|

By Chris Rossini

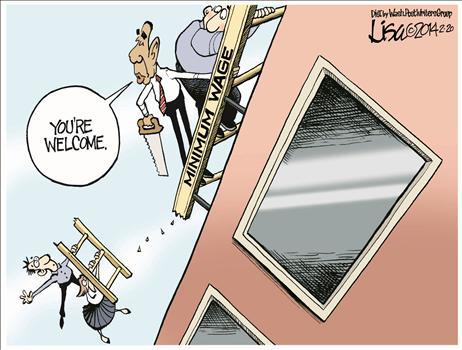

Chris Christie, the Governor of the perennial blue state of NJ, is not someone who normally comes to mind when one thinks of free markets and liberty, but credit must be given when it's due. This week, Christie vetoed a bill pushed by the NJ legislature for a $15 minimum wage. This was a heroic act that should please every poor, low-skilled individual in the Garden State. Their chances of gaining employment have been greatly increased. Now if only the total elimination of the minimum wage were on the table...But alas, that day still lies in the future. For now, the cause of liberty and voluntary contracts can celebrate this token victory. The government has no right to stick its nose in other people's business. Contracts should always be voluntarily made without a third-party bullying its way in and messing everything up. When two people make a contract, it's between them. They're both making decisions that they believe will be to their benefit. Unfortunately, because of very sloppy economic thinking (or non- thinking) many people believe that government can "help" them by tilting the tables in their favor. Of course, government only ends up hurting those it purports to help. With a $15 minimum wage law, a laborer without the skill set or ability to earn $15/hr would not be hired. In other words, the minimum wage is a law that creates forced unemployment. If you can't earn $15/hr, you've been outlawed from getting a job. But what if you were willing to work for $10/hr and an employer was happy to pay you that amount? Tough luck. The NJ Legislature had different plans for you....unemployment. How callous and cruel. The worst part about it is that (thanks to government schooling) the Legislature can count on getting high praise for their destructive act. The truth is that the NJ Legislature can forcefully unemploy as many people as it wants with the arbitrary minimum wage law. What if they mandated a minimum wage of $50/hr? The result would be that an even larger group of people would be outlawed from finding work. Not only would the poor and low-skilled take the heat, but people who are more productive, better educated and have more skills. Only have the skills to earn $25/hr? Tough luck. The minimum wage is $50/hr. This doesn't happen because politicians care about their jobs. They don't want to ruffle too many feathers. They'll raise the minimum wage as long as it's just the poorest of the poor, the uneducated, teenagers, and the elderly who are the only victims. They're an easy target. Plus, once they can't find a job, they're most likely to go on the government dole and act as loyal voters to keep their "benefits" coming. So politicians will "raise the wage," but only if the most vulnerable are the only victims. Chris Christie gave the most vulnerable an ability to get a job. Some still won't get a job because the current minimum wage will continue to prohibit them. But Christie prevented a bad situation from getting worse. For that single act, he deserves some praise. The following interview was originally published at International Man. Nick Giambruno: Doug, I know you’ve been thinking about how the Greater Depression will unfold. It’s no secret the government has created the biggest credit bubble in history through endless money printing—euphemistically called QE—and now “NIRP” (negative interest rates). But I understand you’ve had a different “bubble” on your mind lately… Doug Casey: Yes. I’ve been thinking about the gigantic bubble in military spending in the U.S. And how it’s one of the worst things that can happen, and at the absolute worst time. The U.S. Government is bankrupt, we’re about to go into the trailing edge of a monumental economic hurricane, and both of the presidential candidates are talking about vastly increasing military spending. From an economic point of view, money spent on the military is almost totally wasted. It’s worse than money spent to dig holes during the day and then fill them in again at night—at least that does no actual damage. The “product” of the military is killing people and destroying property. And the amount of money the U.S. spends is provocative to other powers, who feel they have to counter with their own spending. Arms races never end well. I’m going to say some unflattering things about the military, and realize it will probably shock most Americans to hear them. Americans still have a high regard for the military—far too much. They see it as one of the few American institutions that still “works.” They see it as something defending them from evil outside the borders of the “homeland”—which, by the way, is a very recently coined term. But the military is actually just another government bureaucracy, like the Post Office. Albeit much more heavily armed. Most people are unaware how dangerous the U.S. military has become to both the average American and the concept of America. The minions of the Pentagon aren’t protecting Americans. They’re actively endangering them, and what the country has always stood for. The situation has gotten totally out of control. Most obviously from a financial viewpoint. The U.S. currently spends more on “defense” than the next seven governments combined… At one point recently, it was more than the rest of the world combined. But who really knows, since Pentagon accounting is so inaccurate and corrupt? Nick Giambruno: The 2015 budget was $600 billion. More than three times what China spends. Doug Casey: Well, again, nobody knows how big the Pentagon’s, or China’s, or Russia’s, or whoever’s, budgets really are. That’s just the “official” number, which doesn’t include quasi-military spending outside of the Department of Defense. Here, I’m thinking of Homeland Security, “black ops” slush funds, the Department of Energy where a lot of nuclear spending goes, NASA, CIA, and dozens of other ratholes that disguise the real budget. U.S. military spending could easily be over the $1 trillion mark. It’s clear the Pentagon itself doesn’t know. In fact, nobody seems to know how much money is being spent or where it goes. I remember Rumsfeld once remarking, years ago, that they couldn’t find $2 trillion—but there was never a scandal, or even an attempt to find it. The news cycle just went on to the Kardashians or whatever. Now, according to the Office of the Inspector General, at least $6.5 trillion can’t be accounted for. And probably never will be. This is a truly unbelievable number. How dysfunctional has the system become that numbers like that can be dropped with impunity? World War 2 was only supposed to have cost $341 billion 1945 dollars… Even though the law requires annual audits of all federal agencies, the Pentagon never complies. They just tell Congress that the books are such a mess, they can’t give accurate numbers. No matter; nobody is shutting down the Pentagon. The Pentagon—which is to say the military-industrial complex—is at once so sacrosanct, so gigantic, and so corrupt that nobody dares get to the bottom of it. Nick Giambruno: Wow, it’s hard to imagine how many pockets that $6.5 trillion has lined around the Beltway… Doug Casey: Indeed. It makes the TARP bailouts, which came in at around $700 billion, seem trivial in comparison. And nobody knows where that money went, either. It’s funny when you think of the saying attributed to Senator Everett Dirksen in the mid-60s: “A billion here, a billion there, and pretty soon, you’re talking real money.” We’re up to trillions now. Obama might soon be asking his science officer what comes after a trillion. And this at a time when interest rates are at record lows, and every segment of society is carrying record high levels of debt. Frankly, something has to give… much higher interest rates, much higher taxes, much higher inflation, or perhaps a collapse of the system itself. Probably all of them together. When interest rates go back up to normal historic levels, that alone will collapse the structure. It’s bad news all around… all this spending on an organization with the primary mission of blowing things up. The military has become a giant golden hammer looking for a nail. It used to be that Congress actually had to declare a war. Starting with the Korean conflict, however, the president found he could commit the country not to just sport wars, like we’ve always had in Central America, but to a major war. In fact, now the U.S. is in a constant state of undeclared war—Afghanistan, Iraq, Syria, Libya, and a dozen other Third World countries that you rarely hear about. Plus, playing chicken with the Chinese, the Russians, and the Iranians. Read the rest Where does Ron Paul buy his gold?Call Monday-Friday 7:00 AM - 5:00 PM (PST)

Watch Ron Paul introduce Camino Coin Company Interested in being a sponsor? Email us

Homeland Security secretary Jeh Johnson is reported to be considering declaring the US voting process a "critical infrastructure" of the United States and thus under the control of his agency. DHS already controls 16 other "critical infrastructure" sectors. Didn't they promise that the creation of this Department would streamline government rather than expand government control?

By Brittany Hunter

Earlier this month, the Justice Department announced that it plans to stop using privately run prisons after a report found that they were often less safe for inmates than federally run facilities. While it is admirable for the federal government to finally start taking an interest in the well-being of its incarcerated population, referring to these facilities as “private” can be grossly misleading. A truly private organization is characterized by competition in a free marketplace. A private organization does not enjoy any monopoly powers conferred by the state. Nor are the taxpayers forced to pay for the services of any private organization through their tax dollars. “Private” prisons, on the other hand, are nothing like a truly private organization. Specifically, these privately run prisons contract with the federal government to act as agents for the state, paid to create more space for our already massive prison population. While these prisons have had an awful reputation of prisoner abuse and poor living conditions, including reports of contaminated food, it is important to remember that the problem exists not because the prisons are privately owned. The problem stems from the fact that the state is the entity responsible for propping up these facilities and creating the demand for more prisons in the first place. Why There Are so Many Prisoners During the “tough on crime” era of the 1970s and 1980s, the prison population in the United States began to grow exponentially thanks to the newly declared war on drugs and new policies on mandatory minimum sentencing laws. Unable to keep up with the rate of Americans being incarcerated, the government began looking for solutions to this problem. Rather than change the awful policies that were creating new prisoners, the state decided to look to the private sector for help. As we all know, once a private company gets into bed with the government they are no longer functioning within anything we could call a “free market.” No deal done with the government comes without a series of strings attached. Promising to offer quality services at lower costs, these privately run facilities continued to grow over the last several decades. To make matters worse, many of these privately run facilities were built in rural and impoverished communities, where the promise of job growth and economic booms were used to entice cities to agree to house the new prisons. As time went on, the line between public and private was blurred even further as the federal government began selling existing federal prisons to private companies, claiming this would financially benefit the state in the short term. While in theory this partnership was thought to be a cost-efficient way of managing the growing incarceration rate, there has never been any clear or final indication that this has been the case. The Problem with Corporatism What we do know is that this corporatist alliance between the government sector and the private sector has resulted in worsening conditions for inmates and little accountability for either the federal government or the private prisons. Often, each will point the finger at the other leaving little to no recourse for prisoners who report inappropriate and abusive conduct from inside these facilities. Worst of all, perhaps, is the fact that the government has created so much demand for these prisons in the first place. As of 2014, approximately 50 percent of prisoners in federal prisons were serving time for drug-related offenses. In other words, without the federal government’s drug wars, the federal prison system would be a mere fraction of its current size. Would institutions like our drug-war-inflated prison system even exist in a world where truly private prisons existed? While there are differing opinions as to how private law and private prisons would function in a free society, Robert Murphy has spoken extensively on this issue and has offered his opinion on what a private legal system could potentially look like. Private prisons could exist, but let’s not confuse them with the corporatist, cronyist prisons that profit from the drug war and the state’s profligacy. This article was originally published at The Mises Institute.

The Fight in Syria is escalating, find out who is who, and the building alliances in Syria on this segment of the Liberty Report.

By Ron Paul

The monetary system cannot last as it is. Ultimately, major monetary reform will be a pressing issue. When that times comes, it's very important for a critical mass of individuals to understand why we need to End the Fed and make free market competing currencies legal. I discuss this very important topic below:

The new Ford class of super-carriers is years overdue, billions over budget, and not combat worthy. Meanwhile to justify the expense, Washington is ginning up tension in the Persian Gulf and South China Sea. How long can this continue?

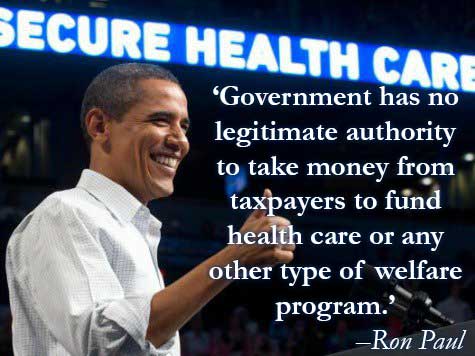

By Ron Paul The decision of several major insurance companies to cut their losses and withdraw from the Obamacare exchanges, combined with the failure of 70 percent of Obamacare's health insurance “co-ops, ” will leave one in six Obamacare enrollees with only one health insurance option. If Obamacare continues on its current track, most of America may resemble Pinal County, Arizona, where no one can obtain private health insurance. Those lucky enough to obtain insurance will face ever-increasing premiums and a declining choice of providers. Many Obamacare supporters claimed that the exchanges created a market for health insurance that would allow consumers to benefit from competition. But allowing consumers to pick from a variety of government-controlled health insurance plans is not a true market; instead it is what the great economist Ludwig von Mises called “playing market.” Unfortunately, if not surprisingly, too many are drawing the wrong lessons from Obamacare’s difficulties. Instead of calling for a repeal of Obamacare and all other government interference in the health care market, many are calling for increased penalties on those who defy Obamacare’s individual mandate in order to force them onto the exchanges. Others are renewing the push for a “public option,” forcing private companies to compete with taxpayer-funded entities and easing the way for the adoption of a Canadian-style single payer system. Even those working to restore individual control over health care via tax deductions, credits, and expanded health savings accounts still support government intervention in order to provide a “safety net” for the poor. Of course, everyone — including libertarians — shares the goal of creating a safety net. Libertarians just understand that a moral and effective safety net is one voluntarily provided by individuals, religious organizations, and private charities. Government has no legitimate authority to take money from taxpayers to fund health care or any other type of welfare program. Government-run health care also does not truly serve the interest of those supposedly “benefiting” from the program. Anyone who doubts this should consider how declining reimbursements and increasing bureaucracy is causing more doctors to refuse to treat Medicaid and Medicare patients. Medicaid patients will face increasing hardships when, not if, the US government's fiscal crisis forces Congress to make spending cuts. When the crisis comes, what is more likely to be cut first: spending benefiting large corporations and big banks that can deploy armies of high-powered lobbyists, or spending benefiting low-income Americans who cannot afford K Street representation? Contrary to myth, low-income individuals did not go without care in the days before the welfare state. Private, charity-run hospitals staffed by volunteers provided a safety net for those who could not afford health care. Most doctors also willingly provided free or reduced-price care for those who needed it. The large amount of charitable giving and volunteer activity in the United States shows that the American people do not need government's help in providing an effective safety net. The problems plaguing the health care system are rooted in the treatment of health care as a "right." This justifies government intervention in the health care marketplace. This intervention causes increasing prices and declining quality and supply. Ironically, those who suffer most from government intervention are the very people proponents of these programs claim to want to help. The first step in restoring a health care system that meets the needs of all people is to start treating health care as a good that can and should only be provided via voluntary actions of free people. Where does Ron Paul buy his gold?Call Monday-Friday 7:00 AM - 5:00 PM (PST)

Watch Ron Paul introduce Camino Coin Company Interested in being a sponsor? Email us By Robert Wenzel The attack on cash has entered a new stage. Kenneth Rogoff, the Thomas D. Cabot Professor of Public Policy at Harvard University and the former chief economist of the International Monetary Fund, is out with an essay this morning in the Wall Street Journal titled, The Sinister Side of Cash. Rogoff writes: When I tell people that I have been doing research on why the government should drastically scale back the circulation of cash—paper currency—the most common initial reaction is bewilderment. Why should anyone care about such a mundane topic? But paper currency lies at the heart of some of today’s most intractable public-finance and monetary problems. Getting rid of most of it—that is, moving to a society where cash is used less frequently and mainly for small transactions—could be a big help... In other words, cash is anti-state, It is about freedom. Rogoff by addressing the above state concerns lays out the true desires of the anti-cash promoters: More state control. It is a further move in the direction of totalitarianism. How does Rogoff want to execute this anti-cash movement? He writes: To be clear, I am proposing a “less-cash” society, not a cashless one, at least for the foreseeable future. The first stage of the transition would involve very gradually phasing out large denomination bills that constitute the bulk of the currency supply. Of the more than $4,200 in cash that is circulating outside financial institutions for every man, woman and child in the U.S., almost 80% of it is in $100 bills. In turn, $50 and $20 bills would also be phased out, though $10s, $5s and $1s would be kept indefinitely. Today these smaller bills constitute just 3% of the value of the currency supply... He also explains how instruments like bitcoin will be thwarted in his statist non-cash world: Won’t the private sector continually find new ways to make anonymous transfers that sidestep government restrictions? Certainly. But as long as the government keeps playing Whac-A-Mole and prevents these alternative vehicles from being easily used at retail stores or banks, they won’t be able fill the role that cash plays today. Rogoff also knows that cash is a check against the Federal Reserve going seriously negative on interest rates: In principle, cutting interest rates below zero ought to stimulate consumption and investment in the same way as normal monetary policy, by encouraging borrowing. Unfortunately, the existence of cash gums up the works. If you are a saver, you will simply withdraw your funds, turning them into cash, rather than watch them shrink too rapidly. Enormous sums might be withdrawn to avoid these loses, which could make it difficult for banks to make loans—thus defeating the whole purpose of the policy. When does he want to launch his program to eliminate $20 bills and up? " I believe the time has come," he writes. The elimination of everything but very low denomination bills is one of the most significant statist power grabs in United States history. It provides the state with unheard of methods of tracking and control. It is an evil plan that must be objected to loudly and forcefully. This is a battle that must be joined. The anti-cash advocates must be defeated. This article was originally published at EconomicPolicyJournal.com Where does Ron Paul buy his gold? Call Monday-Friday 7:00 AM - 5:00 PM (PST)

Watch Ron Paul introduce Camino Coin Company Interested in being a sponsor? Email us By Norm Singleton All of our thoughts and prayers are with the people of Louisiana as they recover from last week's massive flooding. As usually happens after a tragedy like this, Americans are supporting private charitable efforts to help the flood victims. Sadly, but not unexpectedly, some are also using the floods to score political points. During his time in Congress, Ron Paul opposed all federal disaster relief -- even for natural disasters occurring in his own district -- on the basis that federal disaster relief was unconstitutional, immoral, and most importantly ineffective. Immediately after these votes, Dr. Paul would face a lot of criticism from his constituents and local media, but after a few months constituents would start to say: "Dr. Paul was right. I have had a horrible experience with FEMA. We would be better off if the Feds left us alone." FEMA's bureaucratic and authoritarian method of providing "aid" caused numerous hardships for people already suffering from a disaster. For example, Ron was once told that anyone who dared try to enter their home before FEMA gave them permission would be arrested. Following Hurricane Ike, FEMA set up a relief station for those displaced by the Hurricane. However FEMA's relief personnel did not show up until hours after the center was supposed to have opened. FEMA did, however, send out a PR team to assure everyone that they where on top of the situation. Ike occurred in September 2008, yet in February 2009 our office was still trying to get FEMA to clean up debris from the Hurricane. My "favorite" FEMA story is one about a man who called to get a tarp placed on his house because his roof was blown off. FEMA put the tarp on the wrong house and when the man was told that FEMA could not fix the problem for a few weeks, he said he and his neighbor could handle it. FEMA told him that if anyone else touched the tarp they would be arrested. FEMA is a classic case of how a bureaucracies prioritize adherence to their rules and regulations ahead of helping people. They're also one more example of why, contrary to the claims of our critics, it is those of us who support free markets who are truly compassionate. In 2001, Dr. Paul explained the problems with FEMA to FOX news: Even before Hurricane Irene hit the U.S. East Coast, the Federal Emergency Management Agency was preparing to mitigate its devastating impact, spending from its $800 million relief fund to assist communities. But the real disaster may just be the agency itself, Rep. Ron Paul said Sunday. Dr. Paul discussed the problems with FEMA with John Stossel in 2o12. Watch the clip here. This article was originally published at Campaign for Liberty. Call Monday-Friday 7:00 AM - 5:00 PM (PST)

Watch Ron Paul introduce Camino Coin Company Interested in being a sponsor? Email us |

Archives

July 2024

|

RSS Feed

RSS Feed