Jerome Powell Doesn't Know What Interest Rates Should Be (And Neither Does Elizabeth Warren)2/1/2023

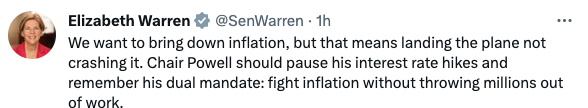

By Chris Rossini Another day of central economic planning is upon us, and the Federal Reserve has raised interest rates once again. In other words - more price fixing. Senator Elizabeth Warren was not happy with the decision: What a situation.

Elizabeth Warren - who has no idea what interest rates should be - is criticizing Jerome Powell - who also has no idea what interest rates should be! This is what happens when the people accept price fixing and government central planning. It's the exact opposite of what should be. And what should be? Interest rates, like every other price, should be set by all of the individuals in the marketplace. No interference by third parties. Let's consider the basics... Imagine having a couple of friends over to watch the upcoming Super Bowl. You overhear two of them trying to strike a deal. One wants to buy a beer from another for $2. But, being a busybody, you interfere with the situation. You say, "No...you cannot sell that beer to him for $2. You must sell it for $4." What business is this of yours? You're not a part of the transaction. They're just trying to make a voluntary trade, that they both benefit from. They don't need your involvement. But alas, you threaten to throw them out if they transact on their own terms, and the deal never takes place. You have just distorted the (very small) economy that exists in your house. This is what government and the Fed do all the time; but on a MASSIVE scale. They distort the economy of hundreds of millions, and even billions of people! As time goes on, the distortions turn into bubbles. The bubbles get bigger and bigger each time. The necessary busts become ever more painful. The 2000 dot-com bust was bad, but the 2008 housing bust was worse. The 2008 housing bust was bad, but the upcoming bust will be worse! Elizabeth Warren believes that this economic pain can somehow be avoided. It cannot. The damage is done. The moment The Fed and government interfere is when the damage is done. The interference has already taken place. Now we wait... I'm sure that The Fed knows this, but they are trapped like every central planner throughout history ends up being trapped. Ultimately the point is reached where the distortions are so great, that there is no more kicking the can down the road. The Soviet Union was a perfect example of this. There was nothing they could do to live up to the utopian expectations that they had. The Fed may not be in as dire straits at the Soviets, but ultimately they will be. Ultimately, it'll be time to shut the doors of The Federal Reserve. Until then, let's not pretend that anyone knows what interest rates should be. It only perpetuates the disaster. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed