|

By Samuel Bryan

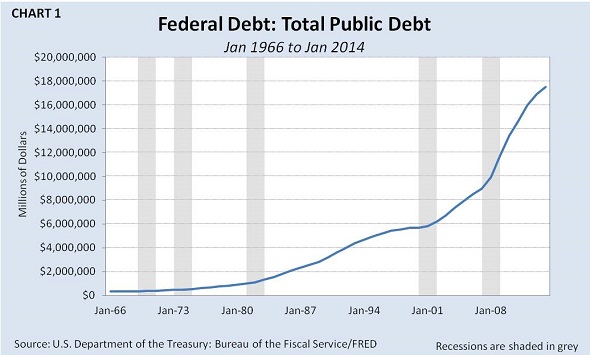

On Monday, the United States national debt increased $339 billion. In one day. Just like that. What caused the sudden spike? That same day, President Obama signed a bill into law suspending the debt ceiling until March 15, 2017. That allows the government to once again borrow, free from the constraints of an $18.1 trillion ceiling.

As USA Today reports, the bill not only suspended the debt ceiling, it also set the federal budget for fiscal years 2016 and 2017, and lifted budget caps to boost spending for military and domestic programs by a total of $80 billion over two years.

From a political standpoint, the budget deal avoided a showdown between Obama and Republicans on the debt ceiling and erased the threat of a government shutdown – at least for the next two years. In other words, Congress and the president kicked the can down the road. “It is a signal of how Washington should work,” Obama said. Free of its constraints, the federal government immediately set about piling on some more debt. According to a website that tracks the debt, the US government owed $18.153 trillion last Friday. On Monday, the number stood at a cool $18.492 trillion. The sudden increase has to do with what are known as “extraordinary measures” that keep the government afloat once it hits the debt ceiling. These include delaying issuance of certain debt instruments, suspending investments in federal employee pension funds, a moratorium on deposits from state and local governments, and drawing down a $23 billion currency stabilization fund. According to the Washington Examiner, the Bipartisan Policy Center estimated that the government had somewhere around $370 billion worth of extraordinary measures to use once it butted up against the $18.1 trillion ceiling earlier this year. Extraordinary measures allow the government to limp along temporarily. Once the cap is lifted, the government scrambles to mitigate the effects of the extraordinary measure, and viola – massive, virtually instantaneous debt increase. So what does this mean practically speaking? As Peter Schiff pointed out recently on Fox Business’ Closing Bell with Liz Claman, “The cost of government is not what it taxes, but what it spends.” Allowing the government to blow past mythical debt ceilings may enable politicians to avoid uncomfortable political clashes, but in the real world, it merely facilitates a dysfunctional economic policy of spending and borrowing and spending and borrowing. As both David Stockman and Peter Schiff have pointed out, that US debt is a massive bubble waiting to burst. Stockman made the case recently on CNBC. We’re going to have a shutdown sooner or later. We’re on the fiscal Titanic, and we’re going to hit something hard and immoveable one of these days. We’re in month 75 of this so-called recovery. Congress has squandered the entire time, done nothing about the long-run fiscal outlook. If anything, they’ve basically been trying to find ways to get out from under the caps they put on themselves in 2011.

The massive debt also has ramification on the Fed’s quest to raise interest rates. Simply put, it can’t do it. Sustained higher interest rates would increase the burden of debt service. Peter Schiff made this point back in September at the Jackson Hole Summit.

Janet Yellen actually said, ‘We are going to shrink the balance sheet down to $1 trillion by the end of the decade.’ Yeah, good luck with that. It hasn’t shrunk at all since she made that promise about a year ago… How are you going to raise interest rates now that you’re so addicted? How much more debt do we have today than we had seven years ago? How much painful is it going to be to try to service that debt if interest rates go up? The truth of the matter is interest rates have to stay at zero, because that’s all we can afford…

All of this means nothing to politicians though. They rarely look past the next election cycle. With the lid off, the debt will continue to skyrocket. Congress will continue to spend. Business as usual will continue – until it can’t any longer.

Reprinted with permission from SchiffGold.com Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed