By Norm Singleton

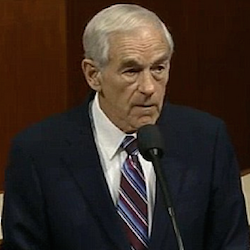

This month marks the eight-year anniversary of the bursting of the housing bubble and the resulting stock market downturn. Following the crash, Congress passed the Emergency Economic Stabilization Act, which authorized the use of taxpayer funds to bailout powerful corporations. As President Bush so memorably put it: “I’ve abandoned free-market principles to save the free market system.” The atmosphere on Capitol Hill following the crash was almost as hysterical as what followed September 11th. In both cases, the panicked atmosphere resulted in the passage of hastily written legislation. Sadly, but not surprisingly, the failure of the so-called "Emergency Economic Stabilization Act" to stabilize the economy did not stop Congress and the Fed from their unprecedented program of bailouts, stimulus spending, and money creation. As those who understand economics predicted, this attempt to spend-and-inflate our way to prosperity has failed miserably, although it has benefited Wall Street, the Big Banks, and well-connected crony capitalists. This is why none other than Donald Trump once said that Quantitative Easing is a "great deal for guys like me." Of course the American people still do not know the full truth about what, if any, plans the Federal Reserve has to bailout Wall Street, the big banks, and foreign governments in the (inevitable) event of a major crash. This is why Campaign for Liberty is pushing for a Senate vote on Audit the Fed this year. Here is Ron Paul's official statement on the Emergency Economic Stabilization Act: Madam Speaker, I rise in strong opposition to this bill. This is only going to make the problem that much worse. The problem came about because we spent too much; we borrowed too much, and we printed too much money; we inflated too much, and we overregulated. This is all that this bill is about is more of the same. So you can't solve the problem. We are looking at a symptom. We are looking at the collapsing of a market that was unstable. It was unstable because of the way it came about. It came about because of a monopoly control of money and credit by the Federal Reserve System, and that is a natural consequence of what happens when a Federal Reserve System creates too much credit. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed