|

By Robert Wenzel

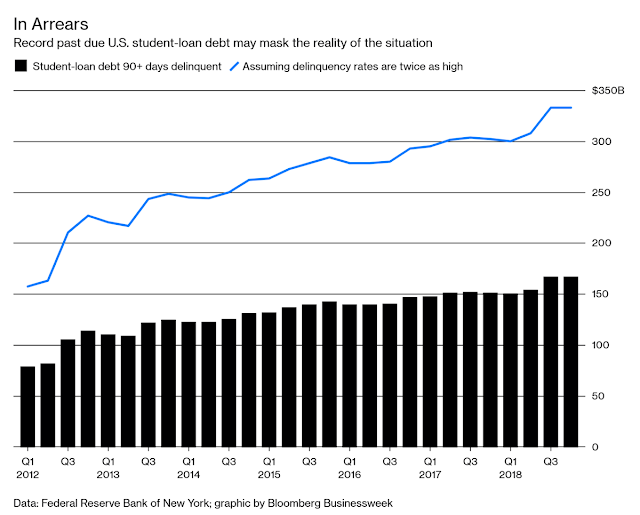

Delinquent U.S. student loans reached a record $166 billion in the fourth quarter, according to a new report from the Federal Reserve Bank of New York. But here is the kicker, the NY Fed says, "delinquency rates for student loans are likely to understate effective delinquency rates” by about half.

Bloomberg does the numbers here to put things in perspective:

Factoring for understatement would imply that about $333 billion in student debt has not been serviced in at least three months. Putting this into perspective, $441 billion had been disbursed under Treasury’s entire Troubled Asset Relief Program to provide financial stability during the recession.

In other words, this is a very serious problem. But it is not at all like the housing crisis. During the housing crisis, many people were evicted from their homes or had to make mortgage payments on houses that were way underwater relative to mortgage balances.

Nothing like that is occurring now, at most, some students who are not making payments are walking around with bad credit ratings. That is not fun but it is not the same thing as being thrown out of a house. But, the student loan delinquency problem is a major problem for the government. From College Scholarships: Up until 2010, guaranteed loans were available through private lending institutions under the Federal Family Education Loan Program (FFELP). These loans were funded by the Federal government, and administered by approved private lending organizations. In effect, these loans were underwritten and guaranteed by the Federal government, ensuring that the private lender would assume no risk should the borrower ultimately default.

So for most college loans made before 2010 where the students are delinquent, the government is on the hook to the banksters who hold the loans. And for loans made from 2010 to date, where payments aren't being made, the government is stuck with some very bad paper.

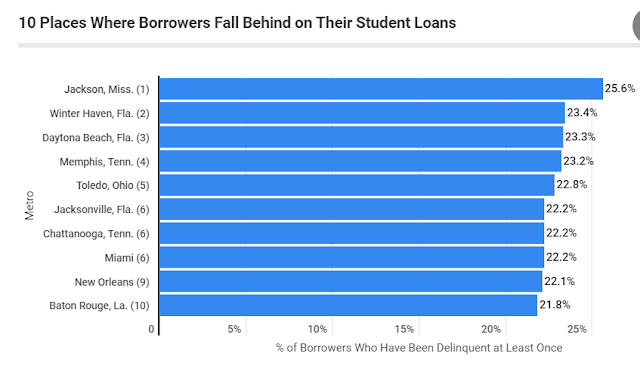

No surprise here. A government program based on the absurd idea that everyone has a "right" to a college has gone bust. College makes sense for those attending to learn a skill such as accounting or engineering. Or those who attend Ivy League colleges, or those on track for a scientific or academic career but that is about all. It is interesting to note that the highest percentage of delinquencies appear to be in areas where there is lower demand for college skills such as software engineering etc.

Nearly 26% of student loan borrowers in Jackson, Miss., have been delinquent on their loan repayment, taking the top spot on the list, according to Student Loan Hero.

Two metro areas in Florida — Lakeland-Winter Haven and Daytona Beach — follow with the next-highest delinquency rates of 23.4% and 23.3%, respectively. On the other end of the spectrum, San Jose (the epicenter of Silicon Valley) has the second lowest delinquency rate at 14%. Provo, Utah, Mormon country, has the lowest delinquency rate at 13%. It is typical socialist shallow thinking to hold the view that funding college education for everyone is somehow going to be a net positive for society. Especially when half the courses are taught by capitalist haters, who teach the kids that demands in the form of fruitcake "rights" are the way to gain rather than by producing something. This article was originally published at EconomicPolicyJournal.com Comments are closed.

|

Archives

July 2024

|

RSS Feed

RSS Feed