By Paul-Martin Foss

Today’s daily joke comes courtesy of Richmond Fed President Jeffrey Lacker, who according to Marketwatch stated at yesterday’s Cato Monetary Policy Conference that “History has demonstrated the gold standard is unworkable.” What he failed to mention, or perhaps what he fails to understand, is that it is not the gold standard that is unworkable, but the expectation that government will adhere to the gold standard that is unworkable. Remember that the gold standard did not fall away because it was inefficient or counterproductive; it was actively destroyed by governments which did not want to continue to be bound by its strictures. The gold standard provides a restraint on the growth of the size and scope of government, which is why rapacious governments sought to do away with it. Is it really too much to expect professional economists to know this economic history? Maybe so. Take a look at the image posted within the Marketwatch article, originally posted to Twitter by the chief economist of the Senate Budget Committee Democrats.

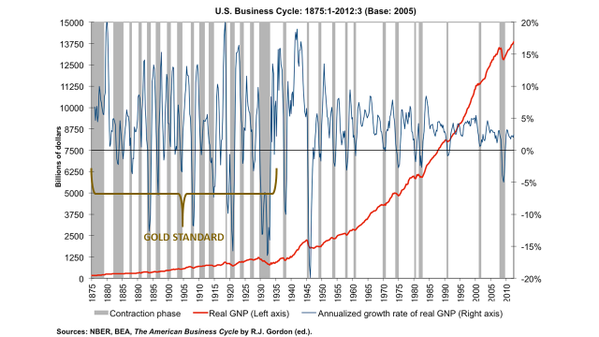

The poster alleges that this chart demonstrates that the “gold standard era wasn’t actually one of stability.” A little sleight of hand in the wording, which we’ll get to in a bit. But do you notice anything funny about the graph? Let’s start off with the fact that the “gold standard” era is extended into the middle of the Great Depression. The classical gold standard era actually died in 1914. The gold standard was suspended during World War I and what resurfaced after the war was a bastardized gold exchange standard.

Note that the two deepest contractions in GNP growth during the alleged “gold standard” era are not in fact the fault of the gold standard, but the result of the Federal Reserve’s monetary creation. The Depression of 1920-21 was the inevitable result of the Fed’s inflationary monetary policy during World War I, and the Great Depression was the result of the Fed’s monetary policy misconduct throughout the 1920s. Once again, the fault of the central bank, not of the gold standard. And what about the alleged volatility during the gold standard? You’ll find that that again is the result of governments and their unwillingness to adhere to the gold standard, largely due to specie suspensions and nonsensical banking regulations. If the government declares that banknotes no longer have to be redeemed for gold, that will result in panicking and increased price volatility. But that again is not a problem of the gold standard, it is a problem of the gold standard being suspended through government fiat. This is where we get back to the sleight of hand in the phrase “the gold standard era wasn’t actually one of stability.” That argument can be made, but the instability of the gold standard era was due to government intervention to suspend or counteract the gold standard, not due to the gold standard itself. The Marketwatch article goes on to state falsely that Ron Paul championed a return to the gold standard. Dr. Paul favored not a return to the late gold standard as it existed in the United States but a return to a system of competing currencies. Just as in the early years of the United States’ founding currencies from around the world circulated throughout the country based on their metal content, so too under a system of competing currencies gold and silver would be the monetary units, with coins circulating based on their metal content. As Dr. Paul states in The Case for Gold: In the last six years, Nobel laureate Friedrich Hayek has called attention once again to the economic advantages of a system of competing currencies. In two books, Choice in Currency andDenationalization of Money, Professor Hayek proposes that all legal obstacles be removed and that the people be allowed to choose freely what they wish to use in transactions. Those competing monies might be foreign currencies, private coins, government coins, private bank notes, and so on. Such unrestricted freedom of choice would result in the most reliable currencies or coins winning public acceptance and displacing less reliable competitors. Good money — in the absence of government coercion — drives out bad. The new coinage that the Gold Commission has recommended and which we strongly endorse is a first step in the direction

This is why Dr. Paul continually sponsored the Free Competition in Currency Act during his time in Congress. But rather than deal with these proposals on their merits, it is far easier for reporters to dismiss Dr. Paul by conflating his proposals with the classical gold standard, and for gold standard opponents to blame the gold standard for the failure of governments to adhere to it. By that same logic, the fact that people commit murder shows the unworkability of laws against murder. That’s the level of thinking demonstrated by most of the top leaders in this country, the people who are making the important decisions that affect your life, the FOMC members who dictate monetary policy. Is it any wonder then that the dollar continues to be devalued, that the booms and busts continue, and that the next financial crash will make 2008 look like a cakewalk? But if our betters claim that up is down, war is peace, and monetary insanity is workable, who are we to question them? Get ready, it’s going to be a wild ride.

This article was originally published at The Carl Menger Center. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed