & War Conference8/27/2018

Rutherford Institute President John Whitehead warns us about the greatest threat to our freedoms and our way of life: an increasingly militarized government at all levels in the United States. This speech is from the Ron Paul Institute's 2018 Media & War conference on August 18th in Washington, DC.

By Liberty Report Staff

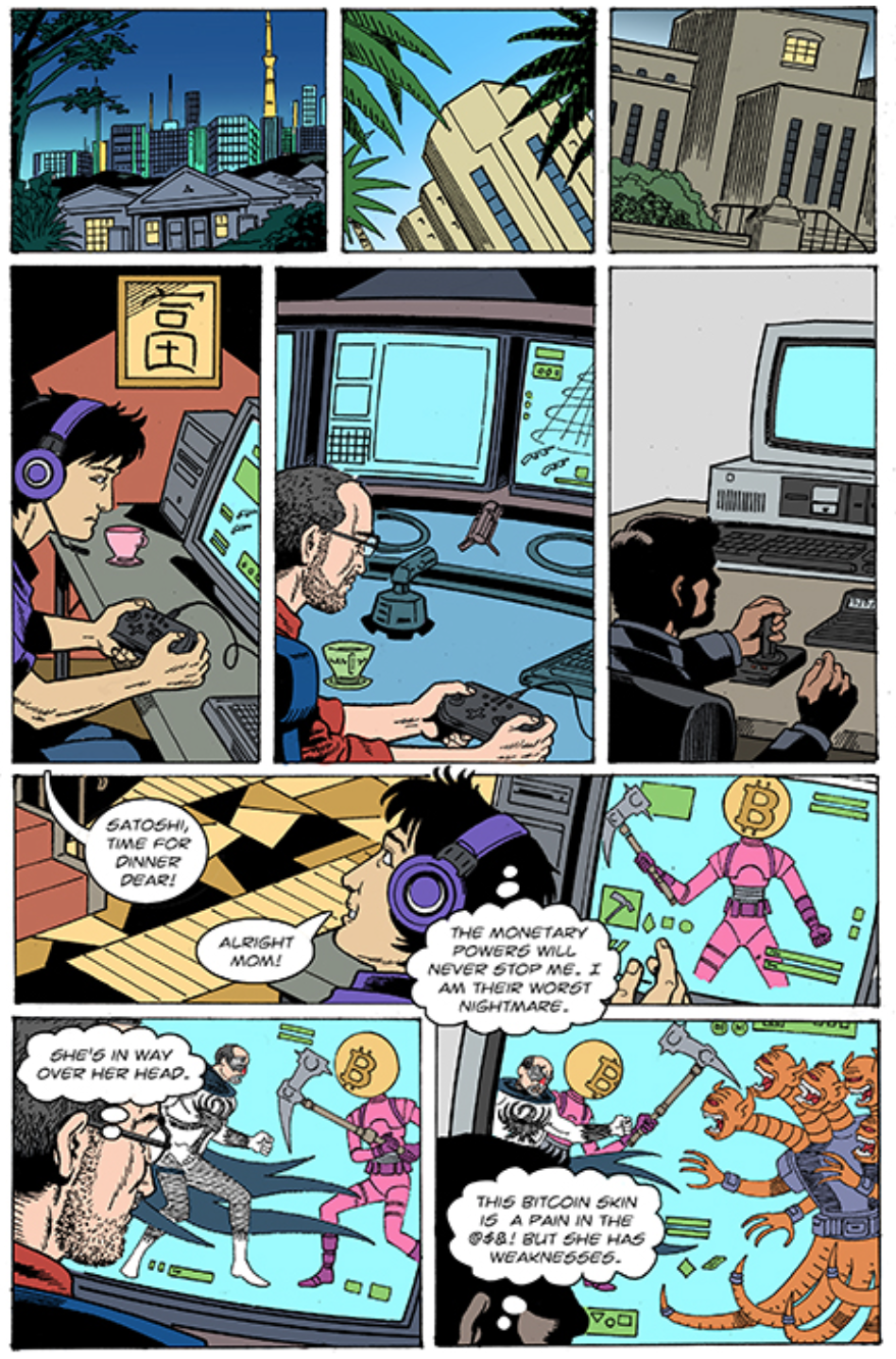

What happens when you mix Nassim Nicholas Taleb and comics? You get Black Swan Man! |

Archives

July 2024

|

RSS Feed

RSS Feed