|

By Ron Paul

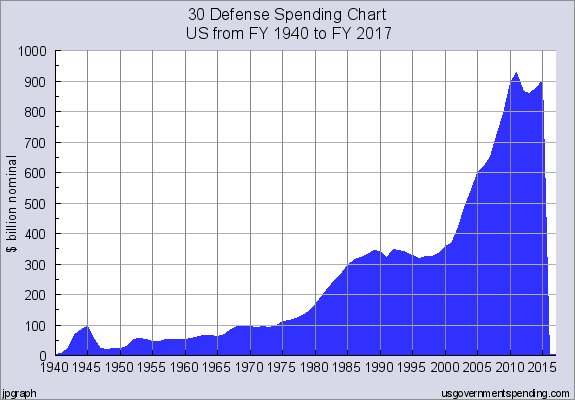

An often ignored, yet major political question is "Why has there been no economic recovery?" There are plenty of silly distractions in the presidential campaign, but no answers for such a critical question. There has been no significant economic growth since 2008! We were told by the media at the time that Federal Reserve Chairman Ben Bernanke was a "Hero". He saved "the system". But what exactly did The Fed save? Wall Street, at least on paper, seems to be thriving. But grassroots America continues to suffer. The Fed's fivefold increase in the monetary base failed to "stimulate the economy," and did nothing to renew economic growth. The federal debt, however, did increase by an astounding $8 trillion! Yet more spending by government has not been a panacea at all. Where are the outcries? Why has no one challenged the conventional wisdom of Keynesian economic planning? Why haven't Keynesian economists and pundits been called to task? They got us into this mess. They've championed the perpetuation of it. Why the silence? You could be sure that if free markets existed, and they produced this kind of economic distress, there would be cries from every corner. We do not have free markets, but centrally planned markets. Where are the cries? Conservatives are offering no help. When conservative politicians are asked about what should be done about the economy, their glib answers provide no solution. Sure lower tax rates and reduced regulations would be a good start, but that's just the very tip of the iceberg. In order to restore soundness to the American economy, we have to go to the root of the problem, and not just tinker around the edges. At the root lies the Federal Reserve and its cadre of central planners. There must be a return to interest rates that are set by the market. The idea of Americans sitting around with baited breath, waiting for central planners to issue their dictates is an embarrassment that future generations will look back on. Future Americans will think to themselves: "Did they actually believe that the Federal Reserve knew what interest rates should be? That's impossible!" It is impossible, and the central planners at the Fed have no clue as to what they're doing. The Fed sits at the root of our problems, and then we can fan out from there. We have no economic recovery because far too many Americans have fallen under the spell of "progressivism," which is the idea that government must be involved in all aspects of our lives. There is no objection to government managed wage rates, and no philosophic resistance to government control of education and medical care. Americans have accepted government control hook, line and sinker! The "progressive" mentality (which is actually regressive) of total government control extends even beyond the American life. Strong support continues for increasing military spending for foreign adventurism. No matter how long the string of foreign policy failures, we still have presidential candidates that are talking about "rebuilding the military." Take a look at how your hard work, and the earnings that you produce, have been funneled into the military-industrial-complex. Does this look like an area that needs to be "rebuilt"?

There is no resistance to runaway welfare entitlement spending either. Astonishingly enough, there are presidential candidates that actually want to ratchet up the welfare, promising "FREE" stuff and making up "rights" that don't exist.

An intellectual renaissance is past due for America. A re-understanding of "capital" is much needed. Capital can only come from savings. It can't be whisked into existence with a Federal Reserve computer. A definable market-based monetary unit must exist once again. Ask someone what a dollar actually is and you're likely to get a blank stare in return. Even central bankers are unable to provide a coherent answer. Excessive debt must be liquidated. Mountains of malinvestments that the Federal Reserve has brought into existence must liquidated as well. Belief in having government involved in every piece of minutia also must come to an end, and it most certainly will. The key question is how much economic pain must be felt in tossing aside the Keynesian and "progressive" ideas that are now clearly running on fumes? You see, these critical mistakes must be corrected. We can run from them, but not forever. One thing is certain though. The longer that we run, the greater the pain that must be felt in the return to reality. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed