|

By David Stockman

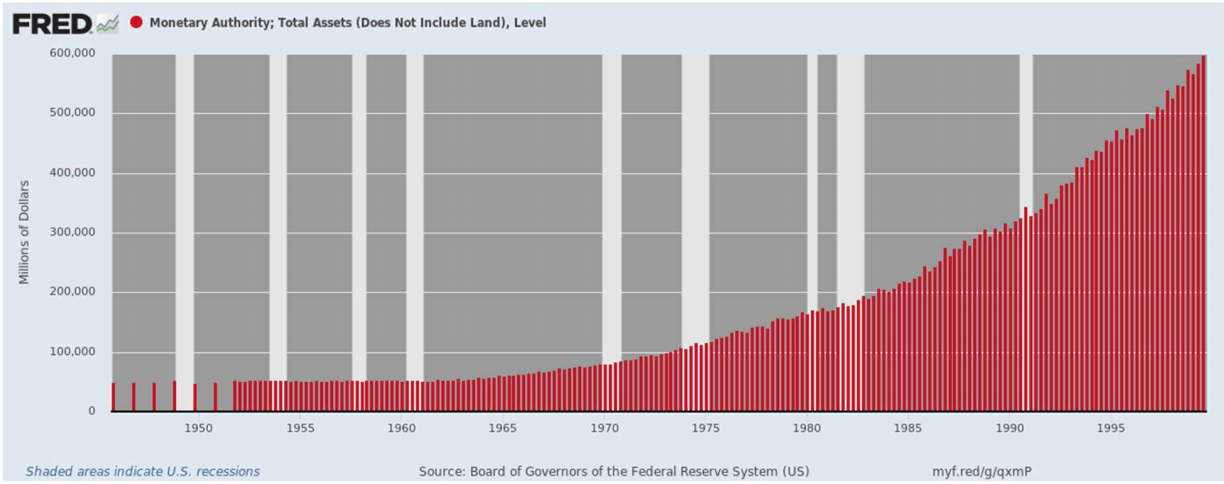

Did we say it’s getting stupid crazy down there in the Imperial City? Well, we probably have....ad infinitum. And we are doing so again but not merely owing to today’s abomination in the once and former Peoples’ House, which thinks so little of its oath to defend the constitution and the rights of current and future taxpayers that it approved the $2 trillion Everything Bailout without even a roll call vote. Then again, like the late night TV pitchman says— wait, there’s more! Consider the chart below, which surely the Fed heads have not. To wit, it took the Fed 95 years after its doors opened in 1914 to print enough money to fund a $600 billion balance sheet. It wasn’t exactly the Ohio State offense– three yards and a cloud of dust—which accomplished this. But it was pretty close—even including Greenspan’s first years at the helm. Between the famous Treasury Accord in 1951, under which the Fed was liberated from Treasury-ordered yield pegging, and 1999, its balance sheet grew at a modest 5.2% per annum. And, by your way, the Fed’s relative stinginess with the printing press was a great big no nevermind. Real GDP grew at 3.4% per annum over that near half-century period, and real median family income more than doubled from $35,000 to $74,000.

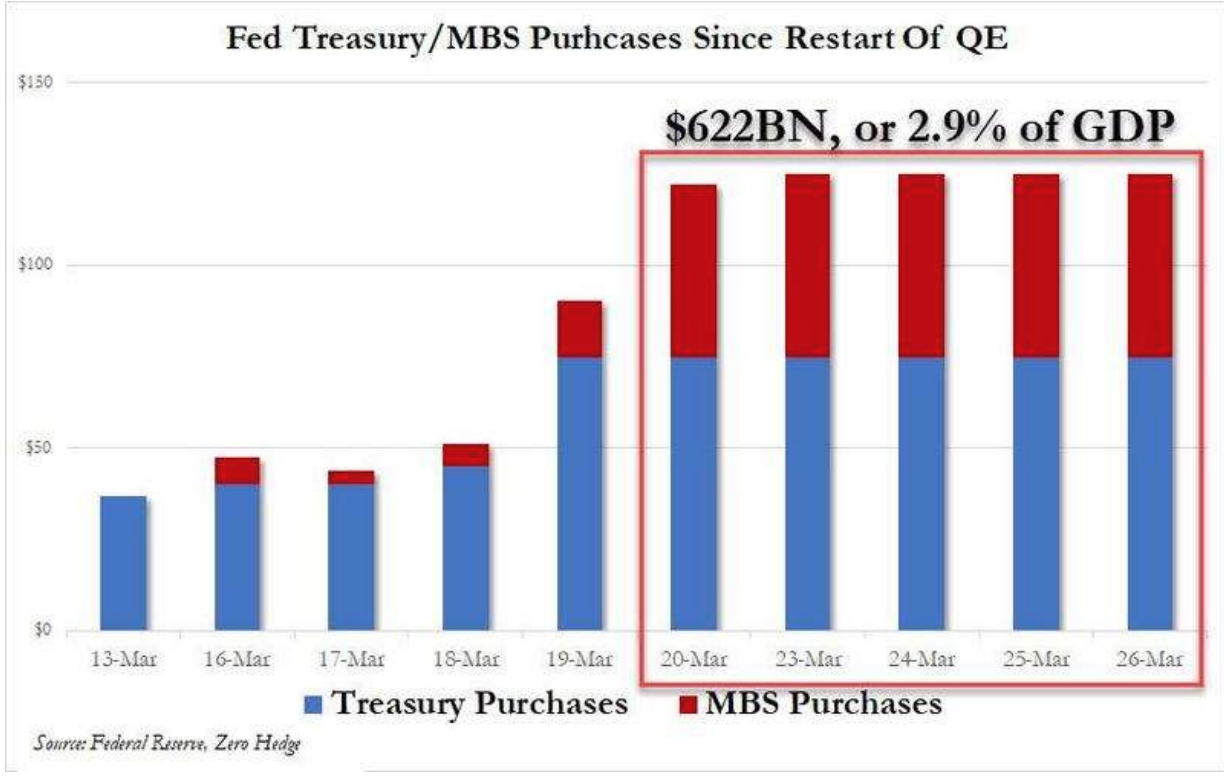

We are pondering the number “$600 billion” today because its capsulizes the insanity loose in the Imperial City. What took 95 years to accomplish in the purportedly benighted 20th century, has now taken just five days!

You truly cannot make this stuff up. The Fed has purchased $622 billion of USTs and MBS since March 19th, meaning that its balance sheet has expanded from $4.75 trillion last Thursday evening to $5.372 trillion last night. And, yes, we do have a calculator which generates compound annual growth rates by the day. Even giving credit to the fact that these madmen/women rested their printing press, apparently, on Saturday and Sunday, the growth rate in the box below computes to, well, 61,084% per annum! Even Uncle Milton Friedman, the evil genius who started all this at Camp David back in August 1971, is surely rolling inconsolably in his grave.

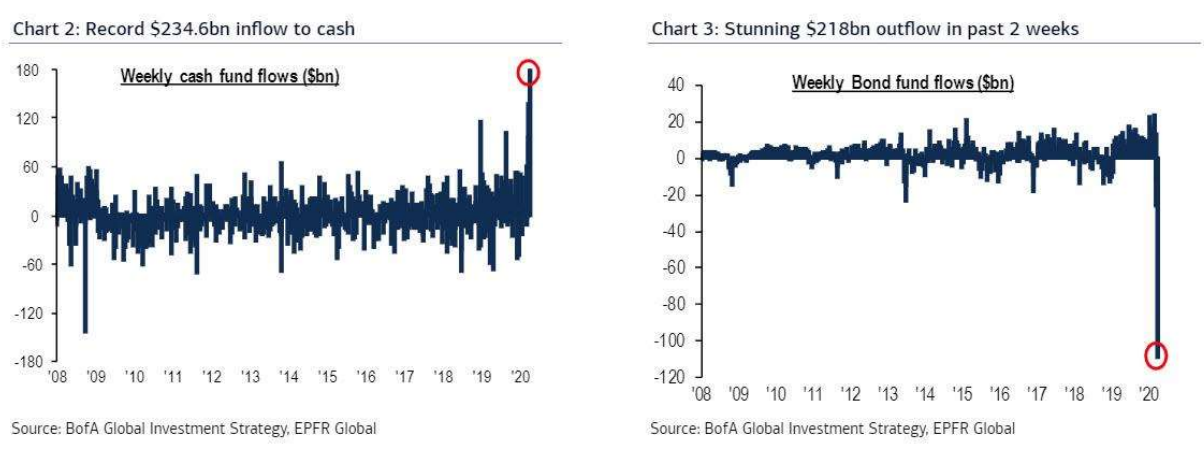

If there is any doubt that this madness is literally destroying the bond markets, you need look no further than the side-by-side charts below. The massive corporate bond bubble that 10 years of the Fed’s foolish interest rate repression generated is now coming unstuck at the seams.

As we have said all along, the specious assurance from the Eccles Building that the financial system is sound because banks have been passing their ludicrously rigged “stress test” was malarkey of the first order. For crying out loud, Waldo wasn’t hiding in bank balance sheets! That was the last rodeo. The latter have been repaired as a result of savaging returns on the bank deposits held by millions of savers and retirees. But that just meant Waldo scampered over to the trillions of new corporate bond mutual funds and ETFs which have risen up to quench the desperate thirst for yield among asset gatherers. But now these hideously low yields are being clobbered by the Covid-19 shutdown panic, causing a run on the bond funds like no brick and mortar bank run ever before. In just the last two weeks there has been a $218 billion outflow from these funds, including $34.6 billion on “bond capitulation day” on March 20 alone. We’d say, better late than never. In an honest market, corporate bond yields would be rising smartly and the C-suite geniuses who trashed their own balance sheets over the last decade to fund rampant stock buybacks and financial engineering adventures might well be getting a tap on the shoulder from their own complicit boards, who might not otherwise relish the prospect of spending the rest of their days in shareholder litigation. Alas, the last thing our monetary central planners wish to see is honest bond yields or any other kind of honest financial asset prices. So that’s why they are virtually flaunting the law and setting up a thinly disguised corporate bond buying double-shuffle with the US Treasury in order to flood the bond pits with a massive state-financed bid for the bonds being dumped by real money private investors. That is, the 5%, 7% or even 10% corporate bond yields that today’s hyper-leveraged corporate balance sheets deserve would finish the job of puncturing the stock market bubble where Covid-19 left off. That moment of reckoning, of course, must be precluded at all hazards, even if it means fostering an even more incendiary blow-up just down the road. That is to say, when the Fed/Treasury owns all the bonds and the private world is sitting on a mountain of cash (nee trash), look out below!

We leave it to another occasion to ponder the financial market implication of the absolute monetary mayhem which has issued from the Fed during the last two weeks, and only hinted at by the above observations.

But the ever prescient Jim Bianco today summarized the action neatly, and what it actually amounts to. In effect, said the great Bianco, meet your new de facto Fed chairman—Donald J. Trump! In just these past few weeks, the Fed has cut rates by 150 basis points to near zero and run through its entire 2008 crisis handbook. That wasn’t enough to calm markets, though — so the central bank also announced $1 trillion a day in repurchase agreements and unlimited quantitative easing, which includes a hard-to-understand $625 billion of bond buying a week going forward. At this rate, the Fed will own two-thirds of the Treasury market in a year.

Now that’s not only a downright frightening thought, but actually at the present fraught moment there is only one entity more dangerous than the Donald and that is the entire lot of numbskulls and morons which comprise the U. S. Congress (with the exception of the Heroic Rep. Thomas Massie, who had the cojones to futilely stand up to the braying herd and demand a recorded vote).

In effect, every shred of historic resistance on Capitol Hill to unhinged spending and borrowing has been vaporized by the Fed’s lunatic nationalization of the bond, loan and money markets. The politicians now literally feel free to borrow like crazy because they know the Fed will monetize every single dollar of it. But here is one thing we do know because we have been there and when it comes to Congressional politicians and the public debt, we have stared into the very white of their eyes. The one and only thing they feared back in the day was that massive borrowing by Uncle Sam would hog the available funding supplies, thereby driving up interest rates and crowding out the only two things they care about: • Room in the budget for their favorite charities and pork; • Angry homeowners, businessmen, farmers and car buyers in their districts getting hammered with high rates or squeezed out of the market entirely. But that’s now a distant memory for the old-timers still in Congress (like our successor, Rep. Fred Upton who has been there 36 years) and most especially the 21st century crop of ne’er-do-wells who, apparently, have no experience with fiscal discipline whatsoever. Thus, this morning we actually heard one of them on CNBC— the former GOP chairman of the House Ways and Means Committee, Rep. Brady— urging a voice vote. That is, the body which the framers charged with originating spending and financing bills was to wave through unread and sight unseen $2 trillion worth of Senate-passed crony capitalist bailouts, coast-to-coast soup lines and $340 billion of new appropriated pork—all contained in 883 pages scribbled together in the dead of night Wednesday. And Rep. Brady was one of the more sober voices rushing for the cameras. Celebrating her 80th birthday in this life and accession to immortality in the financial hall of shame, Nancy Pelosi promised, in effect, that you haven’t seen nothing yet. It seems that another, probably even larger bailout #4 for states and municipalities is already being plotted: @ChadPergram: Pelosi says both bodies of Congress should work on the phase 4 coronavirus response. “Four corners,” as she said....Says she urged Mnuchin to do the direct payments more quickly

We fear even prayer isn’t up to the task. Not when you even scratch the surface of what this drooling pack of fiscal incontinence just gummed through by voice vote.

For instance, it includes $250 billion for unemployment insurance, with most of the money going to a $600 per week boost in normal benefits over the next four months and increasing the standard benefit period from 26 weeks to 39 weeks. Of course, we haven’t heard even the sky-is-falling nitwits on CNN arguing that the shutdown will last for 26 weeks, to say nothing of making provision through next New Year’s Eve (39 weeks). But what takes the cake for mindless profligacy is the $600 per week add-on to benefits which in most states already range between $400 and $700 per week. In this context, we have been insisting that this massive tsunami of money really isn’t about humanitarian concerns or even a modest helping hand for workers and families caught up short, and that’s exactly what we have with the $600 benefit raise. That is, it’s just another plank in the 100% GDP replacement program aimed to restore the false prosperity on main street and the egregious bubbles on Wall Street embodied in the January 2020 status quo ante. That’s why the maximum rate now payable to laid off workers will reach the following per hour equivalents for the next four months; and these figures are based on an assumed 40 hour week, which virtually none of the claimants actually log (US average is about 34 hours per week): • NY ($27.60); • TX ($28.03); • PA ($29.33); • CT ($30.33); • CO ($30.45); • ND ($30.82); • NJ ($32.83); • MN ($33.50); • WA ($34.75); • MA ($35.58) No, we don’t begrudge wage earners getting a generous portion of the loot. But replacing wages at this level on the taxpayers dime for a short-term emergency is just plain ludicrous. Indeed, the reason this insanity is even in the bill is because that’s what the Donald and McConnell had to cough up to Chuckles Schumer and the labor/progressive Dems in order to get what they really wanted: Namely, the massive $4 trillion front door (US Treasury) and back door (Fed) bonanza of crony capitalist handouts that are the real reason for the Everything Bailout. We will address this abomination in detail in Part 5, but consider this: No business should get a dime from Washington to keep people on the payroll who aren’t working (regular UI is already taking care of that); and if they have trashed their own balance sheets over the years, they should pay-up the market rate of interest to borrow the money to cover other cash shortfalls during the Covid-19 shutdown. Take the example of the restaurant chain called the Cheesecake Factory (CAKE), which yesterday ostentatiously announced it would not pay April rents on its 620 locations. Fine. The landlords can throw them out or, more likely, work out a rent abatement program for the relatively short-term duration of the Covid-19 dislocation. In fact, exactly those kinds of adjustments are what happens on the free market and are actually happening from coast-to-coast at this very moment. But we mention CAKE because it was one of those momo stocks awhile back where the top management couldn’t resist the temptation to goose their share price and stock options by trashing the company’s balance sheet to pump a tsunami of money back into Wall Street. To wit, during the past 10 years, the company generated $1.12 billion of cumulative net income and $1.31 billion of operating free cash flow. But, alas, it spent over that same 10-year period $1.50 billion on stock buybacks and dividends. That is, it returned 133% of net income to Wall Street and spent 115% of free cash flow on appeasing the trading gods and robo-machines of Wall Street, not building sustainability and rainy day reserves into its own balance sheet. In fact, the company’s debt currently stands at $1.6 billion or a debilitating 11.2X annual free cash flow. And, yet, these cats want a bailout! Now they will surely get one from the $4 trillion cheap money bonanza the GOP has just rammed through without a vote and even a day of hearings and analysis. As we said, there has never been a Day of Shame on Capitol Hill like that which has just transpired.

This article was reprinted with permission from David Stockman's Contra-Corner.

David Stockman began his career in Washington as a young man and quickly rose through the ranks of the Republican Party to become the Director of the Office of Management and Budget under President Ronald Reagan. After leaving the White House, Stockman had a 20-year career on Wall Street. Stockman is an Advisory Board member for the Ron Paul Institute for Peace and Prosperity. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed