|

By Chris Rossini

Sacrificing Liberty always starts so innocently, and then it ends so badly. Nothing good comes from giving up Liberty, which is why individuals in a free society should resolve never to do it. But it's tough for a lot of people. They get bamboozled rather easily. Politicians, along with the big money people who sponsor them, are expert at couching each power grab in altruistic garb. And, of course, there's always some kind of "emergency," either real, or completely made-up, to give a push to the populace. The emotion of fear is (by far) the most often exploited emotion by the political classes. With each ratchet up of power, those who wield it get bolder and bolder in their beliefs about themselves. They drift away from the reality of being a human being, who only has the capabilities of being a human being. Instead, they start to see themselves as more than human, or at the very least, a special-type of human. With a chronically frightened population at their fingertips, ready to jump through almost any hoop that's put in front of them, the temptation of believing that the world is literally your oyster must be overwhelming. But, as is always the case, the manic drive for total power eventually comes to a head. Today, it is openly being discussed how the entire planet is going to be "Reset." How unusual, considering the planet was never "Set" by individual human beings in the first place. There was never a man-made master plan to get us to the present moment. Thousands and thousands of years of individual choices got us here. No blueprints. No plans. That's how humanity works. If there were some kind of man-made plan to get us to today, we surely wouldn't be alive right now. It would have failed very quickly. Human life and all the various civilizations that populate this Earth could never have been "planned" by men. The variables involved are infinite. You can't plan infinity. And yet, humans have a knack for repeating the absurd. Here we are, constantly being told our fate. We're being told as if it's already a done deal. That's how utopians always operate. They have the great unknown and unwritten future mapped out in their minds, and they're going to tell you how the story goes. You just need to sit back, relax and watch it happen. We're told that we will own nothing and be happy, be under constant surveillance, eat bugs and synthetic meat. Depending on who you are, you'll be able travel where permitted. The idea of the average person being able to see the world is over. Every transaction will be monitored with digital currency. We're even told that we'll be turned into robot-humans! Nothing obeys so perfectly like a robot, right? I wish that this ridiculousness simply existed on the fringes of society, but it doesn't! Our media touts it. Foreign media touts it. Billionaires brag about it. CEO's. The works! How can so many be led so far astray? Power. Constant infusions of power. Western elitists have been taking away Liberty and increasing power for more than a century straight! No corrections. No retracements. No pull-backs. Just constant and relentless power-grabbing. With such a long streak of increases in power, is it any wonder that we're hearing what we're hearing? Is it any wonder that so many believe that they will create a neo-feudal planet, that no one can escape? It's not a surprise at all. In fact, one should expect such a mentality to follow such a long streak of power-grabs. That's what power does to you. Now... There's good news and bad news. We'll start with the good news. This attempt at "Resetting the World" can't succeed any more than every other attempt in history could succeed. The ends are impossible, and the means can never be sufficient to satisfy impossible ends. That's good for humanity. It will go on as it always has. The bad news is the cost that ends up being paid for these mass delusions. The cost is very bad and it affects those who happen to live through it. We didn't suffer the costs of the French Revolution or Napoleon. Most people today didn't suffer the costs of the Soviet Union, or the Nazis. Those costs were endured by those who lived at that time. But we have suffered the costs of the terrible government policies in response to Covid. Look at what was done. Never in mankind's history were such costs endured by everyone on the planet. What will be the long-term costs of the vaccines? No one knows! How will people cope with the financial crisis that everyone knows is coming, and that will be the biggest in mankind's history? Again, no one knows, but the costs will have to be paid. Sacrificing Liberty always starts so innocently, and ends so badly. The lesson is the same after every single mass delusion: Never sacrifice Liberty.

The media has joined the "public health experts" in hyping the danger of the "Delta variant" of the coronavirus. Fauci warns that it is the most dangerous yet. Yet data from the UK strongly suggest that, like all viruses, it becomes weaker with each mutation. So who's telling the truth and who is pushing a narrative? Also today: Capitol Hill Police hold open door for 69 year "insurrectionist" on Jan 6th, but she is arrested yesterday for entering the building. And...what does New York City's botched mayoral election tell us about elections?

Over the weekend President Biden ordered US airstrikes on Syrian and Iraqi territory. The Administration claims that bombing countries 6,000 miles away who could not pose a threat to the US if they wanted was a "defensive" move. One problem: US troops are illegally occupying Syria and the bombing was unequivocally condemned by the Iraqi government. So..."defense"...or aggression? Also today, new polls and studies on Covid and US trust in the media. Don't miss today's Liberty Report.

By Ron Paul

Less than two weeks after NATO members reaffirmed allegiance to Article 5 – that an attack on one member was an attack on all members – the UK nearly put that pledge to the test. In a shockingly provocative move, the UK’s HMS Defender purposely sailed into Crimean territorial waters on its way to Georgia. Press reports suggest that there was a dispute between the UK defense and foreign ministries over whether to violate Russia’s claimed territorial waters with a heavily armed warship. According to reports, Prime Minister Boris Johnson himself jumped in to over-rule the more cautious Foreign Office in favor of confrontation. As Johnson later claimed, because the UK (and the US) does not recognize Russian sovereignty over Crimea, the UK was actually sailing through Ukrainian waters. It was an in-your-face move toward Russia just weeks after the US and NATO were forced to back down from a major clash with Russia in eastern Ukraine This time, as was the case in eastern Ukraine, the Russians took a different view of the situation. Russian coast guard vessels ordered the HMS Defender to exit Russian territorial waters – an order they punctuated with rare live fire of cannon and dropping of bombs. Having had their bluff called, the UK government did what all governments do best: it lied. The Russians did not shoot at a UK warship, they claimed. It was a previously-scheduled Russian military exercise in the area. Unfortunately for the UK government, in its haste to create good propaganda about standing up to Russia, they had a BBC reporter on-board the Defender who spilled the beans: Yes, the Russian military did issue several warnings, yes it did buzz the HMS Defender multiple times, and yes there were shots fired in the Defender’s direction. Similarly, in the spring, Russia rapidly deployed 75,000 troops on the border with Ukraine in response to a US-backed Ukrainian military build-up. The message was clear: Russia would no longer sit by as the US government and its allies intervened next door. Russia now has demonstrated that it will protect Crimea, which voted in a 2014 referendum to re-join Russia. The Crimean vote was triggered by the US-backed coup in Ukraine. That is called “unintended consequences” of foreign interventionism. The problem with the UK, the US, and their NATO allies is that they believe their own propaganda and they act accordingly. A famous 2004 quote attributed to George W. Bush advisor Karl Rove, clearly spelled out this line of thinking. Said Rove, “We're an empire now, and when we act, we create our own reality.” These two recent near-clashes with Russia demonstrate that the “reality” created by an almost religious belief in American or NATO exceptionalism can often crash hard against the reality of 75,000 troops or the Black Sea Fleet The anti-Russia propaganda endlessly repeated by both political parties in Washington and amplified by the anti-Trump media for more than four years has completely saturated the Beltway and beyond. Even as the Russiagate conspiracy was proven to be a lie, the propaganda it spawned lives on. Blustering Boris Johnson almost provoked a major war over an infantile desire to continue poking and prodding Russia in its own backyard. This time the war was averted, but what about next time? Will the adults ever be in charge?

First government recklessly "locks down" businesses, forcing thousands to close, and ruining countless economic lives. Then government passes out money that it does not have. In essence, government pays people not to work. With record job openings, employers are struggling to find people willing to work! And now government wants to spend another $1 Trillion (that it does not have) in order to create jobs! This is the upside-down world created by hyper-interventionist government and The Federal Reserve.

Here we go again! Talk of the so-called "debt ceiling" is back. Of course, shrinking the size and scope of government is not on the table. It never is. The federal government is $28 trillion in the red as it is. Why stop now? Well, logic, mathematics, economic laws, and all of recorded history indicate that the wrong road is being taken.

While not long ago President Biden claimed the unarmed crowd that entered the US Capitol building was the worst attack on our democracy since the Civil War, yesterday he told gun owners they'd need F-15s and nuclear weapons if they wanted to overthrow the government. So...what gives? Also today: CDC says Covid deaths now "preventable" and cases of post-vaccine heart inflammation skyrocket.

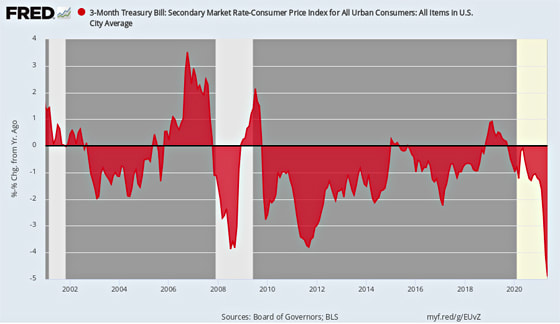

By David Stockman We start with this gem from NY Fed president John Williams. He claims the Fed must keep injecting $120 billion per month of fraudulent credit into Wall Street because, apparently, this quarter’s likely 7% real GDP growth and 5% inflation are not sufficient to meet the Fed’s goals: “… the data and conditions have not progressed enough for the Federal Open Market Committee to shift its monetary policy stance of strong support for the economic recovery.”… You can’t say enough bad things about this knucklehead. He’s the very poster boy for the camarilla of academics and Fed lifers who have hijacked the nation’s central bank. For want of doubt, here is William’s career since age 18:

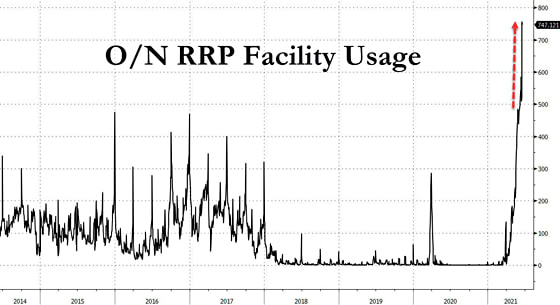

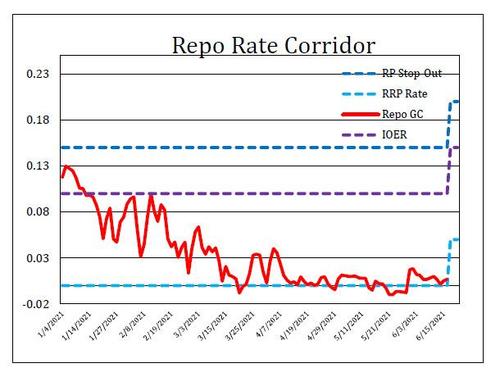

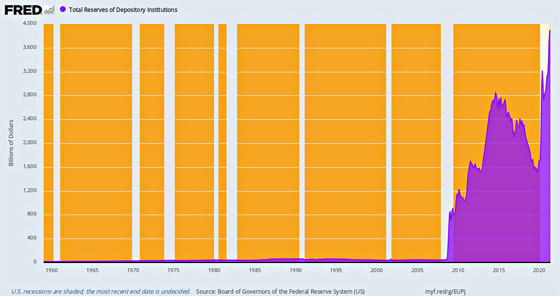

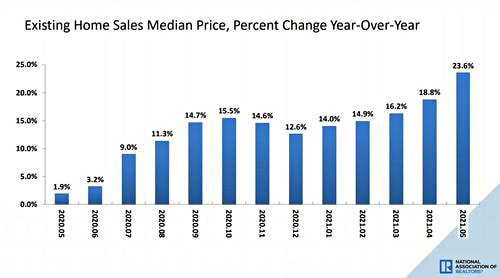

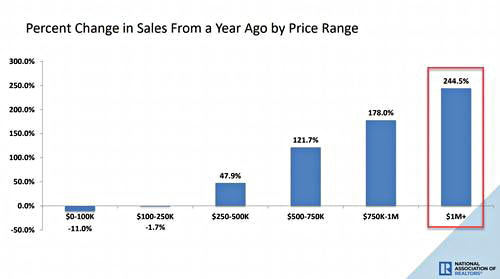

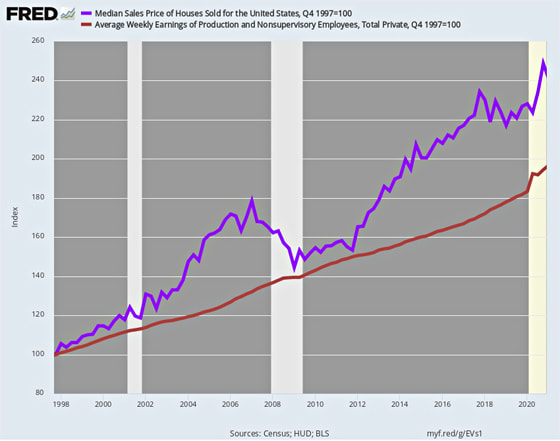

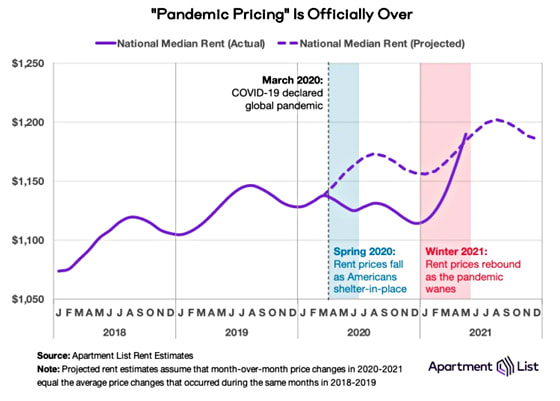

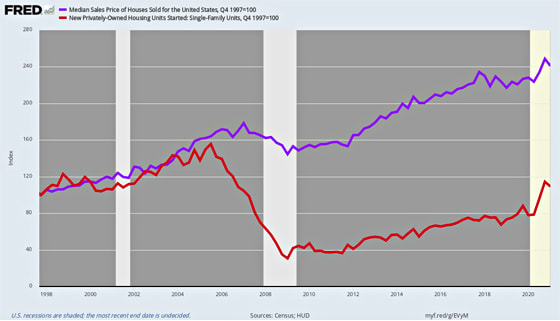

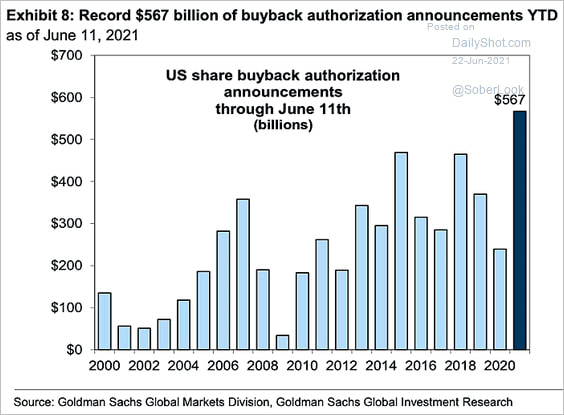

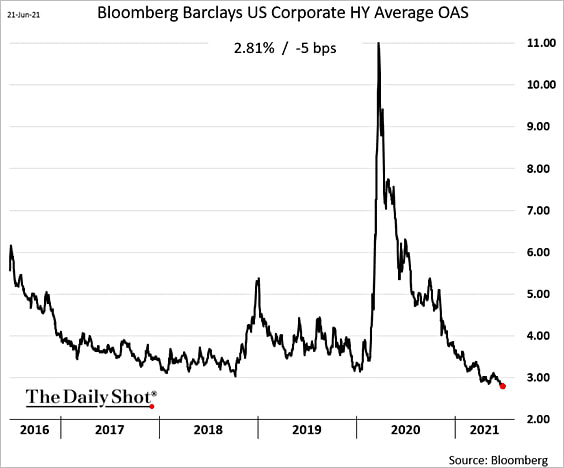

Does this man remind you of a medieval theologian who never escaped the bosom of the Roman Catholic Church, and who did truly believe you can count the number of angels on the head of a pin? Stated differently, Williams has been so mentally flayed by 40 years of captivity in macroeconomic models and the Fed’s theological groupthink that he can no longer think at all. And the evidence is overwhelming. Even as the Fed is injecting $120 billion of fresh cash into the dealer markets each and every month, Wall Street has become so waterlogged with cash that upwards of $800 billion is being loaned right back to the Fed via its so-called o/n RRP facility. That’s right. These drunken sailors have printed so much money that even Wall Street couldn’t find a place to park it with a yield above the 0.00% level that was on offer at the Fed’s RRP window. So as head of the Fed’s trading desk on Wall Street, what did Williams propose? Why nothing less than forcing what amounts to five more monetary angels to sit on the head of the Fed’s sacred pin. That is to say, the money market was so waterlogged with cash that the GC repo rate (red line), which is the general collateral overnight secured borrowing rate in the tri-party repo market, was being pushed under 0.00%. It was therefore threatening to drive the Fed’s sacrosanct target rate for Federal funds below its official 0-10 basis point corridor. But when it comes to the pure marginalia of a handful of basis points in the overnight money market, the Fed commands absolute obedience. Never mind that the funds rate does not make one damn bit of difference to the borrowing costs of any household or business on main street America. And we do mean zero “difference” as in nichts, nada and nugatory. Don’t tell Dr. John Williams, however. By his lights, the Fed must be and will be obeyed by the money markets. Period. So at its recent meeting, the Fed under Williams guidance raised the lower and upper bounds of the control corridor by the astounding sum of, well, five basis points! That’s right. To keep cash heavy Wall Street operators from parking funds overnight in the GC repo market below its 0.00% dictum at the bottom of the corridor, its raised its RRP offer rate to 0.05% (dashed light blue line). By the same token, banks are now choking on $3.8 trillion of excess reserves . So to keep them from putting these reserves to work at rates below the upper corridor of its sacrosanct policy target, the Fed raised its IOER rate (interest paid on excess reserves) from a comical 10 basis points to an only slightly less ludicrous 15 basis points (dashed purple line). This farce, which was announced in weighty techno-speak, amounted to the 6-year old bully in the sandbox expostulating a belligerent, “take that!” What the 5 basis point RRP rate actually means, of course, is that sitting on a $8.0 trillion balance sheet of essentially risk free sovereign debt, the Fed nonetheless will now borrow unlimited amounts at 5 basis points from money market funds and others engorged with cash. Let us repeat the word borrow: The Fed is paying money markets to bring coals to Newcastle, and for no rational purpose other than because it says so. For crying out loud, if it really wanted to drain excess cash from the money markets, which is what the recent $800 billion of o/n RRP facility borrowing amounted to, it could just sell a small portion of its immense $8 trillion hoard of Treasury bills and notes or GSE securities. But, no, that would amount to an admission that its is changing it “policy stance” toward tightening – a shift that the Keynesian fanatics like Williams who dominate the FOMC cannot abide. Indeed, borrowing cash from Wall Street with one-arm while it is pumping out massive new quantities of the same with its other arm is about as absurd as it gets. And paying banks 15 basis points to keep excess reserves stashed at the New York Fed is even more so. The chart below tells you all you need to know. In its misbegotten quest to keep interest rates at essentially zero on the front end of the curve, and well under 1.0% for tenors out to five years, the Fed has pumped so much cash into the banking system as to bury it in Ben Franklins. Since the current reserve requirement on transactions balances was lowered to zero last year, the entirety of bank reserves now amount to excess reserves, which figure totaled $3.89 trillion at the end of April. Do these people have a screw loose? The banks are literally submerged in cash, but the likes of John Williams won’t even talk about talking about tapering their $120 billion per month printathon of even more cash. It is worth noting the thin purple area of the chart stretching from 1947 to exactly August 2008. That was the eve of the Lehman meltdown, which event caused Bernanke to jump the shark at the Fed’s printing press, nearly tripling its balance sheet in barely 13 weeks. Before the Bernanke tsunami, however, total banking system reserves amounted to just $46 billion or a scant 0.3% of GDP. And that, in turn, represented a 50-year trend of declining bank reserves relative to GDP. The former had stood at about $30 billion and 2.5% of GDP when Nixon pulled the plug on gold-backed money in August 1971 and barely 1.2% of GDP when Greenspan cranked up the printing presses in October 1987 to bailout Wall Street from a 22% one-day meltdown. By the end of April 2021, by contrast, bank reserves stood 17.7% of GDP, and for no valid reason of economics, finance or banking. Banks were choking on cash because the madmen in the Eccles Building mindlessly believe, as John Williams averred above, that near-zero interest rates and massive monetization of the public debt are “supporting the economic recovery” Total Reserves of the Banking System No, they are not. Upwards of $6 trillion of fiscal stimulus is doing that job, and then some. What zero interest rates are actually doing is literally destroying every market function that is necessary for sustained capitalist growth and prosperity and the natural equities of the free market, as well. The foremost victim of the Williams/Fed variety of “support for the recovery” is the function of generating real money savings from current production and income. The Fed’s ZIRP policy means that savers unwilling to expose their hard-earned wealth to the wild west casino in the stock and bond markets, which have metastasized from the Fed’s mindless money-printing, are effectively SOL. The chart below covers the 244 months since January 2001 and measures the difference between the 90-day T-bill rate as a proxy for liquid savings and the year-over-year change in the CPI. That is, the real return on savings. As it has happened, the real savings rate has been negative during 187 of those months, or 77% of the time since 2001, when the Greenspan Fed went into money-printing hyper-drive to erase the impact of the dotcom crash. Forget the loss of economic function that must necessarily occur when the supply of savings dries up. These Keynesian nincompoops have been anti-savings since JM Keynes himself called for the euthanasia of the bond owning rentiers back in the 1930s. But what is even more diabolical is the Fed’s implicit edict to blue-haired widows and cautious younger people alike: Namely, put your wealth in harms’ way in the casino via the stock market or junk bonds or we will liquidate it through negative real returns on savings accounts until the cows come home. Indeed, if the Fed could be indicted for grotesque economic and social injustice – this chart is the smoking gun. After all, never in a million years on an honest free market of sound money would savers and borrowers form the hideous bargains shown below in the vast areas below the zero line, and for 20-years running at that. Real Return On Liquid Savings, 2001-2021 Of course, the lifetime savings of tens of millions of citizens are being gutted by an unelected monetary politburo in a manner that has never, ever been, or could be, authorized by the US Congress; and for the malign purpose of insuring the very right amount of inflation as divined by power-hungry crackpots like Powell, Williams, Clarida, Brainard and the rest of the Keynesian posse, whose contributions to the latest Fed dot plot say that the first rate-hike will not occur until 2024! That’s sheer madness. These people are obliterating every rule of sound money and rational finance in a futile effort to deliver something that benefits no one. Namely, 2.00% inflation averaged over a secret period of time known only to the self-appointed high priests of the latter day monetary temple known as the Fed. In fact, the crackpots in the Cleveland branch of the Fed have gone so far as to produce Lego-based animated videos explaining inflation and how the Fed has the tools to keep it on the straight and narrow. As one commentator aptly noted, Lego people scream as a narrator describes hyperinflation, where prices increase at uncontrollable levels, before they’re reassured that the Fed’s got things under control. The final moments leave watchers with a sense of peace, showing how the Fed can keep inflation on track using its various policy tools. “With the help of the Federal Reserve, there’s just the right amount of inflation,” the narrator explains… A still image from an animated video released by the Federal Reserve Bank of Cleveland. Of course, the lifetime savings of tens of millions of citizens are being gutted by an unelected monetary politburo in a manner that has never, ever been, or could be, authorized by the US Congress; and for the malign purpose of insuring the very right amount of inflation as divined by power-hungry crackpots like Powell, Williams, Clarida, Brainard and the rest of the Keynesian posse, whose contributions to the latest Fed dot plot say that the first rate-hike will not occur until 2024! That’s sheer madness. These people are obliterating every rule of sound money and rational finance in a futile effort to deliver something that benefits no one. Namely, 2.00% inflation averaged over a secret period of time known only to the self-appointed high priests of the latter day monetary temple known as the Fed. In fact, the crackpots in the Cleveland branch of the Fed have gone so far as to produce Lego-based animated videos explaining inflation and how the Fed has the tools to keep it on the straight and narrow. As one commentator aptly noted, Lego people scream as a narrator describes hyperinflation, where prices increase at uncontrollable levels, before they’re reassured that the Fed’s got things under control. The final moments leave watchers with a sense of peace, showing how the Fed can keep inflation on track using its various policy tools. “With the help of the Federal Reserve, there’s just the right amount of inflation,” the narrator explains… A still image from an animated video released by the Federal Reserve Bank of Cleveland. Needless to say, the Fed’s cheap money housing boom is occurring right where you might expect it. As is the case with the stock market, the housing boom is distinctly an upper income affair. While May sales for homes above $1 million were up by a staggering 245%, volumes at prices below $250,000 were actually down from last year. And yet these clowns say their policies have nothing to do with the growing (artificially generated) wealth disparities in American society. That’s just plain risible nonsense. Even more importantly, there is nothing new about the above. Wage earners have been running a losing race with Fed-fueled housing price inflation for decades. But that’s especially been the case since Alan Greenspan famously noted the rise of “irrational exuberance” in asset markets in December 1997 and then promptly shoved said observation into the memory hole at the Eccles Building. In fact, since then housing prices (purple line) are up by nearly 150%, while average weekly earnings of all private employees (brown line) have barely risen by 95%. There is absolutely no economic benefit to that yawning gap, while there is an absolute certainty that soaring house inflation is a direct result of the Fed’s massive repression of interest rates. In a world where down payments are as low as 5% and rarely more than 20%, rock bottom mortgage rates are simply financial kerosene that fuels the inflationary housing fires. Median US Home Price Versus Average Weekly Earnings, 1997-2020 Then again, the kind of housing inflation depicted above is not an equal opportunity interloper. It is actually profoundly capricious, conferring massive windfall gains on longtime home-owning Baby Boomers, while shellacking first time buyers and younger move-up households. There is simply no possible justification for state policy interventions which result in such caprice, and especially when the offending central bankers are beyond any kind of democratic accountability. Nor is the story any better for renters. As of May 2021, the median national rent reached $1,527, up 5.5% compared to a year ago, with median rents rising in 43 of the 50 largest metro areas. Likewise, this isn’t a “base effect” case, either. Monthly rental prices are up 7.5% nationwide over the past two years, and are now above the pre-Covid trend (dashed purple line). Needless to say, all of the Fed’s madcap stimulus has not resulted in more housing construction, which is the ostensible purpose. In fact, even with the recent construction mini-boom, single family starts are only up 9% since 1997, even as the median price has soared by the aforementioned 150%. Median Home Prices Versus Housing Starts, 1997-2021 Of course, ultra low rates are good for something, if not rising living standards: Namely, financial engineering and speculation. That was made clear today when the nation’s largest single family landlord – the Blackstone Group – paid an insane $6 billion for Home Partners of America. They latter is also a financial engineering roll-up, with about 17,000 rental units, meaning that Blackstone paid around $350,000 per unit. And that’s not owing to their modest cash flows which are projected to generate about a 5% net returns, but because Blackstone’s carry cost cost of capital is rock bottom. In behalf of our 20-years ago partner, Steve Schwarzman, thank you, Fed! In short, the overwhelming impact of the Fed’s hideous interest rate repression is rampant speculation in the financial markets and among the C-suites. As of June 11, for instance, YTD stock buyback announcements total a record $567 billion. Since the top 1% and 10% of households own 53% and 88% of the stocks, respectively, it is pretty evident what the Fed’s misbegotten policies actually produce: A massive channeling of wealth to the top of the economic ladder – even as savers, wage earners, renters and younger and less affluent home buyers all take it on the chin. At the end of the day, the camarilla of money-pumpers led by the likes of John Williams are damn near criminally incompetent. They now have junk bond spreads at the lowest level in history, and there is no doubt as to where all that radically mispriced capital is going. To wit, to fuel the financial machinations of speculators and financial engineers, who simply extract rents from the existing stock of wealth rather than create more of it. PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.

Apparently the "rules-based order" that the Biden Administration touts does not apply to the United States, as the Justice Department announced yesterday it was seizing the websites of dozens of foreign news outlets, including the Iranian government-funded PressTV. Is taking down foreign news sites a good look for the US? This story and more news in today's Liberty Report...

By Chris Rossini

Each of our individual lives are extremely personal...to us! We experience the consequences of our own decisions. No one else experiences them for us. When we choose (and we are constantly choosing every second of the day) we subsequently experience the results of those choices and must deal with them. Oftentimes, we a pleased with our choices, but since no human being is all-knowing, we quite often make choices that we end up regretting after the fact. It's impossible to have all the information ahead of time. It's impossible to know every implication and all the variables that are at play in each moment. But in this life of perpetual uncertainty, we must choose nevertheless, and then experience the results of those choices. That's what it means to be human. Now... In this environment, other humans, who deal with the same uncertain world that we deal with, come along and attempt to impose their choices on others. Naturally, these individuals gravitate towards government and attempt to use the force of government (which is meant to keep the peace, not coerce the peace) to their advantage. Today, a politician actually has a "vaccine goal" of 70% by July 4th. Now, it appears this goal is not going to be reached, but the fact that such a "goal" even exists shows just how warped the role of government has become. How can one person even have a "goal" for hundreds of millions of other people? That's not how humanity works. We choose our own goals, and when it comes to medical treatments, that's one of the biggest choices that we ever make. Medical treatments are extremely personal. You can't get much more personal than your very own physical body! As such, medical treatments must always be voluntary. No one should ever be "pressured," or "bribed," or "coerced" into sticking a foreign substance into their own body. And most of all, medical treatments are absolutely none of the government's business! And yet, today we see all of these tactics on full display. The pressure campaigns are relentless. The bribes are beyond ridiculous. Stick a foreign substance into your body and get a free burger, or beer, or be entered into a lottery? This is how Americans are viewed by their elected (and unelected) officials? Really? It's beyond insulting. And amongst the most sad of all are the workers who are losing their jobs, or being forced to quit, because they refuse to be part of the biggest medical experiment in mankind's history. No one deserves such treatment. Ironically, even healthcare workers themselves are a part of this group. A few months ago, they were hailed as heroes. Today, many are being kicked to the curb unless they roll up their sleeves. This is how heroes are treated now? It's wrong. In fact, the word "wrong" doesn't fully capture how wrong it is. And so, many people in many different professions are apparently coming to the conclusion that they can always get another job; but they only get this one life. So they ditch the job in favor of preserving their life. A big lesson is on display today. It's a lesson that libertarians have been shouting from the mountaintops for ages. One should never sacrifice personal liberty to the government during a real, or even perceived, crisis. Once that sacrifice is made, a price will have to be paid. That price is never worth it. The government will forever try to convince you that "it's different this time." It's not different. It's never different. Liberty is absolute. We have one life each. We make our choices in an uncertain world, and will experience the consequences of those choices. The consequences cannot be passed off onto anyone else. Sacrificing liberty is much too high of a price to pay. Doing so can end up ruining one's life completely. |

Archives

July 2024

|

RSS Feed

RSS Feed