|

By Paul-Martin Foss

One of the lesser-known victims of inflation is one of its smallest: the penny. At one time, the penny could actually buy you something. Many of our parents remember when a penny could buy a piece of candy. At the Federal Reserve’s creation in 1913, a penny could buy you 2/3 of a pound of potatoes. Three pennies could buy you a pound of flour. Nine pennies could buy you a quart of milk. What can nine pennies buy today? Nothing, really. Inflation has so reduced the purchasing power of the dollar that the penny is useless for commerce. Nobody wants to use them and nobody wants to accept them. It’s not uncommon to see a trail of pennies leading out of a store, as some customer would rather drop them on the ground than put them in his pocket.

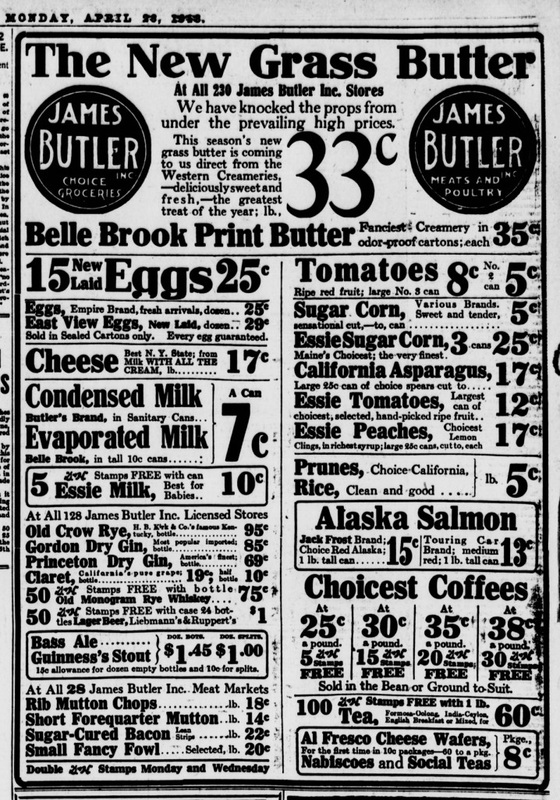

Advertisement from April 28, 1913.

Image Source: Library of Congress It’s no wonder, then, that retailers are beginning to do away with the penny. Whether it’s small convenience stores like my brother’s store Mission Market, or the Department of Defense’s PXes on overseas military bases, the hassle and cost of purchasing, shipping, and storing pennies that will only be thrown away after being given as change is too much for some businesses to tolerate. Don’t forget that businesses have to bear the cost of ordering coins from the bank, sorting coins from cash registers at the end of each shift, and rolling and returning any excess coins to the bank. The time it takes to do all of that is more expensive than the value of the pennies. Those additional costs are an imposition to businesses. All pennies really do is allow prices to be quoted to the nearest hundredth of a dollar, an economic unit that has become useless for daily commerce. Due to inflation, there really isn’t any reason nowadays to quote to anything less than a tenth of a dollar, as even the dime won’t buy you much more than perhaps a stick of gum. The hassle of the penny plays into the government’s war on cash, too. Any way to make the use of cash more burdensome will help to move people towards credit cards and electronic payment methods. The war on cash is well-known and well-documented, and increasing inflation plays into the government’s war on cash in a big way. The US Mint would like very much to stop minting pennies and nickels, as the cost of production has for many years exceeded the face value of the coins. The Bureau of Engraving and Printing will not print Federal Reserve Notes above $100, even though the Secretary of the Treasury is required to maintain plates for printing notes through $10,000. As the smaller denominations of coins fade away, and with $100 bills being the largest notes still printed, there will come a time when the rising prices caused by the Federal Reserve’s monetary inflation will leave fewer and fewer choices for those who still wish to use cash. As more people eschew the use of cash, restrictions on cash usage will ensnare fewer people, leading to less outrage and thus less momentum to overturn them. The war on cash will have run its course, with the government as the winner and consumers as losers. The solution of course is to get government out of the money business altogether. Allow consumers and markets to determine what kind of money they want to use and the problem of inflation and worthless coinage would disappear. A sound, stable monetary system will never exist as long as control over money is placed in the hands of a single centralized institution. This article was originally published at The Carl Menger Center. Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed