|

By Paul-Martin Foss

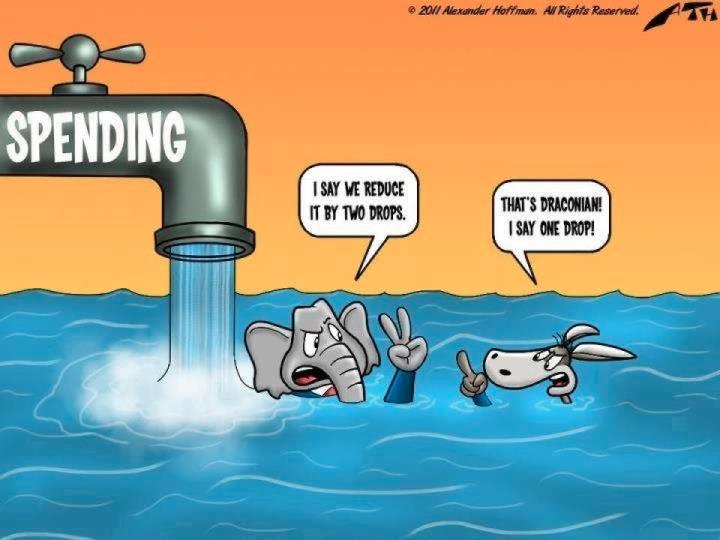

The week before last marked my first time attending the Austrian Economics Research Conference, an annual meeting of economists of the Austrian school hosted by the Ludwig von Mises Institute in Auburn, AL. While many of the presentations were interesting, one that I found particularly helpful was that by Patrick Barron of the University of Iowa. What was especially useful was how he tied together monetary and fiscal policy. The connection between the two might seem self-evident to many Austrians, but it wouldn’t seem self-evident to the man on the street. Yet by tying the two together it should be possible to bring more people to support sound money. Wasteful government spending is something that is apparent to millions of Americans. It makes them angry to see their tax dollars misspent and wasted on costly boondoggles. It is relatively easy, therefore, to get people to support efforts to cut government spending. Yet no matter how much effort is expended in the effort to rein in government spending, it continues to grow out of control. What if you could do one thing that would do more than anything to cut government spending? Imagine how much support you could get for that. That is where Prof. Barron comes in. Sound money, to Dr. Barron, is the most important check on government spending. If money is sound, meaning that the government cannot inflate the money supply at will, then government spending will be limited. Remember that governments can fund their operations through three methods: 1.) Taxation; 2.) Bonds, or borrowing; 3.) Inflation. Taxation is self-limiting because at higher tax rates there will be massive tax avoidance and tax revenues will fall, or the government might be voted out or overthrown if people are angry enough. Bonds have to be repaid, which comes from future taxation, so we are back to the self-limiting aspect of tax funding. Bonds also require interest payments, and if a government isn’t creditworthy then the interest payments may make borrowing money prohibitively expensive. This leads us to the third and preferred method, inflation. By creating more money, the government decreases the value of each monetary unit. But it normally does so in a slow enough manner as to be barely perceptible to the average person. And where does this newly-created money go? Why, to the government’s coffers, of course. There it gets spent on wars, welfare, and other boondoggles. In the meantime, the newly-created money causes the prices of goods to increase, driving up the cost of living for the average person. In this way, inflation is a stealth tax. Its effects are just as insidious as direct taxation in that it takes money from citizens and deposits it into government coffers, but it does so in such an imperceptible way that very few people realize that they are being fleeced. That allows governments to spend far more money than they otherwise would be able to by relying on taxes and borrowing alone, which is why governments prefer it. But in order for inflation to work effectively as a government policy, governments have to exercise control over the monetary system. They have to have the ability to debase money, devaluing each unit of currency. If people can use money that is outside the government’s control then the government’s schemes are thwarted. That is why governments throughout history have tried to monopolize the issuance of money. Reining in government spending will require breaking up that monopoly, eliminating the government’s control over the monetary system, and ensuring that people have sound money and alternative currencies to use when the government tries to use inflation as a policy tool. Inflation and increased government spending are two sides of the same coin. If people are really serious about reining in government spending, they need to jump on the sound money bandwagon. This article was originally published at The Mises Institute. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed