|

By Chris Rossini

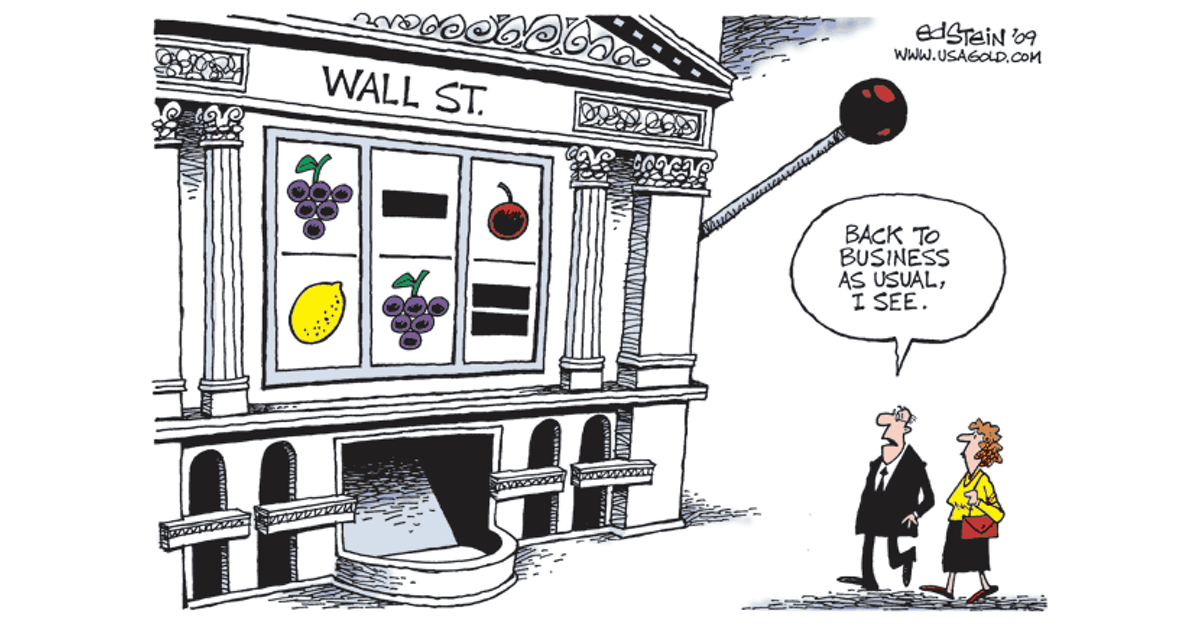

Most of us automatically keep our hard-earned money in the "banking system." It's the safe thing to do, right? Everybody else is doing it, and the little rectangular sign says that the money is "insured." Since the government is honest, it must be OK. If government wasn't honest, surely CNN or MSNBC would let everyone know, right? Once your money is deposited though, it becomes the bank's money, and they subsequently "owe" it back to you. Perhaps 99.999% of depositors don't realize this. Most think that a bank is a place to *store* the money that they work 40, 50, or 60 hours a week for. That is the way that honest banking should work, and did work at one time; but Americans were gradually weaned away from honest banking, with the coup de gras finally occurring in 1913 with the founding of The Federal Reserve "System".

So instead of storing money in a bank, and paying a fee for the storage services, we lend our money to the bank and pay them to speculate with it.

Simon Black explains: Bank of America has $592.4 billion in deposits from retail customers, i.e. regular folks who bank at BOA.

What happens when things go south?

Well, back in 2008, taxpayers picked up the tab. The gambling operation was deemed "too big to fail". Of course, when you reward nefarious behavior, such behavior will only increases in size and intensity. That's exactly what happened over the last decade since the bailout. What will happen when things go south again...this time on an even larger scale than in 2008? Honest banking is always an option. It doesn't have to be this way. There's nothing inherently wrong with banking, or with banks being lenders. It's a legitimate and very important business...when done honestly. But when you merge banking with government power (that's what the Federal Reserve "System" is) you get the house of cards that we currently have today. It can be changed. Enough people have to want it though. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed