|

By David Stockman

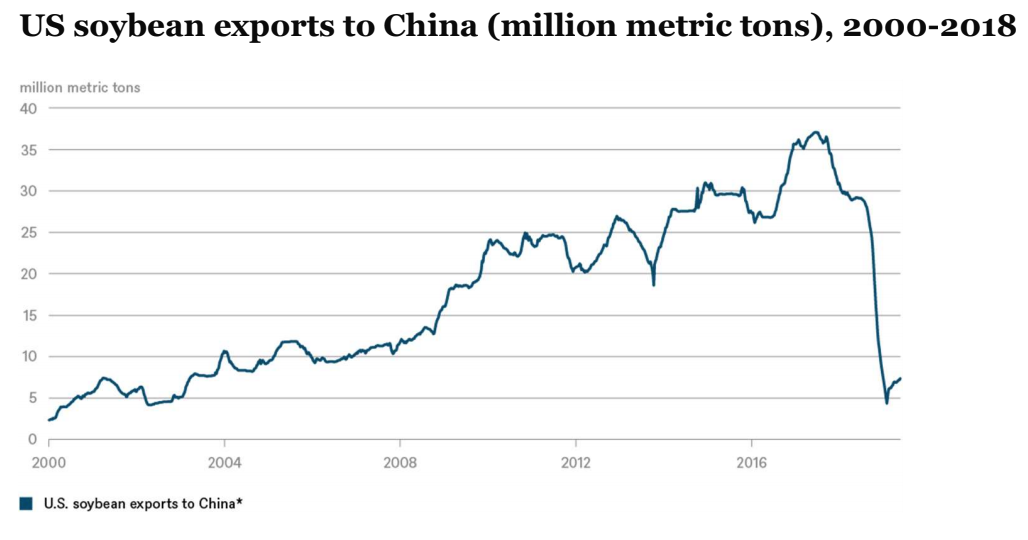

With each passing day the casino becomes an ever greater menace because it embodies an ultra-fragile Super-Bubble which is at the mercy of the out-and-out lunatics who dominate all levers of power in the Imperial City. That is, the deranged House Dem Caucus, the money-printing fools in the Eccles Building and the Orange Swan himself. As to the latter, it's virtually impossible to overstate how far the Donald has gone off the deep-end with his Tariff Man act. During the course of the current week alone he has invented three truly preposterous reasons for imposing tariffs (i.e., taxes) on imported goods freely purchased by American consumers and businesses. To wit, after re-imposing a 25% tariff on Brazilian and Argentine steel and aluminum because he doesn't like the short-term path of their exchange rates and then threatening to tax Dior handbags at 100% because he disapproves of France's new 3% digital services tax, the Donald has now proposed to raise tariffs on German goods because, well, he doesn't think they are spending enough on defense! You truly cannot make this up. Even though in its sovereign discretion, Germany has demonstrated year after year by its action that it doesn't consider Russia a material threat to its national security, and therefore chooses to spend a mere $42 billion or 1.2% of its $4.0 trillion GDP on defense, the Donald is having none of it: He said he expected Germany to ramp up its military spending. "They have to," Today Nancy Pelosi said the House Dems are going ahead with impeachment on the ridiculous grounds that Donald Trump isn't America's King. The irony, however, is that when it comes to America's $4.3 trillion trade account (exports plus imports) specifically and its $21 trillion economy generally, the Donald actually does seem to think he is an economic King. In fact, the Donald is actually such a thorough-going statist as to make even the ghosts of Hubert Humphrey, LBJ or FDR himself blush with envy. He seems to think that the tens of millions of American consumers and businesses, which bought $2.61 trillion of foreign made goods last year, are the servants of the Federal government, and can be commanded to pay not the market price for these goods, but the one the Donald has personally ordained as part of his madcap mercantilist economic policy machinations. So if you are a small metal-working shop in Wisconsin that uses cheaper Brazilian steel to make trailer hitches for final sale to RV customers, please be advised that you have been drafted into US government service. You are now also in the business of teaching this foreign government a lesson as to the proper FX rate for the real per US dollar as decreed by the Donald---notwithstanding that the rate has fluctuated around the barn and back between 1.45 and 4.20 real per dollar during the last two decades. Likewise, never mind the fact that millions of US businesses have spent years---even decades---building up foreign export markets, such as US soybean producers' sales to China. It took 17 years to build US sales from 5 million tons to 36 million tons, but then the Trade King got a whim. In a flash, exports were back to 5 million metric tons after it was decreed in Washington that the good farmers of Iowa and Nebraska would take a bullet for the Donald. And not just for the Donald. Throw in the Big Business lobbies. The latter loudly insist through their K-Street hirelings that when they invest in the Red Ponzi they must be protected by American patent rules and technology transfer practices; and that Washington needs to make that happen, which Trump has been more than happy to oblige by wielding his Tariff weapon as a bargaining lever. The truth is, the US government owes nothing to American companies which voluntarily put their capital and technology at risk in China. If they wish to go on bubblevision or appear at investor conferences, where they brag about their "growth" strategies in China and why this warrants a higher PE and share price (and stock option value), then they can live by the Red Rules or invest elsewhere. Most surely, Washington is not entitled to draft farmers, import-based US finished goods manufacturers or consumers of the $360 billion of Chinese goods now subject to the Donald's malicious tariffs into the cause of forcing China to play nice with American companies. Yet that's exactly what America's self-appointed Trade Czar is now doing.

Moreover, the capricious harm to innocent consumer and business draftees into the

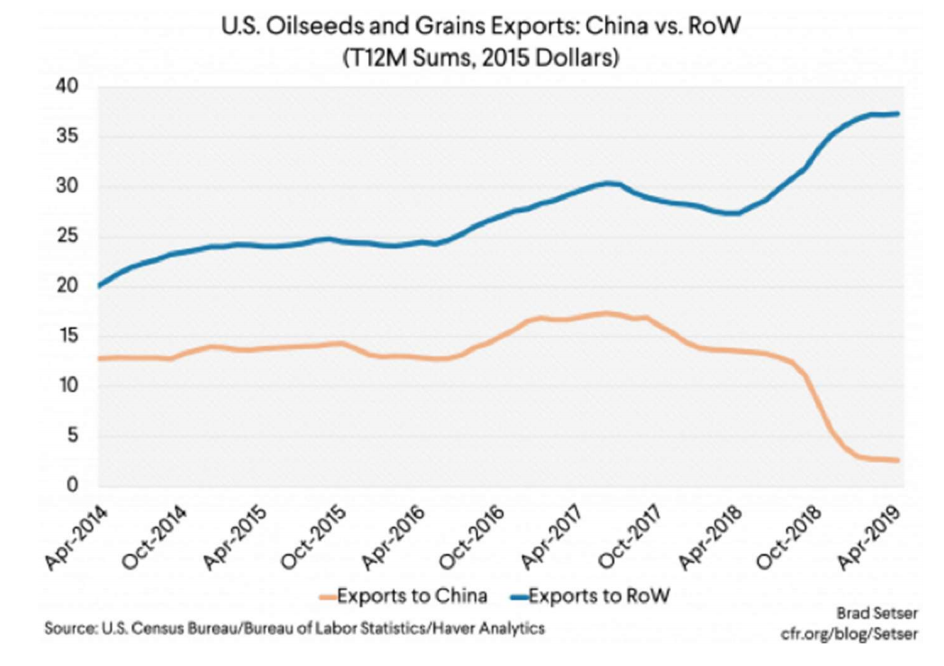

Donald's Trade War doesn't stop with the above collateral damage. Washington is now collecting about $60 billion per year in customs receipts from innocent American buyers of Chinese goods, but is then handing most of it out to American farmers to allegedly compensate them for the Trade War harm that has fallen their way. Consequently, it is now estimated that upwards of 40% of the $92 billion of projected farm income for this year will flow from Federal government subsidies and handouts! That's right. Some bus driver in Lincoln Nebraska is paying more for tariffed goods at Wal-Mart, so that the upcharge can be handed out to his soybean farmer neighbor, who has suffered significant harm from lower soybean prices, but has mainly seen his shipments diverted to Europe and other foreign markets, thereby displacing the South American exports which have gone to China. As shown in the chart below, before the Donald started his China Trade War, US soybean and grain exports to China totaled about $18 billion per annum , while exports of these same products to the rest of the world (RoW) amounted to about $27 billion (2015 $). During the LTM period shown below ending in April 2019, however, exports to China had plunged to barely $4 billion, while exports to the rest of the world had risen to about $37 billion. In short, the Great Deal-Maker has caused US soybean exports to China to drop to ZERO in November, but the all-in impact has been to massively reshuffle the flow of US farm exports in the global markets and top up the farm vote with nearly $40 billion in handouts. Call it what you will, but do not call it MAGA.

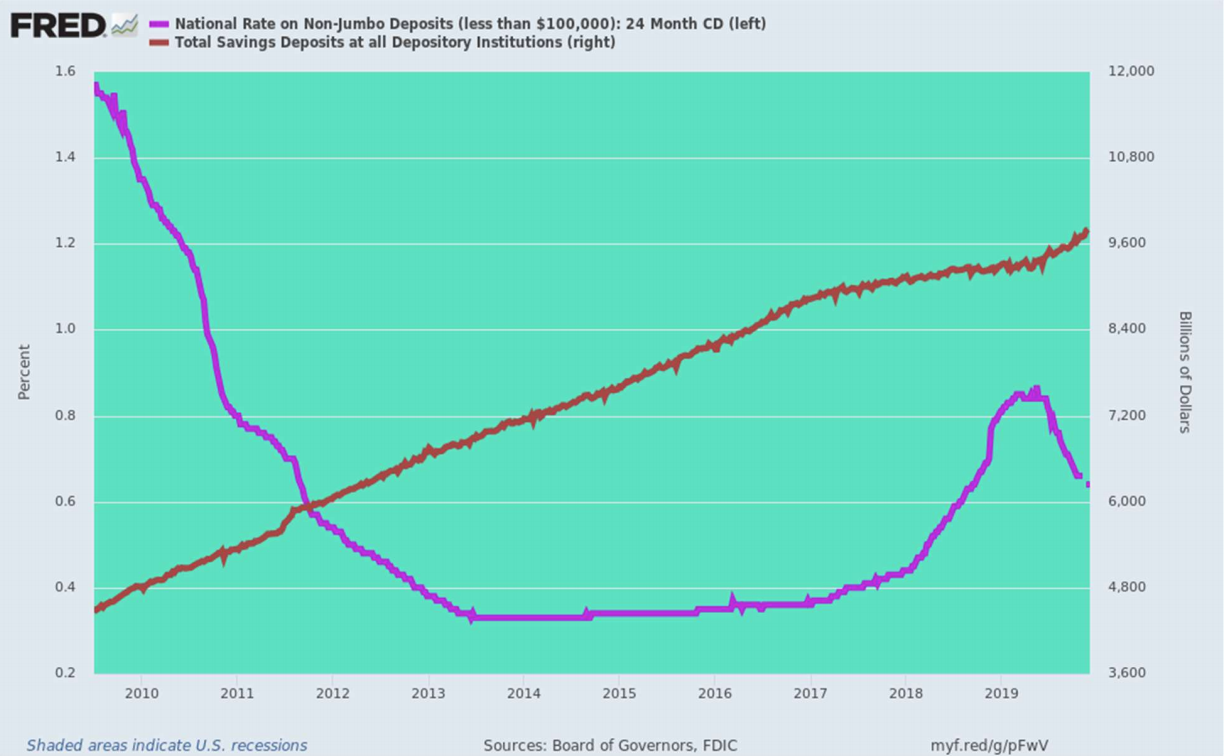

Still, the point is not merely that the Donald is a hopeless economic statist in the realm

of global trade. It's actually much larger than that because he seems to believe that the job of whole classes of the US population---millions of purportedly free citizens---is to bend to the whims of Washington in the course of daily commerce. For example, consider the $9.7 trillion of savings deposits (brown line) in the US banking system----a figure that has nearly doubled since the Great Recession ended in June 2009. Self-evidently, the Fed's radical interest rate repression policies caused the already meager 160 basis points (purple line) of return being earned when the recession ended to sink to barely 30 basis points (0.3%) during most of the recovery. Even when the Fed briefly attempted to normalize interest rates in 2017-2018, the return on 2-year CDs never rose much above 80 basis points---and has now retreated to a pathetic 60 basis points in the face of the Fed's post-July rate cutting campaign. Yet King Donald is up in arms at the Fed on the grounds that its savage attack on U.S. savers is not nearly brutal enough. He essentially wants rates to be reduced to zer0, which means confiscation of the real value of assets at a time when the running inflation rate exceeds 2.25%. Needless to say, the Donald's reason for trashing the Fed's already meager interest rate policy is a reminder of why markets, not kings, should rule in the sphere of economics. To wit, the Donald foolishly believes that he has done such a bang-up job fixing the American economy and making it the global "winner" that he is entitled to the lowest interest rates on the planet; it's a scoreboard thing. Still, the Donald's utter nonsense does raise the question of stupider than what? What we mean is that the Donald's lunatic economic ideas are no state secret: He blasts them out hour-after-hour via his Twitter feed. Yet the delusional day-traders and robo- machines on Wall Street stubbornly refuse to get out of harms' way, and keep buying the dips, as they were again today. But what do these cats think, even if you could dignify it with that term? Can anyone doubt that the market is sitting at the tippy-top of a bubble which has been 10-years in the re-making and that the higher it inflates the more vulnerable it becomes to a blow from the southern end of the Acela Corridor? Stated differently, anyone even near the Oval Office possessed by the outright crack- pottery described above is a clear and present danger to the greatest Wall Street bubble ever. So the question recurs: Why in the world do they think that the Donald will not have an accident, and that it is therefore safe to play for nickels and dimes of gain from here when the downside is 30-50% or even more?

That's especially the case because it is not merely a matter of the Donald's whacko

substantive views on economics, money and trade. He is also completely out to lunch as to the unfolding processes around him and the likely reaction of Beijing and all the other parties that have been meted with his wrath, scorn and amateur negotiating maneuvers. As we indicated above, the Chinese did not buy one freaking bushel of soybeans during November, yet the Donald keeps tweeting and gassing about a trade deal just around the corner. That is, it's plain to see they aren't buying any soybeans---a reality that even Agric. Secretary Perdue was forced to admit earlier this week. Yet just a few weeks ago the Donald claimed to have already made a deal that would have had a fleet of Capsize bulk carriers loaded with soybeans steaming toward China's ports already: The deal I just made with China is, by far, the greatest and biggest deal

The question that crisis analysts will soon be pondering, therefore, is why did not Wall

Street take the madman in the Oval Office at his word? How did they think the Great Big Fat Ugly Bubble that the Donald himself identified during the campaign three years ago would not be suddenly burst by a curveball from the Orange Swan? The answer is surely that all the smart guys at Goldman Sachs and elsewhere on Wall Street believe that there are adults in charge behind the scene, and that the Donald's tweeted and spoken lunacy is just some kind of sideshow act that will never impact the main arena. But that's a delusion. Kudlow is a hopeless Wall Street cheerleader and boss-pleaser and the rest of them should not even be teaching Jr. high school civics. What is really happening is that the state apparatchiks on both sides of the Beijing/Washington corridor have taken over the process and are playing rope-a-dope with each other, while not having the foggiest idea on how to bring the Donald's so- called Trade War to a soft landing, or any landing at all. Indeed, it is the apparatchiks on both sides who are keeping the Donald's trade insanity veiled in a thin veneer of plausibility via a stream of calculated leaks. But this farce has been going on so long now, and the mainstream business media is so invested in bullish delusions, that the "progress" leaks have now become virtually ritualized. Thus, last night the dovish contingent in China's Ministry of Commerce antiseptically averred that "both sides have maintained close communication". Yet that become the peg for a bold-print Wall Street Journal headline, which wasn't even supported by the dispatch.

Actually no Chinese official issued any such "reassurance". What the Commerce

Ministry actually said amounted to a process-oriented nothingburger, and no way contradicted the far less constructive reiteration from the foreign ministry and Xi Jinping's unofficial spokesman at the Global Times that there will be no Phase One deal unless Washington rolls back some of the existing $360 billion of tariffs. But that the Donald and his hardliners are not about to do. Yes, it is likely that the $160 billion of new tariffs slated for December 15 will be delayed, but that's meaningless: It's just the next sequel in the game of perpetual rope-a-dope conducted by both sides. China’s trade negotiations with the U.S. remain on track, Beijing said, offering

Actually, here are the central rope-a-dopsters---Bob Lighthizer and Vice-Premier He.

They'll be in business until the Orange Swan finally brings down the house.

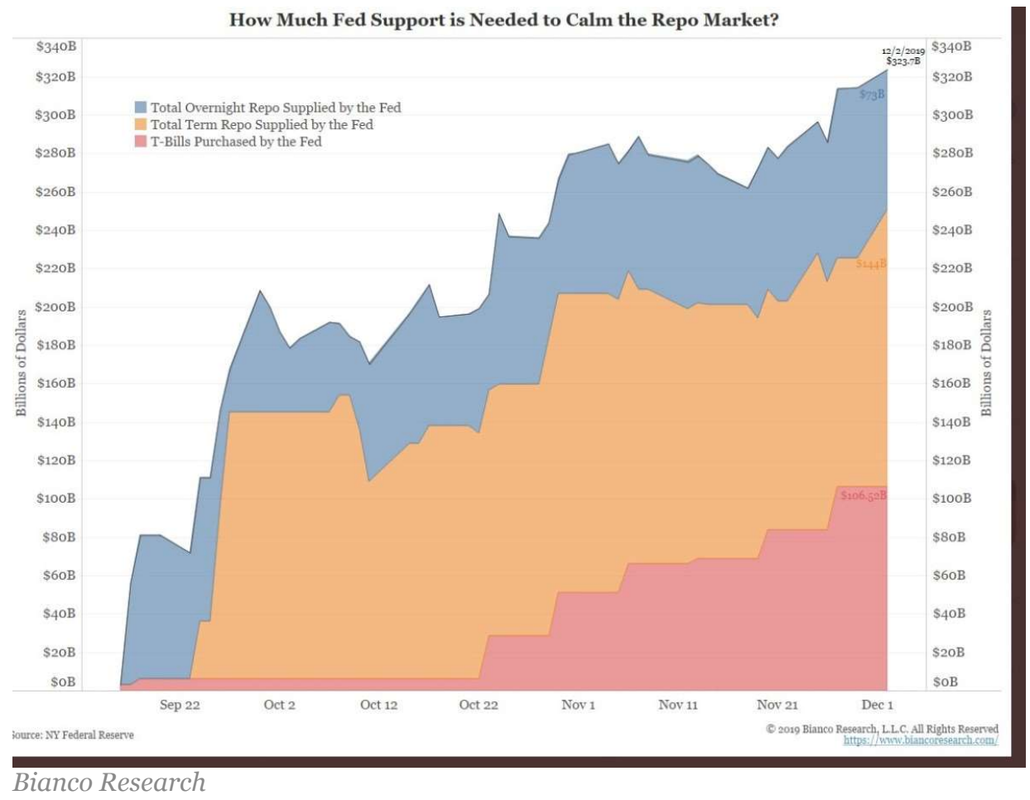

Meanwhile, the Donald's Trade War hijinks are more than matched by the utter

insanity that has over-taken the Eccles Building. As shown in the chart below, there has been more than $320 billion of total repo market support from the Fed since Sept. 17, when the central bank began pumping in daily liquidity after the term repo lending rate on one particular day jumped to almost 10% from nearly 2%. Yet even as the Fed has desperately flooded the bond-pits with freshly minted fiat credit, the talking heads keep jawing about why the repo ructions have been occurring, implying that there is some mysterious ailment in the Wall Street plumbing that the wise men and women on the FOMC have been Johnny-on-the-spot to remediate. Nonsense! There is nothing going on down in the bond pits except that the law of supply and demand has been rearing its head in the face of massive demand for new credit from the US Treasury and Wall Street speculators alike. So the Fed has been clubbing the price of short-term money like a squealing baby seal, blindly hoping to extinguish the thing and move on.

The nonsense of it all, however, was perhaps inadvertently captured by a MarketWatch story on the matter this AM. The focus was on why banks were "hoarding" their reserves which now stand at a staggering $1.5 trillion compared to pre-2008 history when perfectly functioning bond and money markets operated with less than $40 billion of reserves most of the time.

“The big banks are just hoarding cash,” he said. “They told the Fed they

Let's see. Suppose the Fed abolished its idiotic IOER (interest on excess reserves)

program and gave the market a whole week or even a few days to breath. Presto. Earning 0.000% at the Fed, bank reserves would surge into the repo and other wholesale money markets, and after a few days of turmoil money dealers would clear the markets at an honest interest rate. But that rate might not be 1.55%----the level at which the Fed has pegged its almighty policy rate for the tiny Federal funds market that was abolished 10-years ago when Bernanke euthanized it. So what? If the Wall Street gamblers can't stand 2.50% or 4.50% or 6.50% money, so be it. Market clearing money rates would actually be a tonic that would flush speculative activity and capital out of Wall Street and dissuade the C-suites from further strip-mining their already badly impaired balance sheets in order to feed the Wall Street gamblers with stock buybacks, M&A deals and other forms of artificial financial engineering. Of course, that isn't going to happen because the symbiotic ties between the central bankers and the Wall Street gamblers have become virtually insuperable. For example, the apparatchik (Brian Sack) who actually ran the open market desk during all those years of Fed money printing after the crisis has now gone through the revolving door to the Hedge Fund side of the equation. There he has naturally produced a hideously self-serving rationale as to why the Fed needs to turn on its printing presses- --even though the real cost of money has again gone to negative, where it has been 94% of the time since April 2008. Shortly thereafter, former New York Fed markets group head Brian Sack, now

As for Nancy Pelosi's lynching party, that is surely a case of the cat calling the kettle

black, yet one which is likely to become so partisan and bitter as to cause a constitutional crisis before the Electoral College meets in December 2020, as we explained in a recent extended conversation with Tom Woods. https://tomwoods.com/ep-1548-david-stockman-on-impeachment-the-democrats-the- fed-and-more/ Needless to say, a government in virtually an armed stand-off might even wake up the robo-machines.

This article was reprinted with permission from David Stockman's Contra-Corner.

David Stockman began his career in Washington as a young man and quickly rose through the ranks of the Republican Party to become the Director of the Office of Management and Budget under President Ronald Reagan. After leaving the White House, Stockman had a 20-year career on Wall Street. Stockman is an Advisory Board member for the Ron Paul Institute for Peace and Prosperity. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed