|

By David Stockman

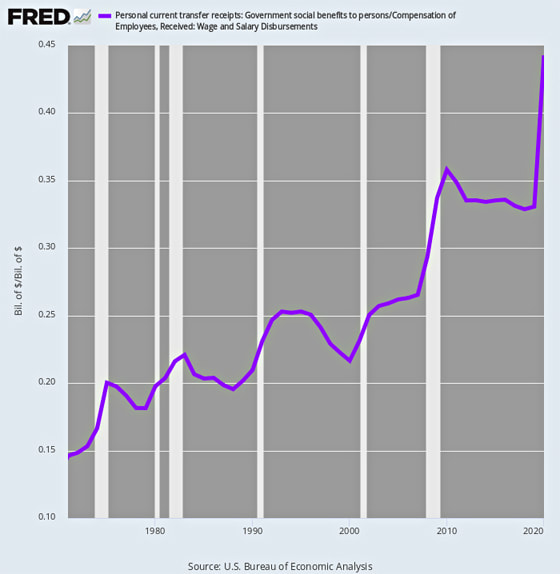

It is perhaps fitting that on the 50th anniversary of Richard Nixon’s dirty deed in August 1971, the US Senate saw fit to pass a budget resolution that will add $3.5 trillion of additional girth to the nation’s already bloated and unaffordable Welfare State. As Forbes properly noted, The Senate on Wednesday set the stage for the biggest expansion of the federal social safety net since the advent of modern-day food stamps, Medicare and Medicaid in the 1960s, approving a blueprint for a massive $3.5 trillion budget bill aimed at “restoring the middle class” through a slew of government initiatives – including universal preschool, tuition-free community college and a new federal health program – while combating climate change and hiking taxes for the ultra-wealthy. We make the connection between the Senate’s latest welfare bonanza and Tricky Dick’s severing of the dollar’s link to gold because on that fundamental matter, Alan Greenspan was actually correct. We are speaking, of course, of the Greenspan of 1966 before he fell off the wagon in pursuit of government power, position, praise and pelf. In his seminal but now forgotten speech called “Gold and Economic Freedom”, the proto-Maestro observed, In the absence of the gold standard, there is no way to protect savings from confiscation through inflation There is no safe store of value……The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard. We have bolded the deficit spending part because it has been the lubricant that has enabled Washington to perennially dispense free stuff today while deferring the due bill to the bye-and-bye. Thus, when Greenspan spoke in 1966, the public debt was just $325 billion – virtually every penny of which had been incurred during wartime including LBJ’s Vietnam folly – and amounted to 40% of GDP. And that figure had been steadily falling from the WWII peak of 125%. No more. The public debt now standards at $28.1 trillion and 127% of GDP, and is rising at breakneck speed. After all, on the eve of the Great Recession just 14 year ago (Q4 2007) that ratio had clocked in at only 62.7% of GDP. While both today’s Warfare State and the Welfare State impose vastly excessive and unnecessary burdens on capitalist prosperity in America, it is the latter which has mushroomed since 1966 under the modern regime of chronic deficit finance. We think the very best way to demonstrate that proposition is to compare total government transfer payments to the aggregate wage and salary compensation earned by American workers. That’s because in an honest and sustainable fiscal regime the producers of income must necessarily pay the taxes to fund transfer payments to the non-workers. Alas, when Tricky Dick pulled the plug on sound money in 1971, there was only 15 cents of transfer payments at all levels of government for every dollar of wage and salary income. In money of the day, those figures were:

By the time Ronald Reagan took office in 1981, transfer payments were up to 20 cents on the dollar of wages and salaries, and by the time he had finished shrinking Big Government in 1988 that figure had been whittled back to, well, 19 cents. Thereafter, however, it was pretty much off to the races. Notwithstanding the economic boom of the 1990s, government transfer payment rose to $1.05 trillion by the year 2000 and represented 22 cents for every dollar of wage and salary earnings, which figure rose to 29 cents on the dollar by the time the big spenders of the George W Bush Administration left office in 2008. Yes, the Great Recession bailouts, Obamacare and endless fiscal stimmies enacted thereafter pushed the figure to 33.5 cents of transfer payments per dollar of earned income by the time Barry left office in 2016. But that was just the warm-up for the the Donald’s purported Covid fighting spend-a-thons during 2020. In fact, here are the figures that underlie the staggering 44.3 cents of transfer payments on the dollar of wages and salaries recorded during 2020.

Stated differently, the four-year gain in transfer payments of $1.46 trillion actually exceeded the $1.35 trillion gain in aggregate wages and salaries of 160 million working Americans. And yet there are still masses of delusional “conservatives” who think the Donald was actually a Republican! At the end of the day, Greenspan was right 55 years ago. Politicians and Keynesian economists alike hated the gold standard because it was the great disciplinary anchor that kept the expansionist impulses of the modern Welfare State at least reasonably in check. The irony, of course, is that it was actually Greenspan himself who pioneered monetary central planning when he redefined sound money to encompass monetizing Republican fiscal deficits. That ensured his stature as toast of the town in Washington, but it also paved the way for the Welfare State bacchanalia depicted in the chart below. Government Transfer Payments As % Of Wage And Salary Incomes, 1971-2020

As it happened, there is a coda to the above which transpired in Q1 2021, and it is nearly too ugly to print. That is, thanks to the Donald’s parting gift in the Christmas Eve stimmies, which was then followed by Sleepy Joe’s $2.3 trillion so-called Covid relief bill in February, shooting the moon got an altogether new definition.

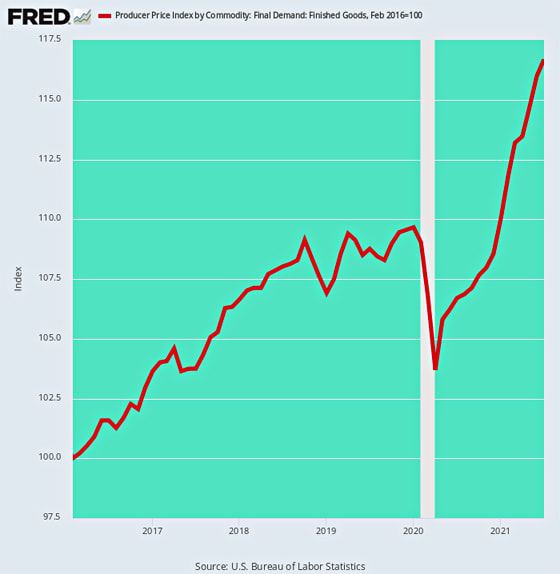

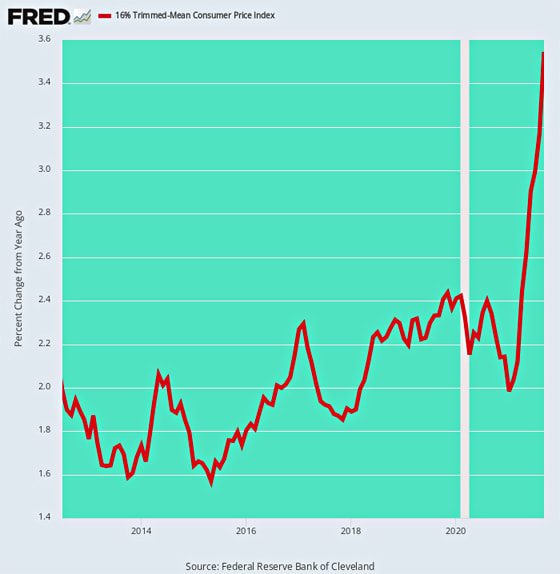

To wit, during Q1 2021 the annual rate of government transfer payments weighed in at $5.92 trillion, compared to wage and salary incomes of just $9.88 trillion. That’s right. Move over Chairman Xi Jinping! America just spent 60 cents on government transfer payments for every dollar of wage and salary income earned during the quarter. And yet….and yet. The fools in the Eccles Building who are monetizing this madness claim that all their lunatic money-pumping is having purely benign, nay, awesome effects, and that currently “elevated” inflation readings are only transitory. Right. The producer price index for finished goods – which embodies pricing pressures in the upstream pipeline – came in this morning at a sizzling 9.4% YoY rate for July. And truly, folks, that ain’t just transitory “base effects”. Here is the trend of the two-year stack on a per annum basis, which, again, averages out the current “elevated” readings with the swoon during last year’s lockdowns. Producer Prices Index for Finished Goods, Annual Increase Rate Of Two-Year Stack:

We are not quite sure how JayPoo and his clueless band of money-pumpers define an accelerating, as opposed to a transitory, trend. But we’d say the above is close enough for government work. Indeed, when it comes to their new-fangled inflation target of 2.00% “averaged over time”, you have to believe they are actually waiting for some kind of monetary Godot. The producer price index is now up by 16.7% since February 2016, which computes to 3.06% per annum. Needless to say, that ain’t price stability, and after 5.4 years running, it ain’t even a matter of averaging to 2.00% over time.

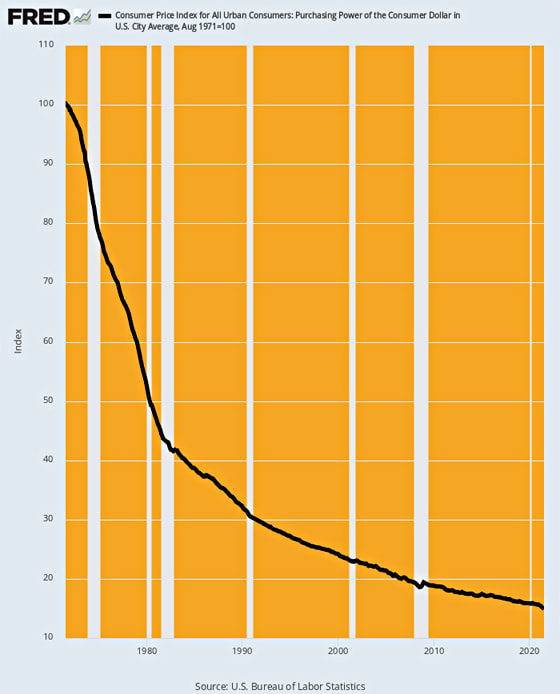

What it actually amounts to is just more proof that Alan Greenspan got it right the first time when he averred back in 1966 that,

“in the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” For want of doubt, here is the dollar’s purchasing power descent since August 1971. It’s worth just 15 cents today and that’s not transitory! Nor is it productive or equitable. The pro-inflation fools domiciled in the Eccles Building have much to answer for, but foremost is surely the screaming tyranny of a monetary regime that sacrifices the hard-earned wealth of savers and the purchasing power of workers in order to promote the dubious public good embodied in 2.00% inflation. Indeed, the essence of tyranny is the arbitrary and capricious deployment of state power, yet that’s exactly what inflation-targeting amounts to. Plain observation tells you that there is not a snowball’s chance in the hot place that rising prices, wages and costs will move together in exact lockstep – so the longer this foul regime goes on, the greater the social inequity which must inexorably ensue. Decline In Purchasing Power Of The Dollar Since Nixon Did The Dirty Deed In August 1971

That much is stunningly evident in the chart below. Back in 1989 a newly arrived Greenspan apparently realized that dollar liabilities could be created at will and that the rest of the world would have no choice except to join the Fed’s inflationary caravan by scooping up excess dollars and replacing them with their own currency emissions.

That had the effect, of course, of exporting industrial production and importing goods deflation from China and other low wage venues. That was bad enough for ordinary main street workers and households, but it also wasn’t the half of it. What Greenspan and his heirs and assigns also accomplished was putting goods inflation on a temporary sabbatical, while permitting financial asset inflation to run wild. The chart below is the proof of the pudding and there is no other explanation for it than wanton monetary inflation by the central bank. To wit, in Q3 1989 the net worth of the top 1% stood at $4.891 trillion, which amounted to 6.3X the $737 billion net worth of the bottom 50% of US households. That was when the Fed’s balance sheet stood at about $300 billion and it had taken 75 years to get there from the time of the Fed’s opening in November 1914. Fast forward to the present and the Fed’s balance sheet is 28X larger at $8.3 trillion. Alas, there is absolutely no doubt as to who benefited from that massive monetary inflation. That is, the net worth of the top 1% is now $41.52 trillion, where it stands 16X larger than the $2.6 trillion of wealth held by the bottom 50% of households. The distribution of income and wealth, of course, should be strictly the business of the private market, not the machinations of the state. Then again, it wasn’t private capitalism which boosted the wealth ratio from 6.3X to 16X in barely three decades. That’s the insidious outcome of Tricky Dick’s Dirty Deed 50 years ago this week. Net Worth Of Top 1% Versus Bottom 50% Of US Households

Reprinted with permission from David Stockman’s Contra Corner.

Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed