|

By Nick Giambruno

Politicians are always generous with other people’s money… until it runs out. Near the peak of the late-’90s tech bubble, California’s legislature passed the largest pension increase in its history. Today, with as much as $750 billion in unfunded public pension debt, California has one of the worst pension situations in the country. But it’s far from alone. Illinois has a staggering $250 billion in unfunded pension obligations. State pension plans in Connecticut, Pennsylvania, New Jersey, and many other states are taking on water, too. Unfunded public pension liabilities in the US have surpassed $5 trillion.

Taxpayers Are Stuck With the Bill

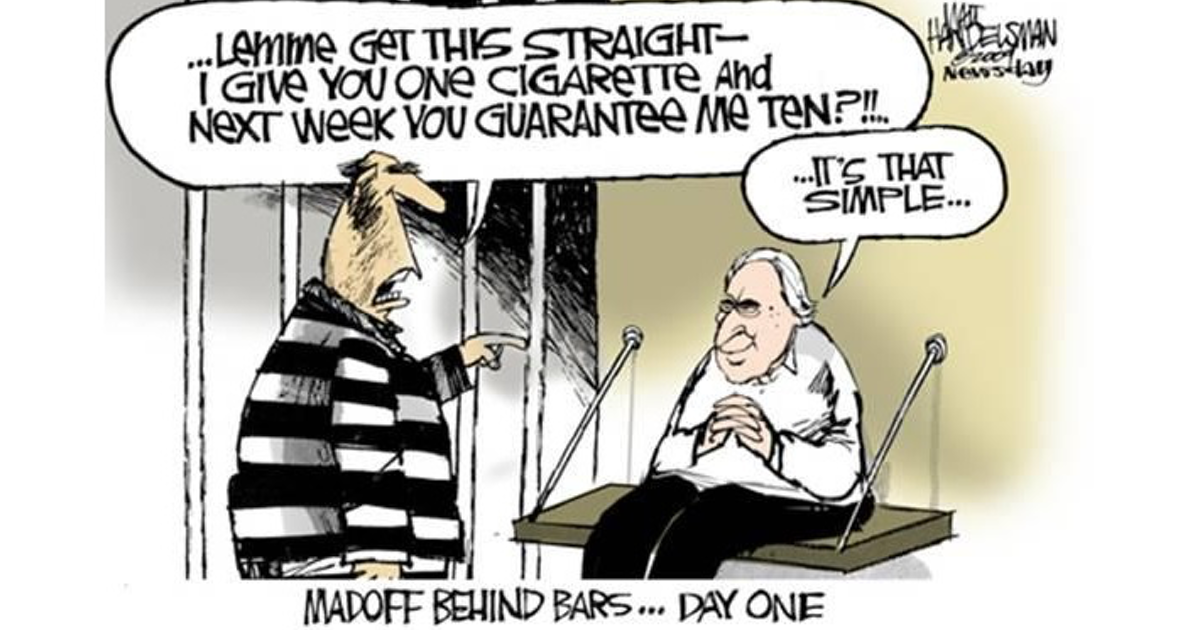

There used to be a simple formula for a secure retirement. American workers would work for a big company for decades. Then, at a certain age, they were eligible for a monthly pension check… for life. Once common, pensions have virtually disappeared from the private sector. Today, less than 4% of companies offer them. It’s another vector in the devalued standard of living of the average American. Essentially, only government employees get pensions now. The government isn’t subject to the same constraints as the private sector. So it has no problem promising benefits it can’t afford to pay. That’s because government revenue doesn’t come from the voluntary exchange of goods or services. It comes from taxes, which it extracts via coercion. Politicians only care about the next election. So there’s no way to hold them accountable in the long term. They automatically do the most expedient thing in the short term, like promising extravagant pension benefits. In the long term, their successors have to deal with the consequences. Naturally, not one of the politicians who voted for California’s record pension increase is still in office. It’s bad enough that politicians give themselves and other state employees extravagant retirement benefits and stick the taxpayers with the bill. But the story gets worse… Government pension plans use all sorts of accounting wizardry that would land someone in the private sector in prison. Read the rest at International Man Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed