Politicians who preside over economic booms often develop delusions of competence. You can see this domestically: Jeb Bush imagines that he knows the secrets of economic growth because he happened to be governor when Florida was experiencing a giant housing bubble, and he had the good luck to leave office just before it burst. Krugman's observation is actually very true. When The Federal Reserve creates an artificial boom with its printing press, politicians who happen to be in office like to take the credit. Whether it be Jeb Bush during the housing bubble, or Bill Clinton during the dot-com bubble, politicians like to capitalize on the Fed-created delusion. They want the public to think that it was their brilliant policies that created the "good times". The problem is not that Krugman is calling Jeb Bush out on this. The problem is that it's Krugman who's doing the calling out. You see, after the dot-com bust, it was Paul Krugman who wanted another fake boom to replace it. Here's what he wrote in 2002: To fight this recession the Fed needs…soaring household spending to offset moribund business investment. [So] Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble. Krugman, of all people, is in no position to be criticizing Bush for "delusions of competence". It was Paul Krugman himself who was pushing for the "giant housing bubble" in the first place.

Krugman is in the same boat as Bush! Jeb gets to falsely claim that his policies created economic prosperity in Florida, and Krugman gets to falsely claim that his Keynesian policies are necessary for the U.S. economy to function. Contrary to both claims, Fed-induced bubbles are not prosperity. They are times of massive malinvestment. What appears to be prosperity is nothing but a dream that doesn't have a happy ending. After the housing bubble burst, Krugman went on to claim that Ben Bernanke saved the U.S. economy by printing money like The Fed has never done before. We're not too far from waking up from that dream as well. Hopefully, as a result, we move a step closer to saying goodbye to Paul Krugman's delusions once and for all.  By Jeff Deist Presidential hopeful Bernie Sanders recently raised the ire of both progressives and libertarians with his remarks concerning immigration: “Open borders? No, that’s a Koch brothers proposal,” Sanders said. “That’s a right-wing proposal, which says essentially there is no United States.” In just a few sentences, Sanders manages to demonstrate a hodgepodge of nativist, nationalist, protectionist, and socialist sentiments. But for anyone wondering why he wandered off the progressive narrative on immigration, it’s because protectionist labor unions pay him better than, say, La Raza.

If Bernie Sanders sounds like Donald Trump when it comes to “taking our jobs,” consider that both are statists who reflect the widely and deeply held belief that nations are defined by states. This may be an uncomfortable reality for libertarians, but it is reality nonetheless. National borders by definition are political boundaries. They mark the edge of a particular territory over which a political entity — a state — claims exclusive jurisdiction. Since political borders require states, “open borders” is an oxymoron. Nothing controlled by government is “open,” whether we’re talking about the New York City taxi market or federal ethanol subsidies or the Brownsville, Texas border bridge. Open borders can exist only if states do not exist. States require borders because they are defined by borders. So from the statist perspective, Sanders is right: you can’t have large centralized states and unregulated borders, because those borders are at the heart of the state’s identity and its raison d’etre: control. The political technocrats who run modern nation-states have zero incentive to cede control over the flow of humans entering (or in some cases leaving) their territories. If anything, the political impulse is ever and always to expand the state’s zone of control by pushing borders outward. Immigration is a tricky issue for libertarians precisely because the very concepts of states, borders, and “public” land (the commons) are wholly inconsistent with a political and legal philosophy based on self-ownership and property rights. It’s hard to speak rationally about immigration under the present circumstances, because we’re so far from a free society that we risk piling one kind of illibertarian “solution” upon another. While the understandable libertarian impulse is to comport our principles with the innately human desire for free migration, we too often forget that the Noble Immigrant archetype is rooted in a statist view of immigration: one controlled by the state, in which public space trumps private property and free association. The benefits and detriments of immigration are weighed only in terms of their impact on the state. In a libertarian society, there is no commons or public space. There are property lines, not borders. When it comes to real property and physical movement across such real property, there are owners, guests, licensees, business invitees, and trespassers — not legal and illegal immigrants. Admittedly, it might be quite difficult to establish rightful (lawful) property owners under some sort of Lockean homesteading analysis — even in a nation as young as the US. While libertarians generally are absolutist regarding unfettered immigration, they will entertain “halfway” arguments about the most libertarian path available in a statist world on other topics (for example, see Sheldon Richman’s cogent argument analogizing access to public roads with access to publicly-issued marriage licenses). But if Hans-Hermann Hoppe offers an interim argument for dealing with the societal costs imposed by immigrants given our current system of “public goods” and entitlements, he is considered a wrongheaded statist. The same progressives and left-libertarians who champion tort liability for corporations when it comes to environmental damage fall strangely silent on the externalities caused by human migration. Let’s be clear: the tendencies of a society based on property rights may well make progressives and left-libertarians quite unhappy. Such a society necessarily entails freedom of association and its corollary, the right to exclude. Free association might well result in regions that develop naturally based on (gasp) shared familial, economic, linguistic, social, and cultural interests. Contra the DNC, government is not “the only thing we all belong to.” This is not to say that a libertarian concept of naturally arising “nations” entails a clannish retreat into suspicious enclaves. Surely a free society would have regions where market demand for the cosmopolitan benefits of life in a multicultural society prevails (imagine a stateless Singapore). But multicultural social democracies with vast welfare states, like Western Europe and the US, did not arise through the “market.” They are big-government constructs, and they are quickly becoming unsustainable. Multicultural welfare states are a recipe for disaster. Unfortunately, it appears for now we are stuck with the likes of Mr. Sanders and his faulty concept of nation-states. But if we want to advocate for a freer society, we need to apply first principles rather than sentimentality. There is a deep-rooted and natural human preference for the familiar face over the stranger, and human migration in a free society is likely to reflect this reality. This article was originally published at The Mises Institute.  By Andrew P. Napolitano In a column I wrote in early July, based on research by my colleagues and my own analysis of government documents and eyewitness statements, I argued that in 2011 and 2012 then-Secretary of State Hillary Clinton waged a secret war on the governments of Libya and Syria, with the approval of President Obama and the consent of congressional leadership from both parties and in both houses of Congress. I did err in that column with respect to an arms dealer named Marc Turi. I regret the error and apologize for it. I wrote that Turi sold arms to Qatar as part of Clinton’s scheme to get them into the hands of rebels. A further review of the documents makes it clear that he applied to do so but was denied permission, and so he did not sell arms to Qatar. Other arms dealers did. I also erred when referring to Qatar as beholden to Washington. In fact, Qatar is in bed with the Muslim Brotherhood and is one of the biggest supporters of global jihad in the world — and Clinton, who approved the sales of arms to Qatar expecting them to make their way to Syrian and Libyan rebels, as they did, knew that. She and her State Department caused American arms to come into the possession of known al-Qaida operatives, a few of whom assassinated U.S. Ambassador Chris Stevens. When Sen. Rand Paul, R-Ky., asked Clinton in January 2013 at a Senate Armed Services Committee hearing whether she knew of any weapons coming from the U.S. and going to rebels in the Middle East, she denied such knowledge. She either has a memory so faulty that she should not be entrusted with any governmental powers, or she knowingly lied. It gets worse. It now appears that Clinton was managing her war using emails that she diverted through a computer server owned by her husband’s charitable foundation, even though some of her emails contained sensitive and classified materials. This was in direct violation of federal law, which requires all in government who possess classified or sensitive materials to secure them in a government-approved venue. The inspector general of the intelligence community and the inspector general of the State Department each have reviewed a limited sampling of her emails that were sent or received via the Clinton Foundation server, and both have concluded that materials contained in some of them were of such gravity that they were obliged under federal law to refer their findings to the FBI for further investigation. The FBI does not investigate for civil wrongdoing or ethical lapses. It investigates behavior that may be criminal or that may expose the nation’s security to jeopardy. It then recommends either that indictments be sought or the matter be addressed through non-prosecutorial means. Given Clinton’s unique present position — as the president’s first secretary of state and one who seeks to succeed him, as well as being the wife of one of his predecessors — it is inconceivable that she could be prosecuted as Gen. David Petraeus was (for the crime of failing to secure classified materials) without the personal approval of the president himself. Let’s be realistic and blunt: If the president wants Clinton prosecuted for failing to secure classified materials, then she will be, no matter the exculpatory evidence or any political fallout. If he does not want her prosecuted, then she won’t be, no matter what the FBI finds or any political fallout. I have not seen the emails the inspectors general sent to the FBI, but I have seen the Clinton emails, which are now in the public domain. They show Clinton sending or receiving emails to and from her confidante Sid Blumenthal and one of her State Department colleagues using her husband’s foundation’s server, and not a secure government server. These emails address the location of French jets approaching Libya, the location of no-fly zones over Libya and the location of Stevens in Libya. It is inconceivable that an American secretary of state failed to protect and secure this information. But it is not inconceivable that she would lie about it. Federal statutes provide for three categories of classified information. “Top secret” is data that, if revealed, could likely cause grave damage to national security. “Secret” is data that, if revealed, could likely cause serious damage to national security. “Confidential” is data that, if revealed, could likely cause some damage to national security. Her own daily calendars, which she regularly emailed about, are considered confidential. Clinton has repeatedly denied ever sending or receiving data in any of these categories. She probably will argue that an email that fails to use the terminology of the statute cannot be deemed classified. Here the inspectors general have corrected her. It is the essence of the data in an email — its potential for harm if revealed — that makes its contents classified and the failure to protect it a crime — not the use of a magic word or phrase in the subject line. She is no doubt lying again, just as she did to the Senate Armed Services Committee. Yet the question remains: Why did she use her husband’s foundation’s computer server instead of a government server, as the law requires? She did that so she could obscure what the server recorded and thus be made to appear different according to history from how she was in reality. Why did she lie about all this? Because she thinks she can get away with it. Will American voters let her? Reprinted with author's permission  By Daniel McAdams National Endowment for Democracy president-for-life Carl Gershman takes to the pages of the Washington Post today to put a positive spin on a recent Russian government decision to finally send that US government-funded regime-change organization packing. The Russian finding that NED is a threat to the constitutional order, writes Gershman, only demonstrates that "the regime of President Vladimir Putin faces a worsening crisis of political legitimacy." According to Gershman, Putin is terrified at the prospect of any political opposition and is therefore clamping down by ousting the NED. In other words, as Gershman writes, "the pressures are now building toward what many in Russia believe is a major political turning point." Heavy words, but like much of what the NED does overseas, the claims are not backed by numbers. The "worsening crisis" that Gershman pushes is hardly evident anywhere but in Gershman's mind. Indeed, recently Time Magazine reported that Putin enjoys an unprecedented 89 percent approval rating (by the way, according to an average of all major US polling companies this summer, the US Congress has a 16 percent approval rating). The only opposition party that enjoys significant support in Russia is the Russian Communist Party, which makes Putin's US views look Atlanticist by comparison. Gershman's pro-US "democratic" parties are so unpopular in Russia that they are not even represented in the Russian parliament. Likely it is their dependence on Gershman's millions in US backing that keeps them unpopular at home -- after all, who would vote for a foreign-funded stooge? And that is the real crux of Gershman's dilemma. He is trying to extract blood from a stone and it is only his bottomless checkbook (thanks to the US taxpayer) that he can continue in his fool's errand. The more he backs pro-US political parties, the more they are rejected by Russians who rightly see them as foreign sock-puppets. The lies and deceits in Gershman's Washington Post article are too numerous to detail (like mentioning Russia's economic struggles without mentioning the US-demanded sanctions that have contributed to them), but one in particular must be addressed. "Russia has passed the law prohibiting Russian democrats from getting any international assistance to promote freedom of expression," he claims, and this move "contradict[s] international law." Well one law it does not contradict is the law in Gershman's own country. Both the 1966 Foreign Agents Registration Act and the follow-up 1974 Federal Election Campaign Act explicitly forbid the activities that make up the core of the National Endowment for Democracy's mission. According to the US Federal Elections Commission website: The Federal Election Campaign Act (FECA) prohibits any foreign national from contributing, donating or spending funds in connection with any federal, state, or local election in the United States, either directly or indirectly. It is also unlawful to help foreign nationals violate that ban or to solicit, receive or accept contributions or donations from them. Persons who knowingly and willfully engage in these activities may be subject to fines and/or imprisonment. ... Therefore, a Russian or Chinese or Iranian Carl Gershman would be kicked out of the United States (or perhaps imprisoned) for doing exactly what an American Carl Gershman does in Russia, Ukraine, Armenia, Hungary, Romania, and so on overseas. His mission is criminal according to US law, but the US taxpayer is still robbed every year to pay for it.

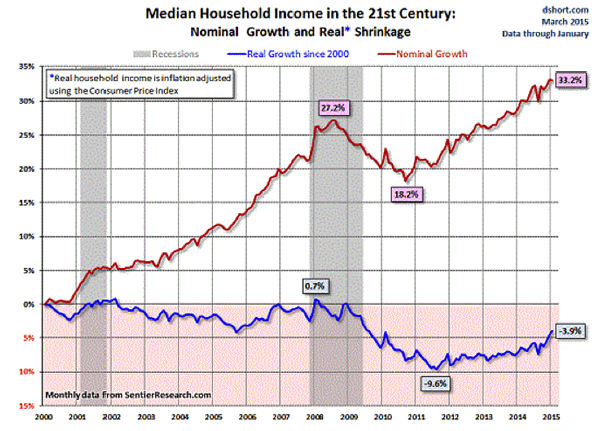

Carl Gershman is a lifelong neocon Trotskyite who has made a fortune peddling snake oil to the Washington elites who truly believe that the rest of the world pines to be exactly like us, whether they know it or not. He continues his fight for a global (communist) revolution under a different banner, but his view of the hegemony of his fellow elites never falters. The National Endowment for Democracy fears democracy more than any tyrant they may to oppose. As NED founder Allen Weinstein famously said, "a lot of what we [NED] do was done 25 years ago covertly by the CIA." If only other countries overseas would wake up and send the regime-change operatives of the National Endowment for Democracy back to Washington... This article was originally published at The Ron Paul Institute For Peace & Prosperity  By Chris Rossini It's always a great danger when people place faith into government, no matter where in the world it may occur. The more faith placed into it, the more government is expected to come in and fix the problems that it often caused in the first place. If faith reaches the level of Socialist Venezuela, the entire country turns into an economic basket case. Venezuela has been spiraling into the abyss, and "government help" has been the driver's seat. Every move the government has made in recent years to reverse the spiral only quickens the decline. Venezuela has instituted capital controls (which shouldn't exist). It has raised the minimum wage by 30% (which also shouldn't exist). The country's central bank has been printing money like there's no tomorrow. (Of course, central banks should never exist). As a result of the money printing, prices for consumer goods went through the roof. That opened the door for the Venezuelan government to make things even worse by instituting price controls (which should never be done). Economics 101 dictates that price controls must lead to shortages. Unsurprisingly, shortages for even the most basic goods have become a daily experience for Venezuelans. That's a lot of damage that the government has created already. But faith in government leads to a never-ending thirst for more "help". So after driving prices up, and following it with price controls and shortages, the next move is to seize the food suppliers and warehouses! As government infested as the U.S. economy has become, can you imagine an Obama or Bush rationing food to American citizens? Who do you think would get the food? If your answer is those who are closest friends and cronies to the politicians (along with the politicians themselves of course), your answer is correct! The solution for Venezuela is really very simple, but faith in government bars its consideration. Minimum wages should be immediately abolished so that teenagers, the low-skilled, and poor could gain employment. Price Controls should be abolished so that shortages can disappear and market clearing prices can operate. The Venezuelan Central Bank should be turned into a museum and capital controls should go with it. Venezuelans should be free to use a market-determined currency that cannot be destroyed by government's money printing. It's easy to look at the situation in Venezuela and feel sorry at the ideas that have been embraced. They after all are further down the line of decline than we are here in the U.S. But we here in America are not very far from the downward spiral if the ideas that dominate here do not change. We too have a monstrous central bank that prints with reckless abandon. We too have confused politicians calling for a $15/hr. minimum wage, or some arbitrary "living wage". When inflation kicks into high gear in America, it's almost certain that the government will try to institute price controls. So shortages can be right around the corner. We already went through them when government created gas lines in the 1970's. If Americans are unable to understand the chain of events, it's not out of bounds to think they too will support government nationalization of industries as well. Never place faith in government to "help" to fix problems. It'll help everyone right into the economic abyss. The goal should be to incessantly peel government away. That'll keep it from preventing most of the problems that we encounter in the first place.  By Charles Hugh Smith You’ve probably read that there is a “war on cash” being waged on various fronts around the world. What exactly does a “war on cash” mean? It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash. These limits are broadly called “capital controls.” Why Now? Before we get to that, let’s distinguish between physical cash — currency and coins in your possession — and digital cash in the bank. The difference is self-evident: cash in hand cannot be confiscated by a “bail-in” (i.e., officially sanctioned theft) in which the government or bank expropriates a percentage of cash deposited in the bank. Cash in hand cannot be chipped away by negative interest rates or fees. Cash in the bank cannot be withdrawn in a financial emergency that shutters the banks (i.e., a bank holiday). When pundits suggest cash is “obsolete,” they mean physical paper money and coins, not cash in a bank. Cash in the bank is perfectly fine with the government and its well-paid yes-men (paging Mr. Rogoff and Mr. Buiter) because this cash can be expropriated by either “bail-ins” or by negative interest rates. Inflation and Negative Interest Rates Mr. Buiter, for example, recently opined that the spot of bother in 2008–09 (the Global Financial Meltdown) could have been avoided if banks had only charged a 6 percent negative interest rate on cash: in effect, taking 6 percent of the depositor’s cash to force everyone to spend what cash they might have. Both cash in hand and cash in the bank are subject to one favored method of expropriation, inflation. Inflation — the single most cherished goal of every central bank — steals purchasing power from physical cash and digital cash alike. Inflation punishes holders of cash and benefits those with debt, as debt becomes cheaper to service. The beneficial effect of inflation on debt has been in play for decades, so it can’t be the cause of governments’ recent interest in eliminating physical cash. So now we return to the question: Why are governments suddenly declaring war on physical cash, the oldest officially issued form of money? Why They Hate Cash in Hand The first reason: physical cash has the potential to evade both taxes as well as officially sanctioned theft via bail-ins and negative interest rates. In short, physical cash is extremely difficult for governments to steal. Some of you may find the word theft harsh or even offensive. But we must differentiate between taxes — which are levied to pay for the state’s programs that in principle benefit all citizens — and bail-ins, i.e., the taking of depositors’ cash to bail out banks that became insolvent through the actions of the banks’ management, not the actions of depositors. Bail-ins are theft, pure and simple. Since the government enforces the taking, it is officially sanctioned theft, but theft nonetheless. Negative interest rates are another form of officially sanctioned theft. In a world without the financial repression of zero-interest rates (ZIRP — central banks’ most beloved policy), lenders would charge borrowers enough interest to pay depositors for the use of their cash and earn the lender a profit. If borrowers are paying interest, negative interest rates are theft, pure and simple. Why are governments suddenly so keen to ban physical cash? The answer appears to be that the banks and government authorities are anticipating bail-ins, steeply negative interest rates and hefty fees on cash, and they want to close any opening regular depositors might have to escape these forms of officially sanctioned theft. The escape mechanism from bail-ins and fees on cash deposits is physical cash, and hence the sudden flurry of calls to eliminate cash as a relic of a bygone age — that is, an age when commoners had some way to safeguard their money from bail-ins and bankers’ control. Forcing Those With Cash To Spend or Gamble Their Cash Negative interest rates (and fees on cash, which are equivalently punitive to savers) raise another question: why are governments suddenly obsessed with forcing owners of cash to either spend it or gamble it in the financial-market casinos? The conventional answer voiced by Mr. Buiter is that recession and credit contraction result from households and enterprises hoarding cash instead of spending it. The solution to recession is thus to force all those stingy cash hoarders to spend their money. There are three enormous flaws in this thinking. One is that households and businesses have cash to hoard. The reality is the bottom 90 percent of households have less income now than they did fifteen years ago, which means their spending has declined not from hoarding but from declining income. While corporate America has basked in the glory of sharply rising profits, small business has not prospered in the same fashion. Indeed, by some measures, small business has been in a six-year recession. The bottom 90 percent has less income and faces higher living expenses, so only the top slice of households has any substantial cash. This top slice may see few safe opportunities to invest their savings, so they choose to keep their savings in cash rather than gamble it in a rigged casino (i.e., the stock market).

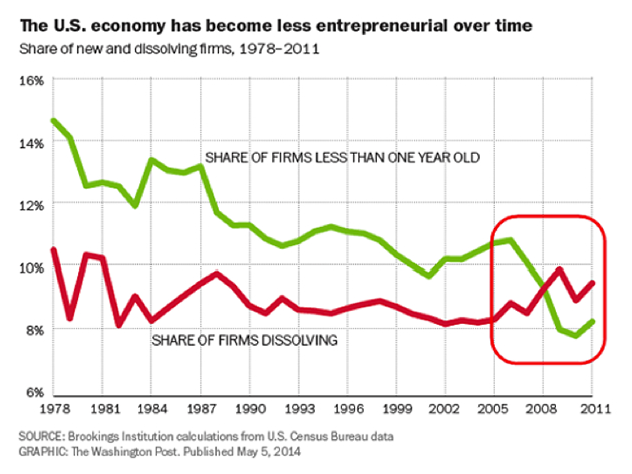

The second flaw is that hoarding cash is the only rational, prudent response in an era of financial repression and economic insecurity. What central banks are demanding — that we spend every penny of our earnings rather than save some for investments we control or emergencies — is counter to our best interests. A War on Cash Is a War on Capital This leads to the third flaw: capital — which begins its life as savings — is the foundation of capitalism. If you attack savings as a scourge, you are attacking capitalism and upward mobility, for only those who save capital can invest it to build wealth. By attacking cash, the central banks and governments are attacking capital and upward mobility. Those who already own the majority of productive assets are able to borrow essentially unlimited sums at near-zero interest rates, which they can use to buy more productive assets. Everyone else — the bottom 99.5 percent — is reduced to consumer-serfdom: you are not supposed to accumulate productive capital, you are supposed to spend every penny you earn on interest payments, goods, and services. This inversion of capitalism dooms an economy to all the ills we are experiencing in abundance: rising income inequality, reduced opportunities for entrepreneurship, rising debt burdens, and a short-term perspective that voids the longer-term planning required to build sustainable productivity and wealth. Physical Cash: Only $1.36 Trillion According to the Federal Reserve, total outstanding physical cash amounts to $1.36 trillion. Given that a substantial amount of this cash is held overseas, physical cash is a tiny part of the domestic economy and the nation’s total assets. For context: the US economy is $17.5 trillion, total financial assets of households and nonprofit organizations total $68 trillion, base money is around $4 trillion, and total money (currency in circulation and demand deposits) is over $10 trillion (source). Given the relatively modest quantity of physical cash, claims that eliminating it will boost the economy ring hollow. Following the principle of cui bono — to whose benefit? — let’s ask: What are the benefits of eliminating physical cash to banks and the government? Benefits To Banks and the Government of Eliminating Physical Cash The benefits to banks and governments by eliminating cash are self-evident:

In fractional reserve systems such as ours, banks are only required to hold a fraction of their assets in cash. Thus a bank might only have 1 percent of its assets in cash. If customers fear the bank might be insolvent, they crowd the bank and demand their deposits in physical cash. The bank quickly runs out of physical cash and closes its doors, further fueling a panic. The federal government began insuring deposits after the Great Depression triggered the collapse of hundreds of banks, and that guarantee limited bank runs, as depositors no longer needed to fear a bank closing would mean their money on deposit was lost. But since people could conceivably sense a disturbance in the Financial Force and decide to turn digital cash into physical cash as a precaution, eliminating physical cash also eliminates the possibility of bank runs, as there will be no form of cash that isn’t controlled by banks. So, when the dust has settled who ultimately benefits by this war on cash, government and the central banks, pure and simple. This article was originally published at The Mises Institute  By Chris Rossini Vox ran an extensive interview with Presidential hopeful Bernie Sanders, and it's very concerning that a large number of Americans are buying what he's selling. Bernie likes to refer to himself as a "Democratic Socialist," which should be viewed as nothing more than trying to soften the ugliness of Socialism by throwing the word "Democratic" in front of it. Regardless of what Sanders calls himself, this is not a man who believes in Liberty. After reading the interview, you can't help but come away without knowing that he does not believe in private property, voluntary exchange, individual responsibility, supply & demand, or even the proper definition of the word "right". While page after page can be written to refute the positions that Sanders holds, in the interest of brevity, let's just focus on one issue, and hopefully it can easily be seen how misinformed and confused Sanders really is. Bernie says: What right-wing people in this country would love is an open-border policy. Bring in all kinds of people, work for $2 or $3 an hour, that would be great for them. I don't believe in that. For those of us that believe in Liberty and voluntary association, left-wing and right-wing are both disappointments since they subscribe to neither concept. But let's discuss what a wage really is. In an economy (even as hampered by government as ours is) individuals, in order to sustain themselves, must trade and exchange with other individuals. One thing that most of us trade is our labor. We each have different skill sets, that are demanded by potential employers in different proportions. If your skill set is in high demand, employers must compete with each other to hire you, and they do so by offering you higher pay and benefits. Relative to the rest of the people who are selling their labor, there aren't many others like you and that have your skills. Employers must compete for you. On the opposite end, if there are many others who have the same skills that you do, employers have many other individuals to choose from. In order to make yourself stand out, you may have to offer your labor at a cheaper price in order to get hired. You are competing with many others for that job. Either that, or you have to get rolling on upping your skill level so that you face less competition. Labor, like everything else that is traded, operates under the laws of supply and demand. As long as all transactions are done voluntarily, and neither party is allowed to use aggressive force, the transactions should be looked at with the highest ethical and moral regard. There is no such thing as a "wrong" wage as long as both parties freely agree to the terms. If they agree, it means they believe that their life is better off than not making the agreement. Bernie Sanders has a problem with supply and demand. He believes that everyone that is working should make at least $15 per hour. How he can arbitrarily make such a statement is hardly ever questioned. Anything under $15 per hour should be forbidden by government and against the law according to Sanders. Logic dictates that such a law must harm the very people that Sanders proclaims to be helping. Under such a law, the large numbers of people who only have rudimentary skills are forbidden (by law) in competing for a job! They can't offer their labor for less than $15 per hour, even if they want, and are more than happy to do. As a result, teenagers, the low-skilled, the poorest and most vulnerable members in our society are forced into unemployment by law. Bernie knows about the youth unemployment problem. He just has no idea of the cause: You know what youth unemployment is in the United States of America today? If you're a white high school graduate, it's 33 percent, Hispanic 36 percent, African American 51 percent. Of course youth unemployment is high. The minimum wage forbids the youth from competing for a job. The minimum wage does not increase anyone's skill level. It merely dictates that those who do not have the skills to earn $15 per hour must (through no fault of their own) head to the unemployment line.

Bernie and his followers are fighting a battle that they cannot win. Man cannot override economic laws. Government will not negate supply & demand.  By Gary North For as long as the present economic system lumbers along, Keynesians will control the levers of power and influence. But when at last the system goes down in a heap, and central banks cannot restore the system, there will be a quest for answers. Keynesians have the long-run disadvantage of being in control of the tax-funded educational system. They are in charge of the major economic institution of our day, the Federal Reserve System. They will get blamed. When people's retirement plans are smashed, they are going to look for somebody to blame. That means Keynesians. The Keynesians will not be able to transfer this responsibility to somebody else. When you are in charge, the buck stops on your desk. In the case of Federal Reserve policy, it's not just the buck that stops on your desk. It's trillions of bucks. Academic economists never want to take responsibility for the outcome of their recommended policies. They always try to blame somebody else for not having implemented what the recommended. But when you come to the 14 people who are on the Federal Open Market Committee, which sets policy for the Federal Reserve, there is no place to hide. The FOMC almost always is unanimous in its policy recommendations. There may be one dissenter, but that's about it. So, there really is no place to hide. When the Federal Reserve finally is not in a position to restore economic growth by means of inflating the currency, Keynesians are going to get blamed. When you live by the Federal Reserve, you die by the Federal Reserve. HOW KEYNESIANS CONQUERED I first began reading economics in 1958. Like so many of my contemporaries who began to study free market economics in that era, I was introduced to economics by The Freeman. The editor was a good writer, and he did not let bad writers' articles into the magazine. In 1960, I took my first course in college-level economics. The instructor seemed incompetent to me. In reviewing his economic textbook 55 years later, I am still convinced that he was indeed incompetent. He was never famous. He never got tenure. He disappeared into academic oblivion. He was a Keynesian. I understood from my time in that class that academic economics is not based on any kind of logic that the average person can follow. This is one of the advantages that free market economists have. John Maynard Keynes could write cogent prose, but The General Theory (1936) is incoherent. Yet it gained an army of academic followers. It is the classic case of the emperor who had no clothes. How did Keynes get his followers? Because he defended what the academic world wanted in 1936. It defended government intervention. Governments had been intervening for five years by the time the book was published. There was no academic defense of this intervention. Younger economists had become disillusioned with free market economics, because free market economists, with the exception of the Austrians, could not explain why the depression in 1936 was as bad as it was in 1931. In other words, there was a loss of faith among younger economist regarding the academic establishment of 1936. The older academic economists in 1936 could not avoid this responsibility. The buck stopped there. They never recovered. By 1946, the year of Keynes's death, among younger economists, Keynesianism was becoming dominant. With the publication of Samuelson's textbook in 1948, it became dominant. By 1950, Keynesians dominated the economics profession, and the old-timers who may not have agreed were unable to follow the logic of Keynesianism. They were unable to do the mathematics that Samuelson was able to do. They looked like old fogies. They in fact were old fogies. They were not Austrian fogies. They could not defend their position. Today, the Keynesians are in the position of the non-Austrian economists in 1930. Things look shaky, but not out of control. The Federal Reserve seems to be beyond criticism. Central banking runs the world, but the world is obviously in trouble. Read the rest here

"It is so naive that he [Obama] would trust the Iranians. By doing so, he will take the Israelis and march them to the door of the oven. This is the most idiotic thing, this Iran deal. It should be rejected by both Democrats and Republicans in Congress and by the American people." Huckabee is sticking by his words too, despite the fact that even his warmongering Republican counterparts admitted that the statement was over-the-top: "I will not apologize and I will not recant because the word Holocaust was invoked by the Iranian government. They used that very word." Interestingly enough, Huckabee did not always hold such a hyperbolic view of Iran. Back in 2007, he held a much more reasoned and peaceful position on Iran: Right now we are proceeding down only one track with Iran – armed confrontation. Nothing would make Osama bin Laden happier – he would welcome war between the United States and Iran, his two biggest enemies. I try to avoid doing anything that brightens bin Laden’s day. [...] When President Bush included Iran in his Axis of Evil, everything went downhill fast. How sad that it is now Huckabee who has decided to go downhill fast, when it comes to war versus peace with Iran.

By Paul-Martin Foss In the aftermath of the financial crisis, central banks around the world began to subject their banking systems to “stress tests” – creating hypothetical worst-case scenarios and analyzing whether or not banks were capable of remaining in operation under those hypothetical conditions. The central banks would then publicize the results of the stress tests and announce which banks had passed and which still needed to raise capital. As Matthew Klein at the Financial Times Alphaville blog pointed out, as late as October 2014 the European Central Bank conducted stress tests of Greece’s four largest banks and declared three of them adequately capitalized, with the fourth one not too far off. Yet as the Greek crisis has demonstrated, passing that stress test was absolutely meaningless, as all Greek banks are now close to failure. So what good are bank stress tests? Klein points out that one of the likely assumptions in these stress tests is that under adverse economic conditions, banks will still have access to funding from the central bank. Remove that lifeline and the likelihood of a bank failing increases exponentially. That of course leads one to wonder, what kind of assumptions does the US Federal Reserve make when it undertakes its bank stress tests? Not surprisingly, the “most transparent central bank in the world” just a couple of weeks ago announced that its stress test models would not be made public. While the Fed’s explanation was that publishing its models would allow banks to game the system, one has to wonder if perhaps the models are not nearly as robust and realistic as they should be. If we now know that the ECB’s stress tests of Greek banks were absolutely worthless, why then should we trust the Federal Reserve’s stress tests any more? We can only conclude that the stress tests have two purposes: 1.) to reassure the public that the banking system is safe and sound so that depositors will continue to deposit their money; and 2.) to punish any banks who fall afoul of the Fed for any reason by giving them a negative assessment after a stress test, thus tarnishing their reputation in the public eye. The former is probably more important than the latter, as the overall health of the banking system depends on the existence of deposits. Without money deposited in banks, banks cannot lend and make money. Thus, ensuring that depositors don’t flee the system is one of the primary aims of central banks and banking regulators. Bank stress tests then are really nothing more than a dog and pony show, especially if the stress test models aren’t being made public so that their relevance (or lack thereof) can be ascertained. Rather than serving as any sort of benchmark or indicator of the health and strength of the banking system, they are yet another tool that the Federal Reserve uses to “manage expectations” – to manipulate people into believing that banks are safer and sounder than they actually are. The citizenry will faithfully continue to deposit their money into bank accounts, not once doing due diligence to see just how sound their banks actually are. And the whole rotten system will continue to lurch from crisis to crisis until its final collapse. The above article originally appeared at The Carl Menger Center |

Archives

July 2024

|

RSS Feed

RSS Feed