|

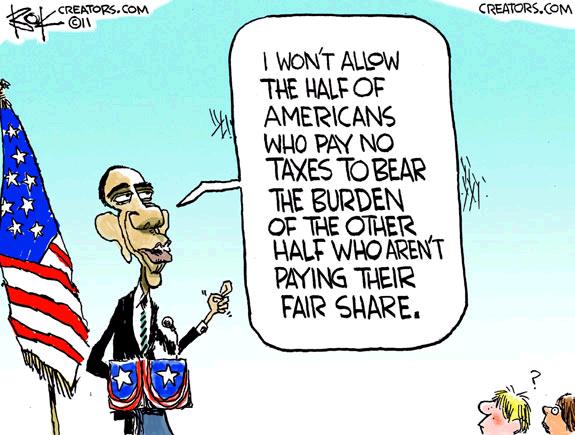

By Simon Black There are two words that kept coming up over and over again over the last 20+ months during the US Presidential circus: “fair share”. Hardly a day went by without hearing that certain taxpayers “need to pay more of their fair share.” It sounds really great, and given the voter statistics, this idea resonated with tens of millions of people. After all, who could possibly be against fairness? When you dive into the numbers, however, the data doesn’t support this assertion at all. According to IRS figures, households that earn more than $1 million annually, roughly 0.4% of all taxpayers, pay a total of $364 billion in federal income tax. This amounts to roughly 27% of all the US federal individual income tax that’s collected. So in other words, the top 0.4%, pays 27% of the total tax bill. If you extend this analysis to the upper middle class, i.e. the top 24.5% of households earning more than $100,000 per year, the numbers are even more dramatic. (Bear in mind this includes two spouses earning $50,000 each.) This group of households earning between $100,000 up to $1 million contributes 50.4% of all US federal individual income tax. Combined, the two groups, which comprise the top 25% of US taxpayers, pay nearly 80% of the total tax bill. (In case you’re wondering, the bottom 50% of income earners contributes less than 5% to the total tax bill.) This isn’t intended to be a slight against any income group; rather, I’m honestly wondering exactly how much these people consider to be “fair”? Because it’s not intuitively obvious to me that sticking 25% of the people with 80% of the bill is “unfair.” Now, the common refrain from the “fair share” crowd is that taxes go to fund our roads, schools, police departments, fire fighters, etc., and that rich people can afford to pay more. But there’s a big problem with this logic. All the benefits that people cite, from fire fighters to public schools, are typically funded at the state and local level… and paid for with state and local taxes. NOT federal tax. Your federal tax dollars don’t fund local fire departments. Instead you’re paying for a giant, bloated, federal bureaucracy that squanders tax revenue on some of the most obscene waste imaginable. You paid $2 billion for the Obamacare website that didn’t work. You paid $1 billion for the military to destroy $16 billion of perfectly good ammunition. You paid $856,000 for the National Science Foundation to teach mountain lions how to run on treadmills. And you paid an incalculable sum of money to drop bombs by remote control on innocent civilians and children’s hospitals in countries populated by brown people. None of this money is going to fix the pot hole in front of your driveway. But despite their argument being totally specious and unsupported by IRS data, the “fair share” cries grow ever louder. Warren Buffett, a 0.01% guy himself, has been a loud voice claiming that wealthy people should pay more. Buffett complains every year that he pays less tax as a percentage of his income than his secretary. And this has created a popular belief that wealthy people pay very low tax rates. Again, IRS statistics disprove this claim; the average tax rate for top income earners in the US is over 30%, versus 9.8% for the bottom half of income earners. Moreover, there’s nothing stopping Warren Buffett from writing a bigger check to the US government. If he feels so strongly about his “fair share,” he’s free to make a donation to pay down the national debt. But he hasn’t done that. Quite the opposite, in fact. Several years ago Warren Buffett pledged to leave nearly all of his wealth to the charitable foundation run by Bill and Melinda Gates. And he donates billions each year to other charities. Warren Buffett could have bequeathed his entire fortune to Uncle Sam. But he didn’t. That’s because Buffett knows his money can do more good in the world by funding those private organizations instead paying for more federal waste. And this statement is true whether you make $50 million per year, or $50,000. Bottom line, it’s not evil for anyone to want to keep their hard-earned savings and income out of the federal government’s ignominiously wasteful hands. Nor is it evil to take completely legal steps to reduce what you owe, no matter what the specious “fair share” crowd says. (By the way, regardless of your income level, there are always options to reduce your tax bill.) Taking these steps is totally sensible. And if you’re like me and feel disgusted by much of the destruction that your federal taxes have funded, you might even feel a moral obligation to do so. This article was originally published at Sovereign Man

Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed